Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

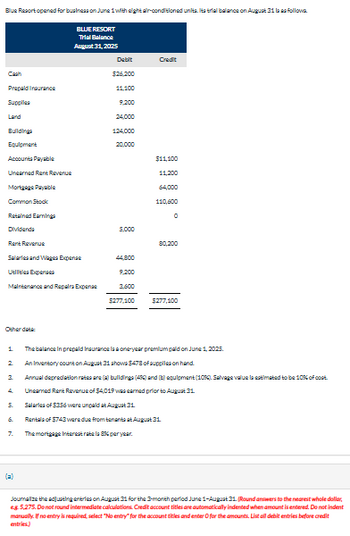

Transcribed Image Text:Blue Resort opened for business on June 1 with eight all-conditioned units. Its trial balance on August 31 followi

BLUE RESORT

Trial Balance

August 31, 2025

Debit

Credit

Cash

$26,200

Prepaid Insurance

11,100

Supplies

9,200

Land

24,000

Buildings

124,000

Equipment

20,000

Accounts Payable

Unearned Rent Revenue

Mortgage Payable

$11,100

11,200

64,000

Common Stock

Retained Earnings

110,600

о

Dividenda

5,000

Rent Revenue

80,200

Salaries and Wage Expens

44,800

Utilities Expe

9,200

Maintenance and Repairs Expense

3,600

$277,100

$277,100

Other de

1

The balance in prepaid Insurance is a one-year premium paid on June 1, 2025.

2

An Inventory count on August 31 shows $478 of supplies on hand.

3

Annual depreciation rates are (a) buildings (456) and (b) equipment (105) Salvage value la estimated to be 10% of cost.

4.

Unearned Rent Revenue of $4,019 was earned prior to August 31

5.

Salaries of $356 were unpaid at August 31

6.

Rentals of $743 were due from tenants at August 31

7.

The mortgage Interest rate la 8% per year.

(a)

Journalize the adjusting entries on August 31 for the 3-month period June 1-August 31. (Round answers to the nearest whole dollar,

eg. 5.275. Do not round intermediate calculations. Credit account titles are automatically indented when amount is entered. Do not indent

manually. If no entry is required, select "No entry" for the account titles and enter for the amounts. List all debit entries before credit

entries)

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- pter 15, 16, and 17 Saved p%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q Help Save & E payments. Isaac Incorporated began operations in January 2024. For some property sales, Isaac recognizes income in the period of sale for financial reporting purposes. However, for income tax purposes, Isaac recognizes income when it collects cash from the buyer's installment In 2024, Isaac had $621 million in sales of this type. Scheduled collections for these sales are as follows: 2024 $ 61 million 2025 121 million 2026 131 million 2027 152 million 2028 156 million $ 621 million Assume that Isaac has a 25% income tax rate and that there were no other differences in income for financial statement and tax purposes. Note: Round your answer to the nearest whole million. Ignoring operating expenses and additional sales in 2025, what deferred tax liability would Isaac report in its year-end 2025 balance sheet? here to search Multiple Choice # $ 3 4 5 E R W 27 DOLL 9:29 PM Construction on…arrow_forwardCurrent Attempt in Progress Metlock, Inc. purchased an 18-month insurance policy on May 31, 2022 for $10080. The December 31, 2022 balance sheet would report Prepaid Insurance of: O $6160. O $3920. O $10080. O $0 because Prepaid Insurance is reported on the Income Statement. Save for Later Attempts: 0 of 1 used Submit Answerarrow_forwardDiscount Auto Insurance deposited $1800 in a saving account paying 3 1/2 % compounded daily on January 1 and deposited an additional $2300 in the account on March 12. Find the balance of April 1. A $4100.00 B $4120.01 C $4102.01 D $4210.02arrow_forward

- T. Bryan is a retailer whose Trial Balance at 2020 December 31 is given below:DR CR$ $Purchases and Sales 72 000 119 400Returns 750Carriage Inwards 930Wages and Salaries 27 670General Expenses 4 750Cash at Bank 4 210Cash in Hand 150Premises 62 520Fixtures and Fittings 9 000Inventory at 2020 January 01 5 550Accounts Receivable and Payable 7 200 4 850Motor Vehicle at cost 13 150Provision for Depreciation onMotor Vehicle at 2020 January 01 2 630Capital at 2020 January 01 82 500Drawings 3 000---------- ----------210 130 210 130====== ======The following additional information is available:1. Inventory at 2020 December 31 was valued at $5 200.2. General Expenses of $400 paid for the year 2021.3. A debt of $200 is to be written off as bad.4. Provision is to be made for doubtful debts of 5% on Accounts Receivables (after writing offthe Bad Debt of $200) at 2020 December 31.5. Depreciation is to be provided for 2020 as follows:Fixtures and Fittings at 10% using the straight -line method; Motor…arrow_forwardTransactions (a) through (e) took place in Stoney Heights Private Hospital during the year ending December 31, 2019.a. Gross revenues of $5,000,000 were earned for service toMedicare patients.b. Expected contractual adjustments with Medicare, a third-party payor, are $2,500,000; and an allowance for contractual adjustments account is used by Stoney Heights.c. Medicare cleared charges of $5,000,000 with payments of $2,160,000 and total contractual allowances of $2,840,000 ($2,500,000 + $340,000).d. Interim payments received fromMedicare amounted to $250,000.e. The hospital made a lump-sum payment back toMedicare of $100,000.1. Record the transactions in the general journal.2. Calculate the amount of net patient service revenues.3. What is the net cash flow from transactions withMedicare?4. What adjustments must be made at year-end to settle up with Medicare and properly report the net patient service revenues after this settlement?arrow_forward6arrow_forward

- Hurd Inc. prepays rent every 3 months on March 1, June 1, September 1, and December 1. Rent for the 3 months totals S3,600. On December 31, 2019, Hurd will report Prepaid Rent of: a. $0 b. $1,200 c. $2,400 d. $3,600arrow_forwardA VAT-registered business makes a sale of P12,000, inclusive of VAT. The VAT on the sale can be computed as* a. P12,000 x 12%b. P12,000 / 12% c. P12,000 x 12% / 112%d. P12,000 / 12% / 112%arrow_forwardThe insured has divided the insurance on its building as follows: $200,000 with insurer M and $300,000 with insurer R. The If there is a $100,000 loss, insurer M will pay: OA $40,000 OB. $60,000 C $66,666 $100,000 D.arrow_forward

- make journal entries for recording interest income and interest received and recognition of FV at dec31, 2023, 2024, and 2025. the entries should be: to record interest collected (3 lines) to record Fair value adjustment to record interest collected (3 lines) to record Fair value adjustment to record interest collected (3 lines) to record gain or loss Dont use AI Tools. Thank youarrow_forwardTB MC Qu. 7-107 Kansas Enterprises purchased equipment for... Kansas Enterprises purchased equipment for $79,000 on January 1, 2021. The equipment is e of $7,950 at the end of ten years. Using the straight-line method, the book value at December 31, 2021, would be: Multiple Cholce $71,895. $71,050.arrow_forwardPurchase InvoiceFrom Bell Canada, $79.00 plus HST for telephone service for the month of October. what is journal?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub