FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

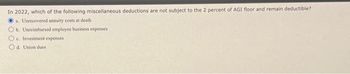

Transcribed Image Text:In 2022, which of the following miscellaneous deductions are not subject to the 2 percent of AGI floor and remain deductible?

a. Unrecovered annuity costs at death

b. Unreimbursed employee business expenses

Oe Investment expenses

d. Union dues

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2022, NB, Incorporated's federal taxable income was $242,000. Compute the required installment payments of 2023 tax in each of the following cases: Required: a. NB's 2023 taxable income is $593,000. b. NB's 2023 taxable income is $950,000. c. NB's 2023 taxable income is $1,400,000. a. Total installment payments b. Total installment payments c. Total installment payments Amountarrow_forwardFour independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: ($ in thousands) _____ Situation________ 1 2 3 4 Taxable income $100 $232 $228 $308 Future deductible amounts 16 20 20 Future taxable amounts 16 16 44 Balance (s) at…arrow_forwardE19.12 (LO 1) (Deferred Tax Asset) Callaway SA has a deferred tax asset account with a balance of €150,000 at the end of 2021 due to a single cumulative temporary difference of €375,000. At the end of 2022, this same temporary difference has increased to a cumulative amount of €500,000. Taxable income for 2022 is €850,000. The tax rate is 40% for all years.arrow_forward

- Presented below are two independent situations related to future taxable and deductible amounts resulting from temporary differences existing at December 31, 2020.1. Buffalo Co. has developed the following schedule of future taxable and deductible amounts. 2021 2022 2023 2024 2025 Taxable amounts $ 200 $ 200 $ 200 $ 200 $ 200 Deductible amount — — — ( 1,400 ) 2. Carla Co. has the following schedule of future taxable and deductible amounts. 2021 2022 2023 2024 Taxable amounts $ 200 $ 200 $ 200 $ 200 Deductible amount — — ( 2,200 ) — Both Buffalo Co. and Carla Co. have taxable income of $ 4,800 in 2020 and expect to have taxable income in all future years. The tax rates enacted as of the beginning of 2020 are 30% for 2020–2023 and 35% for years thereafter. All of the underlying temporary differences relate to noncurrent assets and liabilities.1. Compute the net amount of deferred…arrow_forwardH6. Explain wrong options and explain with detailsarrow_forwardFor the 2022 property tax levy for local governments in Illinois, which of the following statements is correct? A. On the lien date in 2022, property tax revenue for 2023 is neither measurable nor available. B. On the levy date in 2022, property tax revenue for 2023 is measurable but not available. C. A and B. D. Neither A nor B.arrow_forward

- Carla Vista Construction Company uses the percentage-of-completion method of accounting. In 2025, Carla Vista began work under contract #E2-D2, which provided for a contract price of $2,219,000. Other details follow: Costs incurred during the year Estimated costs to complete, as of December 31 Billings during the year Collections during the year (a) Your answer is correct. Revenue recognized in 2025 Revenue recognized in 2026 $ 2025 $620,490 970,510 $ 428,000 350,000 What portion of the total contract price would be recognized as revenue in 2025? In 2026? (Do not round intermediate calculations.) 865,410 2026 1,353,590 $1,429,000 -0- 1,699,000 1,471,000arrow_forwardProblem 5-28 (LO. 4) Blue Corporation, a manufacturing company, decided to develop a new line of merchandise. The project began in 2019. Blue had the following expenses in connection with the project: Salaries Materials Insurance Utilities Cost of inspection of materials for quality control Promotion expenses Advertising Equipment depreciation Cost of market survey + 2019 $500,000 $600,000 90,000 70,000 8,000 11,000 6,000 8,000 7,000 6,000 11,000 18,000 20,000 14,000 0 15,000 8,000 2020 0 The new product will be introduced for sale beginning in July 2021. Determine the amount of the deduction for research and experimen expenditures for 2019, 2020, 2021, and 2022. If necessary, round the annual deduction to the nearest dollar.arrow_forwardPresented below are two independent situations related to future taxable and deductible amounts resulting from temporary differences existing at December 31, 2020. 1. Mooney Co. has developed the following schedule of future taxable and deductible amounts. 2021 2022 2023 2024 2025 Taxable amounts $300 $300 $300 $ 300 $300 Deductible amount — — — (1,600) — 2. Roesch Co. has the following schedule of future taxable and deductible amounts. 2021 2022 2023 2024 Taxable amounts $300 $300 $ 300 $300 Deductible amount — — (2,300) — Both Mooney Co. and Roesch Co. have taxable income of $4,000 in 2020 and expect to have taxable income in all future years. The tax rates enacted as of the beginning of 2020 are 30% for 2020–2023 and 35% for years thereafter. All of the underlying temporary differences relate to noncurrent assets and liabilities. Instructions For each of these two situations, compute the net amount of deferred income taxes to be reported at the end of…arrow_forward

- 10030.arrow_forwardE18.19 (LO 1, 2, 4) (Two Temporary Differences, Multiple Rates, Future Taxable Income) Nadal Inc. has two temporary differences at the end of 2024. The first difference stems from installment sales, and the second one results from the accrual of a loss contingency. Nadal's accounting department has developed a schedule of future taxable and deductible amounts related to these temporary differences as follows. Taxable amounts 2025 2026 2027 2028 $40,000 $50,000 $60,000 $80,000 (15,000) (19,000) Deductible amounts $40,000 $35,000 $41,000 $80,000 As of the beginning of 2024, the enacted tax rate is 34% for 2024 and 2025, and 20% for 2026-2029. At the beginning of 2024, the company had no deferred income taxes on its balance sheet. Taxable income for 2024 is $500,000. Taxable income is expected in all future years. Instructions a. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2024. b. Indicate how deferred income taxes would be…arrow_forwardWhich of the following statements is true? a) If funds are withdrawn from an annuity during liquidation, no federal income tax is paid B) If funds are withdrawn from an annuity, and the annuitant is older than age 75, no federal income tax is paid C) If funds are withdrawn from an annuity during the accumulation period, no federal income tax is paid D) If funds are withdrawn from an annuity before age 591/2, there is a federal income tax penalty in addition to the ordinary income taxarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education