FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:T

w up

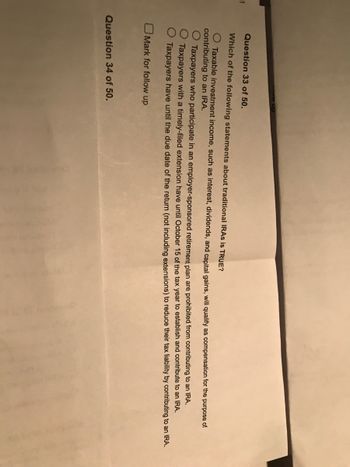

Question 33 of 50.

Which of the following statements about traditional IRAs is TRUE?

O Taxable investment income, such as interest, dividends, and capital gains, will qualify as compensation for the purpose of

contributing to an IRA.

Taxpayers who participate in an employer-sponsored retirement plan are prohibited from contributing to an IRA.

Taxpayers with a timely-filed extension have until October 15 of the tax year to establish and contribute to an IRA.

Taxpayers have until the due date of the return (not including extensions) to reduce their tax liability by contributing to an IRA.

Mark for follow up

Question 34 of 50.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In a defined benefits retirement plan, the employer bears the investment risks in funding a future retirement income benefit. ____ 12. The cost of replacing an engine in a truck is an example of ordinary maintenance that should be expensed instead of capitalized. ____ 13. For proper matching of revenues and expenses, the estimated cost of fringe benefits must be recognized as an expense of the period during which the employee earns the benefits. ____ 14. Medicare taxes are paid by both the employee and the employer. ____ 15. Costs associated with normal research and development activities should be treated as intangible assets. True and false questions....arrow_forwardExplain how distributions from a qualified pension plan, which are made in the form of annuity payments, are reported by an employee under the following circumstances: No employee contributions are made to the plan. The pension plan provides for matching employee contributions. a. b. C a. Explain how distributions from a qualified pension plan, which are made in the form of annuity payments, are reported by an employee when no employee contributions are made to the plan. O A. The distributions are only taxable to the employee once the taxpayer is retired. O B. The distributions are only taxable to the employee once the taxpayer reached 65 of age. O C. The distributions are fully taxable to the employee when the payment is received. O D. The distributions are not taxable to the employee when the payment is received.arrow_forwardThe IRA deduction that is an adjustment to income on Form 1040, line 10a is allowed for Select one a. Roth IRA contributions Ob. 401(K) deferred compensation contributions C. Rollovers to a traditional IRA Od. Traditional contributions onlyarrow_forward

- ! Required information [The following information applies to the questions displayed below.] Alexa owns a condominium near Cocoa Beach in Florida. This year, she incurs the following expenses in connection with her condo: Insurance Mortgage interest Property taxes Repairs & maintenance Utilities Depreciation $ 2,050 7,450 4,200 650 4,650 23,700 During the year, Alexa rented out the condo for 137 days. Alexa's AGI from all sources other than the rental property is $200,000. Unless otherwise specified, Alexa has no sources of passive income. Assume that in addition to renting the condo for 137 days, Alexa uses the condo for 8 days of personal use. Also assume that Alexa receives $47,750 of gross rental receipts and her itemized deductions exceed the standard deduction before considering expenses associated with the condo and that her itemized deduction for non-home business taxes is less than $10,000 by more than the real property taxes allocated to rental use of the home. Answer the…arrow_forwardIn an NOL carryback year, the NOL is combined with the AGI from the return as originally filed or amended. All of the following income items and deductions are recomputed based on the new AGI EXCEPT: Charitable contributions. Taxable social security benefits. IRA deduction. Medical expenses.arrow_forwardWhat is required for the employer's payment of a student's loan to be tax - free to the student?Payment must not exceed $2,500Payment must be only for loan principal Payment must be only for loan interestThe student employee must not have the option to receive the funds as taxable incomearrow_forward

- X Co. can deduct life insurance premiums paid providing: O the life insurance policy is required as security on a loan from a financial institution O the company paid the life insurance policy within the year O the premium paid is for insurance on the president of X Co O the premium paid is reasonable in terms of costarrow_forwardExplain how distributions from a qualified pension plan, which are made in the form of annuity payments, are reported by an employee under the following circumstances: a. No employee contributions are made to the plan. b. The pension plan provides for matching employee contributions. a. Explain how distributions from a qualified pension plan, which are made in the form of annuity payments, are reported by an employee when no employee contributions are made to the plan. O A. The distributions are only taxable to the employee once the taxpayer is retired. B. The distributions are only taxable to the employee once the taxpayer reached 65 of age. C. The distributions are fully taxable to the employee when the payment is received. D. The distributions are not taxable to the employee when the payment is received. b. Explain how distributions from a qualified pension plan, which are made in the form of annuity payments, are reported by an employee when the pension plan provides for matching…arrow_forwardThe following relates to different types of registered plans: Registered Retirement Income Fund Tax-Free Savings Account Registered Education Savings Plan Registered Retirement Savings Plan What plan permits the amount contributed to be deducted from the individual's total income in the year contribution is made or carry forward if unused? Question 2 options: a) i, ii and iii b) ii, iii and iv c) iv only d) None of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education