FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

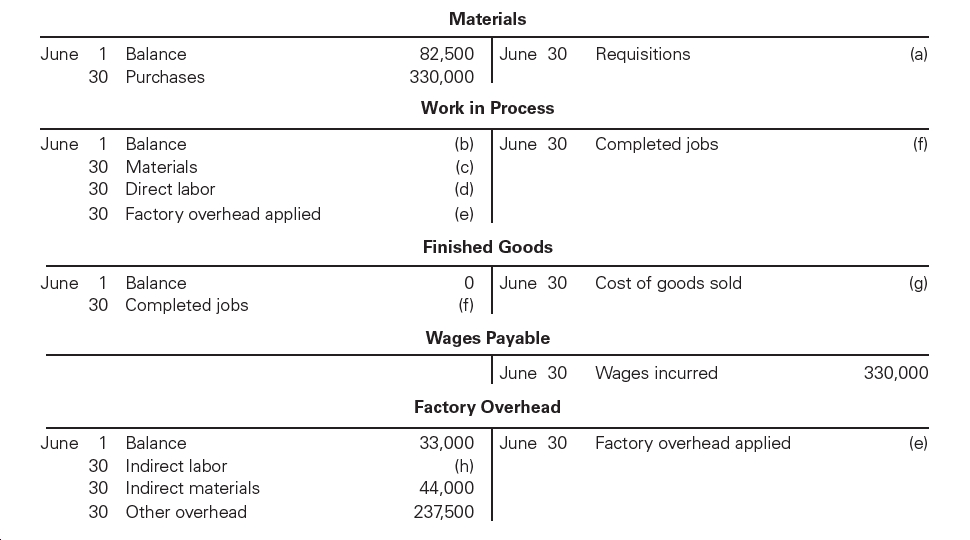

Fire Rock Company manufactures designer paddle boards in a wide variety of sizes and styles. The following incomplete ledger accounts refer to transactions that are summarized for June:

See Attachment

Transcribed Image Text:Materials

June

Balance

82,500

June 30

Requisitions

(a)

30 Purchases

330,000

Work in Process

Completed jobs

June

Balance

(b)

June 30

(f)

30 Materials

(c)

(d)

30

Direct labor

30 Factory overhead applied

(e)

Finished Goods

June 30

(f)

Cost of goods sold

June

Balance

(g)

30 Completed jobs

Wages Payable

Wages incurred

330,000

June 30

Factory Overhead

June 30

June

Balance

33,000

Factory overhead applied

(e)

30 Indirect labor

(h)

44,000

30 Indirect materials

30 Other overhead

237,500

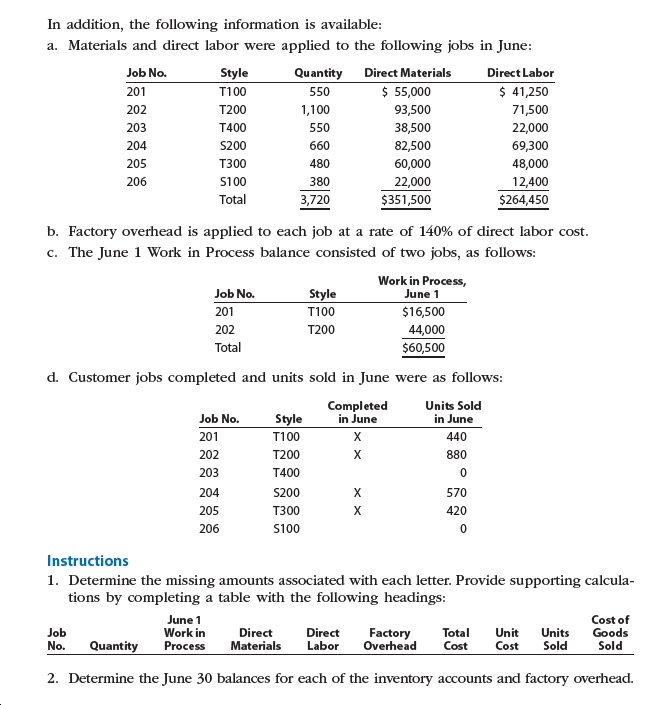

Transcribed Image Text:In addition, the following information is available:

a. Materials and direct labor were applied to the following jobs in June:

Job No.

