FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Pares

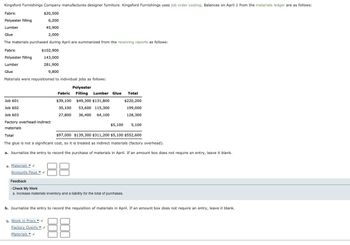

Transcribed Image Text:Kingsford Furnishings Company manufactures designer furniture. Kingsford Furnishings uses job order costing. Balances on April 1 from the materials ledger are as follows:

Fabric

$20,500

Polyester filling

6,200

Lumber

45,900

2,000

Glue

The materials purchased during April are summarized from the receiving reports as follows:

Fabric

Polyester filling

Lumber

Glue

$102,900

143,000

281,900

9,800

Materials were requisitioned to individual jobs as follows:

Polyester

Filling Lumber Glue Total

$49,300 $131,800

$220,200

53,600 115,300

199,000

36,400 64,100

128,300

Job 601

Job 602

Job 603

Factory overhead-indirect

materials

a. Materials

Accounts Paya

Fabric

Total

$97,000 $139,300 $311,200 $5,100 $552,600

The glue is not a significant cost, so it is treated as indirect materials (factory overhead).

a. Journalize the entry to record the purchase of materials in April. If an amount box does not require an entry, leave it blank.

$39,10

b. Work in Proce

30,100

27,800

Factory Overhe▾ ✔

Materials

$5,100 5,100

Feedback

Check My Work

a. Increase materials inventory and a liability for the total of purchases.

b. Journalize the entry to record the requisition of materials in April. If an amount box does not require an entry, leave it blank.

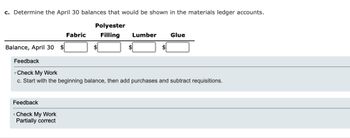

Transcribed Image Text:c. Determine the April 30 balances that would be shown in the materials ledger accounts.

Polyester

Filling Lumber

Balance, April 30

Fabric

Feedback

Check My Work

Partially correct

Glue

Feedback

Check My Work

c. Start with the beginning balance, then add purchases and subtract requisitions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education