Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I want right answer

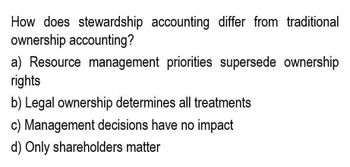

Transcribed Image Text:How does stewardship accounting differ from traditional

ownership accounting?

a) Resource management priorities supersede ownership

rights

b) Legal ownership determines all treatments

c) Management decisions have no impact

d) Only shareholders matter

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How does stewardship accounting differ from traditional ownership accounting?arrow_forwardWhat is the possible agency conflict between inside owner/managers andoutside shareholders?arrow_forwardWhich of the following is/are correct regarding agency costs? 1. Indirect costs occur when managers, acting to minimize the risk of the firm, forego investments shareholders would prefer they take. II. Direct costs occur when shareholders must incur costs to monitor the manager's actions. III. Direct costs occur when managers buy assets considered necessary by the firm's owners. Select one: O a. I, II, and III O b.ll only O c.Il and IIl only O d.lonly O e.l and II onlyarrow_forward

- Why does stakeholder impact analysis matter? [Financial Accounting] a) Impact remains constant b) Shareholders alone matter c) Users need identical information d) Different user needs affect reporting choicesarrow_forwardManagement accounting and financial accounting differ in that management accounting information is prepared a.following prescribed rules b.using whatever methods the company finds beneficial c.for shareholders and investors d.for the Inland Revenue Department e.none of thesearrow_forwardWhich of the following types of reporting does the Triple Bottom Line not incorporate? A. management B. social C. environmental D. economicarrow_forward

- Which of the following statements is incorrect? The practice of management accounting is fairly flexible. The information gathered from management accounting is not required by law. Management accounting focuses mainly on the internal user. Reports produced using management accounting must follow GAAP.arrow_forwardWhat are organizational costs? What are the reasons for and against capitalizing organizational costs? Do you think that FASB was correct when it changed the accounting rules to prohibit capitalizing these costs?arrow_forwardWhat are some of the conflicts that can arise when a company is owned by group of shareholders but managed by a different group of people? How could you reduce the significance of these conflicts?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Business/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Business/Professional Ethics Directors/Executives...

Accounting

ISBN:9781337485913

Author:BROOKS

Publisher:Cengage