Style

Quantity

Direct Materials

Direct Labor

$ 55,000

$ 41,250

T100

201

550

202

T200

1,100

93,500

71,500

T400

203

550

38,500

22,000

S200

69,300

204

660

82,500

205

T300

480

60,000

48,000

22,000

$351,500

206

S100

380

12,400

Total

3,720

$264,450

b. Factory overhead is applied to each job at a rate of 140% of direct labor

ost.

c. The June 1 Work in Process balance consisted of two jobs, as follows:

Work in Process,

June 1

Job No.

Style

201

T100

$16,500

202

T200

44,000

Total

$60,500

d. Customer jobs completed and units sold in June were as follows:

Units Sold

in June

Completed

in June

Job No.

Style

201

T100

440

202

T200

880

203

T400

204

S200

570

205

T300

420

206

S100

Instructions

1. Determine the missing amounts associated with each letter. Provide supporting calcula-

tions by completing a table with the following headings:

June 1

Work in

Process

Cost of

Goods

Sold

Job

No.

Direct

Direct

Factory

Overhead

Total

Cost

Unit

Cost

Units

Sold

Materials

Labor

Quantity

2. Determine the June 30 balances for each of the inventory accounts and factory overhead.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

How do I calculate Work In procces

Solution

by Bartleby Expert

Follow-up Question

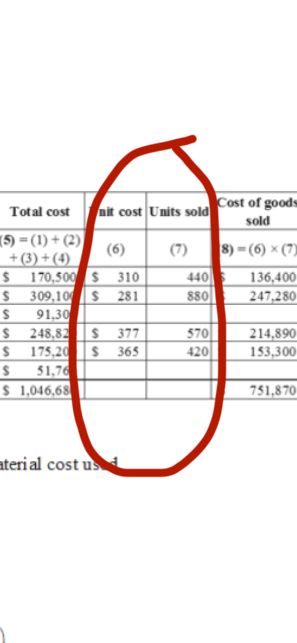

How did you find these?

Transcribed Image Text:Total cost

(5)=(1)+(2)

+(3)+(4)

nit cost Units sold

(6)

S 170,500 $ 310

$ 309,10 $281

91,30

248,82 S 377

175,20 S 365

51,76

S

S

S

S

$ 1,046,68

aterial cost us

440

880

570

420

Cost of goods

sold

8)-(6) x (7)

136,400

247,280

214,890

153,300

751,870

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

How do I calculate Work In procces

Solution

by Bartleby Expert

Follow-up Question

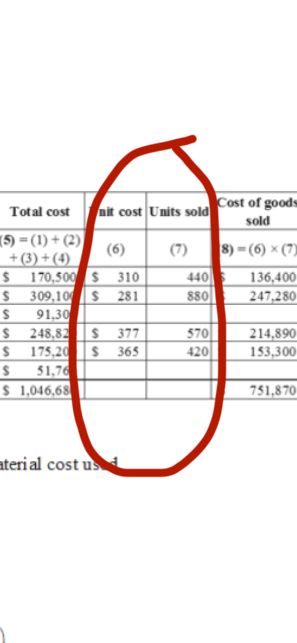

How did you find these?

Transcribed Image Text:Total cost

(5)=(1)+(2)

+(3)+(4)

nit cost Units sold

(6)

S 170,500 $ 310

$ 309,10 $281

91,30

248,82 S 377

175,20 S 365

51,76

S

S

S

S

$ 1,046,68

aterial cost us

440

880

570

420

Cost of goods

sold

8)-(6) x (7)

136,400

247,280

214,890

153,300

751,870

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Chapter 7, Part 3. Please answer in same format as question so it's easy to readarrow_forwardRequired information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Pro-Weave manufactures stadium blankets by passing the products through a weaving department and then a sewing department. The following information is available regarding its June inventories: Raw materials inventory Beginning Inventory $ 154,000 450,000 640,000 Work in process inventory-Weaving Work in process inventory-Sewing Finished goods inventory 1,396,000 The following additional information describes the company's manufacturing activities for June: Raw materials purchases (on credit) Other actual overhead cost (paid in cash) Materials used Direct-Weaving Direct-Sewing Indirect Labor used Direct-Weaving Direct-Sewing Indirect Overhead rates as a percent of direct labor Weaving Sewing Sales (on credit) $ 625,000 200,000 $ 288,000 81,000 166,000 $ 1,325,000 405,000 1,775,000 (a) Transferred from Weaving to Sewing (b) Transferred…arrow_forwardProvide tablearrow_forward

