Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I want to correct answer general accounting

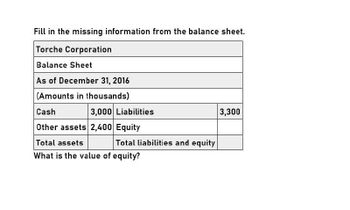

Transcribed Image Text:Fill in the missing information from the balance sheet.

Torche Corporation

Balance Sheet

As of December 31, 2016

(Amounts in thousands)

Cash

3,000 Liabilities

Other assets 2,400 Equity

Total assets

Total liabilities and equity

What is the value of equity?

3,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Financial accounting....use the following. ...arrow_forwardUse the following information for questions 2-9 Category Accounts payable Accounts receivable Accruals 2016 2017 34,500 37,500 96,000 102,000 13,500 11,250 Additional paid in capital Cash Common Stock@par value COGS Depreciation expense 187,500 204,000 6,000 16,800 10,500 11,550 109,500 144,000 18.000 19,500 Interest expense 13,500 13,800 Inventories 93,000 96,000 Long-term debt 112,500 116,250 Net fixed assets 315,000 ??? Notes payable 49,500 54,000 Operating expenses (excl. depr.) 42,000 52,500 Retained earnings Sales Taxes Net fixed assets in 2017 were $ 1) 331,750 2) 332,750 102,000 114,000 213,000 282,000 8,250 15,750 3) 333,750 4) 344,750 5) 345,750arrow_forwardhas the following balance sheet (December 31, 2023). The figures are in $ million. Cash Short-term investments Accounts receivable Inventory Current assets Gross fixed assets Accumulated deprec. Net fixed assets $40 30 30 70 170 250 50 200 Total assets Accounts payable Accruals Notes payable $370 Current liabilities Long-term debt Common stock (par value=$1) Retained earnings Total common equity Total liab. & equity Note that only 50% of "cash" (shown in the balance sheet above) is used in operation. $30 50 10 90 70 30 180 210 Use the above information to answer questions 8 8. What is its total operating capital for 2023? $240 m $370arrow_forward

- Is Maness receiving a good return on equity? Explain.arrow_forwardBased on the financial statements below, what is the current ratio and quick ratio?arrow_forwardCash Accounts receivable (net) Inventories Total current assets Noncurrent assets Current liabilities Long-term liabilities Shareholders' equity Net income Interest expense Income tax expense Sanchez Corporation Selected Financial Information The debt to equity ratio for 2016 is: OA) 0.80 OB) 0.44 Oc) 0.67 OD) 0.13 12/31/16 $ 20,000 100,000 190,000 310,000 230,000 200,000 40,000 300,000 $40,000 10,000 20,000arrow_forward

- Use the following data: Barry Computer Company Balance Sheet as of December 31, 2014 In thousands of $ Cash 85,775 Accounts payable 171,550 Receivables 669,045 Other current liabilities 257,325 Inventories 446,030 Notes payable 85,775 Total current assets 1,200,850 Total current liabilities 514,650 Net fixed assets 514,650 Long-term debbt 394,565 Common equity 806,285 Total assets 1,715,500 Total liabilities and equity 1,715,500 Barry Computer Company Income Statement For the year ended December 31, 2014 In thousands of $ Sales 2,350,000 COGS Materials 1,081,000 Labour 517,000 Heat, light and power 164,500 Indirect labour 188,000 Depreciation 94,000 Total COGS 2,044,500 Gross profit 305,500 Selling expenses 164,500 General and administrative expenses 47,000 EBIT 94,000 Interest expense 39,457 EBT 54,543 Federal and state income taxes (40%) 21,817 Net income 32,726 Calculate the following ratio for Barry Company. Round your answer to two decimal places. ROIC:arrow_forwardGiven the information below, determine the free cash flow for 2014. Income Statement (In Thousands) Sales Operating costs EBITDA Depreciation Earnings before interest and taxes Interest (8%) Earnings before taxes Taxes (40%) Net income Common dividends 2014 2013 $24,800.00 $22,000.00 $14,880.00 $13,200.00 $9,920.00 $8,800.00 -$920.00 $800.00 $9,000.00 $8,000.00 -$112.00 -$160.00 $8,888.00 $7,840.00 -$3,555.20 -$3,136.00 $5,332.80 $4,704.00 $2,082.00 $2,352.00arrow_forwardSuppose the 2025 adidas financial statements contain the following selected data (in millions). Current assets Total assets Current liabilities Total liabilities Cash $4,582 8,900 2,900 5,162 (c) 750 (a1) Compute the following values. Interest expense Income taxes Net income (a) Working capital. (Enter answer in millions.) $150 100 275 (b) Current ratio. (Round to 2 decimal places, e.g. 6.25:1.) Debt to assets ratio. (Round to O decimal places, e.g. 62%.) (d) Times interest earned. (Round to 2 decimal places, e.g. 6.25.) $ ta millions :1 % timesarrow_forward

- Just Dew It Corporation reports the following balance sheet information for 2017 and 2018. JUST DEW IT CORPORATION2017 and 2018 Balance SheetsAssetsLiabilities and Owners' Equity 20172018 20172018 Current assets Current liabilities Cash$ 10,400 $ 10,450 Accounts payable$ 72,250 $ 62,750 Accounts receivable28,000 27,200 Notes payable47,000 47,750 Inventory63,900 63,100 Total $ 119,250 $ 110,500 Total $ 102,300 $ 100,750 Long-term debt$ 63,000 $ 64,700 Owners' equity Common stock and paid-in surplus$ 83,000 $ 83,000 Fixed assets Retained earnings 157,050 190,550 Net plant and equipment$ 320,000 $ 348,000 Total$ 240,050 $ 273,550 Total assets $ 422,300 $ 448,750 Total liabilities and owners' equity $ 422,300 $ 448,750 Based on the balance sheets given for Just Dew It, calculate the following financial…arrow_forwardPlease include part D.arrow_forwardAll the figures are in millions Please write down the formulas used to answer the question and use excel to answer. Calculate: debt ratio and times interest earned ratio. LLC Current Asset Current Liabilities Total Liabilities Total Assets 2016 5,857.9 8,824.3 12,978.2 18,592.9 2017 6,261.3 10,757.7 14,687.7 20,854.2 2018 6,314.2 6,588.0 10,549.4 16,963.6 2019 5,756 6,287 10,821 17,178 2020 5,977 5,653 10,816 17,748 2021 4,950 5,983 10,049 17,000 BKW Net Cash Provided by operating activities Operating Income Before Tax Finance Costs Cash and cash eqiv & Accounts receivables 2016 853.0 862.8 - 126.2 1,008.4 + 2,785.0 2017 146.0 1,007.0 - 108. 6 1,249.2 + 2,749.2 2018 72.8 1,066.2 - 88.0 1,177.1 + 2,670.2 2019 60 620 - 142 1,290 + 2,050 2020 137 - 536 - 165 1, 1 1 1 + 1,667 2021 468 295 - 146 1,662 +…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning