Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

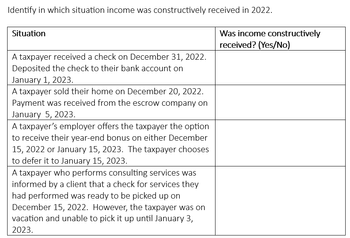

Transcribed Image Text:Identify in which situation income was constructively received in 2022.

Situation

A taxpayer received a check on December 31, 2022.

Deposited the check to their bank account on

January 1, 2023.

A taxpayer sold their home on December 20, 2022.

Payment was received from the escrow company on

January 5, 2023.

A taxpayer's employer offers the taxpayer the option

to receive their year-end bonus on either December

15, 2022 or January 15, 2023. The taxpayer chooses

to defer it to January 15, 2023.

A taxpayer who performs consulting services was

informed by a client that a check for services they

had performed was ready to be picked up on

December 15, 2022. However, the taxpayer was on

vacation and unable to pick it up until January 3,

2023.

Was income constructively

received? (Yes/No)

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A taxpayer has unutilized or excess Creditable Withholding Taxes (CWT) for the taxable year 2019. The taxpayer has collected its CWT certificates or BIR Form 2307 from its income payors/customers. a. What are the options of the taxpayer in relation to its unutilized or excess CWT? b. Assuming during the review of the taxpayer for his Annual Income Tax Return filed for the year 2019, the taxpayer decided to apply for a refund instead of its initial decision of carrying the excess forward to the next taxable periods. Is the application valid? Justify your answer.arrow_forwardA taxpayer employs a qualified PWD for a total salary of P50,000. Assuming taxpayer meets all requirements, how much may he claim as special deduction from gross income? a. 50,000 b. 12,500 c. 10,000 d. 7,500arrow_forwardIn 2023, a taxpayer who paid $16,500 of self-employment tax would deduct $ deduction. of the tax as a (for/from) I AGIarrow_forward

- Use the 2021 FICA tax rates, shown, to answer the following question. If a taxpayer is not self-employed and earns $149,000, what are the taxpayer's FICA taxes? Employee's Rates Matching Rates Paid by the Employer Self-Employed Rates 7.65% on first $142,800 of 7.65% on first $142,800 paid 15.3% on first $142,800 of net income in wages 1.45% of income in excess 1.45% of wages paid in of $142,800 excess of $142,800 profits 2.9% of net profits in excess of $142,800 + The taxpayer's FICA taxes are $ (Round to the nearest cent as needed.)arrow_forwardIf a taxpayer works for more than one employer during the year, how much in FUTA taxes is remitted in the name of the taxpayer? Multiple Choice If the employee earns less than $7,000 at the first job, the next employer must remit FUTA taxes until the employee has earned a total of $7,000. If the employee earns more than $7,000 at the first job, all other employers are exempt from paying FUTA taxes for this employee during the year. Only the first employer is required to remit FUTA taxes on the wages earned. Both employers must remit FUTA taxes they pay to the employee on the first $7,000 of wages earned by the employee at each job.arrow_forwardA taxpayer has unutilized or excess Creditable Withholding Taxes (CWT) for the taxable year 2019. The taxpayer has collected its CWT certificates or BIR Form 2307 from its income payors/customers. Assuming during the review of the taxpayer for his Annual Income Tax Return filed for the year 2019, the taxpayer decided to apply for a refund instead of its initial decision of carrying the excess forward to the next taxable periods. Is the application valid?arrow_forward

- 8. Youngstown Decking is an accrual basis taxpayer. On July 1, 2022, Youngstown paid $22,800 cash for a comprehensive liability and property insurance policy that covers a 24-month period. The deduction for insurance expense for 2022 is: a.$11,400. b.$22,800. c.$6,650. d.$5,700. e.$950.arrow_forwardNorman Foster filed his 2020 tax return as was required on June 15, 2021. His Notice of Assessment dated August 28, 2021, indicated that his return was accepted as filed. On March 15, 2022, he receives a Notice of Reassessment dated March 8, 2022 indicating that he owes additional taxes, as well as interest on unpaid amounts. What is the latest date for filing a notice of objection for this reassessment? Explain your answer. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). A v BIUS Paragraph Arial 14px Q E E E E x X2 T Te - 田 田田国 Ť (i} 田 田 田arrow_forward1.arrow_forward

- True or False Points paid in connection with the purchase of a second residence may be deducted in the year paid. Answer: Points paid to refinance a mortgage on a principal residence are fully deductible in the year paid. Answer: If an employee incurs travel expenditures and is fully reimbursed by the employer, neither the reimbursement nor the deduction is reported on the employeeʹs tax return if reporting is pursuant to an accountable plan. Answer: answer all 3arrow_forwardHelp Save & Erit Submit Check my work Trevor is a single individual who is a cash-method, calendar-year taxpayer. For each of the next two years (2021 and 2022), Trevor expects to report salary of $104,000, contribute $8,450 to charity, and pay $3,400 in state income taxes. Required: a. Estimate Trevor's taxable income tr 2021 and 2022 using the 2021 amounts for the standard deduction for both years. b. Now assume that Trevor combines his anticipated charitable contributions for the next two years and makes the combined contribution in December of 2021. Estimate Trevor's taxable income for each of the next two years using the 2021 amounts for the standard deduction. c. Trevor plans to purchase a residence next yeat, and he estimates that addinional property taxes and residential interest will cost $3,200 and $28,000, respectively, each year. Estimate Trevor's taxable income for each of the next two years (2021 and 2022) using the 2021 amounts for the standard deduction and also…arrow_forwardAll the listed benefits paid by an employer are required to be included in an employee's income for a tax year except one. Which one? Question 4 options: a) Tuition fees for training that relates to employer's work b) Medical expenses of an employee c) Forgiveness of employee debt d) Cost of life insurancearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education