- Sheridan Company manufactures pizza sauce through two production departments: Cooking and Canning. In each process, materials and conversion costs are incurred evenly throughout the process. For the month of April, the work in process inventory accounts show the following debits. Beginning work in process Direct materials Direct labor Manufacturing overhead Costs transferred in April 30 30 Cooking 30 $0 30 23,940 9,690 35,910 Journalize the April transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Canning $4,560 Date Account Titles and Explanation 10,260 (To record materials used) 7,980 29,480 60,420 (To assign direct labour to production) (To assign overhead to production) (To record transfer of units to the Canning Department) Debit Creditarrow_forwardeBook Show Me How E Print Item Rex Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Compute the overhead rate for each activity. Round your answers to two decimal places. Overhead Overhead Annual Rate per Activity per Activity Usage Activity Machine Setups $162,750 4,200 Machine Hours 381,051 14,113 Inspections 110,550 3,300arrow_forwardI need to finish with these three questions and need help please. Journalize the entries for costs transferred from Milling to Sifting and the costs transferred from Sifting to Packaging. 2. Determine the increase or decrease in the cost per equivalent unit from June to July for direct materials and conversion costs. 3.Discuss the uses of the cost of production report and the results of part (c).arrow_forward

- Interdepartment Services: Step Method O'Brian's Department Stores allocates the costs of the Personnel and Payroll departments to three retail sales departments, Housewares, Clothing, and Furniture. In addition to providing services to the operating departments, Personnel and Payroll provide services to each other. O'Brian's allocates Personnel Department costs on the basis of the number of employees and Payroll Department costs on the basis of gross payroll. Cost and allocation information for June is as follows: Direct department cost Number of employees Gross payroll Personnel Payroll Housewares Clothing Furniture $7,300 $3,800 $12,300 $20,000 $15,650 5 Total costs $ 2 $6,100 $2,800 Payroll 0 (a) Determine the percentage of total Personnel Department services that was provided to the Payroll Department. (Round your answer to one decimal place.) 12.5 X% (b) Determine the percentage of total Payroll Department services that was provided to the Personnel Department. (Round your answer…arrow_forwardRequired information [The following information applies to the questions displayed below.] Marco Company shows the following costs for three jobs worked on in April. Balances on March 31 Direct materials used (in March) Direct labor used (in March) Overhead applied (March) Costs during April Direct materials used Direct labor used Overhead applied Status on April 30 a. Materials purchases (on credit). b. Direct materials used. View transaction list Journal entry worksheetarrow_forwardSierra Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the cutting process. The following information is available regarding its May inventories. Beginning Inventory Ending Inventory Raw materials inventory $ 81,000 $ 97,900 Work in process inventory—Cutting 193,500 135,500 Work in process inventory—Stitching 213,300 107,000 Finished goods inventory 50,100 38,250 The following additional information describes the company's production activities for May. Direct materials Raw materials purchased on credit $ 100,000 Direct materials used—Cutting 25,500 Direct materials used—Stitching 0 Direct labor Direct labor—Cutting $ 23,100 Direct labor—Stitching 92,400 Factory Overhead (Actual costs) Indirect materials used $ 57,600 Indirect labor used 58,000 Other overhead costs 62,000 Factory Overhead Rates Cutting 150% of direct…arrow_forward

- Subject : Accountingarrow_forwardFriedman Company has a production process that involves three processes. Units move through the processes in this order: cutting, stamping, and then polishing. The company had the following transactions in November: View the transactions. Prepare the joumal entries for Friedman Company. (Record debits first, then credits. Exclude explanations from journal entries.) 1. Cost of units completed in the Cutting Department, $14,000 Date Nov. 30 Accounts Debit Credit Transactions 1. Cost of units completed in the Cutting Department, $14,000 2. Cost of units completed in the Stamping Department, $28,000 $39,000 3. Cost of units completed in the Polishing Department, 4. Sales on account, $40,000 5. Cost of goods sold is 80% of sales - Xarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education