Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting

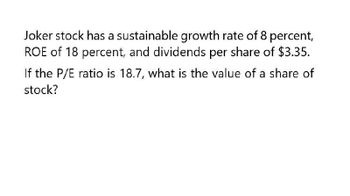

Transcribed Image Text:Joker stock has a sustainable growth rate of 8 percent,

ROE of 18 percent, and dividends per share of $3.35.

If the P/E ratio is 18.7, what is the value of a share of

stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A stock has a market price of $33.45 and pays a $.95 dividend. What is the dividend yield?arrow_forwardIf a stock's P/E ratio is 13.5 at a time when earnings are $3 per year and the dividend payout ratio is 40%, what is the stock's current price?arrow_forwardA stock has a dividend yield of 2.85% and a capital gains yield of 6.93%. What is the stock's required return?arrow_forward

- What is the cost of equity?arrow_forwardOvitable, Inc. has preferred stock with a price of $22.24 and a dividend of $2.20 per year. What is its dividend yield?arrow_forwardA share of common stock just paid a dividend of $1.00. If the expected long-run growth rate for this stock is 5.4%,and if investors' required rate of return is 11.4%, what is the stock price?arrow_forward

- The current price of XYZ stock is $27 per share. If the required rate of return is 0.13 percent, and the growth rate is expected to stay at 0.055 what is the current dividendarrow_forwardA preferred stock pays a dividend of $5.8. If the required return is 12.3%, what is the value of the stock? Answer:arrow_forwardDetermine the cost of common stock (equity). The T-Bill rate is 5.2%. The Market Return is 12.7%. What is the company's cost of equity capital if the company has a beta of 1.27? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Cost of equity %arrow_forward

- A stock has earned $3.54 per share before dividends. They have a DPR of 35%. Similar stocks have P/E ratios of 15.3. What is your expected price target if the company earns $3.97 per share next year?arrow_forwardGiven correct answer financial accountingarrow_forwardChoi Tech stock currently sells for $64 per share and the required return is 12 percent. The total return is evenly divided between the capital gains yield and the dividend yield. What is the current dividend per share if it's the company's policy to always maintain a constant growth rate in its dividends? What are the inputs to solve this on a BA II plus financial calculator?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT