Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Provide correct option general accounting

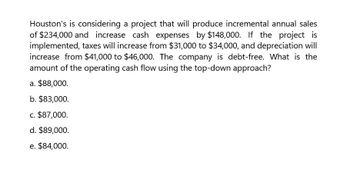

Transcribed Image Text:Houston's is considering a project that will produce incremental annual sales

of $234,000 and increase cash expenses by $148,000. If the project is

implemented, taxes will increase from $31,000 to $34,000, and depreciation will

increase from $41,000 to $46,000. The company is debt-free. What is the

amount of the operating cash flow using the top-down approach?

a. $88,000.

b. $83,000.

c. $87,000.

d. $89,000.

e. $84,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Machin company wishes to invest in a project to maximize its sales. Which requires a Total Final Investment of $6658. A discount rate of 15% was valued. The projected cash flows are as follows: 1 2 3 $2,500.00 $3,700.00 $4,980.00 Calculate the internal rate of return, the present value, the net present value and its payback. The project is accepted or rejected, and why it reaches these conclusionsarrow_forwardEach of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. a. Campbell Manufacturing is considering the purchase of a new welding system. The cash benefits will be $480,000 per year. The system costs $2,950,000 and will last 10 years. b. Evee Cardenas is interested in investing in a women's specialty shop. The cost of the investment is $280,000. She estimates that the return from owning her own shop will be $45,000 per year. She estimates that the shop will have a useful life of 6 years. c. Barker Company calculated the NPV of a project and found it to be $63,900. The project's life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $135,000. Required: 1. Compute the NPV for Campbell Manufacturing, assuming a discount rate of 12%. If required, round all present value calculations to the nearest dollar. Use the minus sign to indicate a…arrow_forwardAl's Bistro is considering a project which will produce sales of $23,000 and increase cash expenses by $13,000. If the project is implemented, taxes will increase from $25,000 to $27,500 and depreciation will increase from $5,000 to $8,000. What is the amount of the operating cash flow using the top-down approach?arrow_forward

- Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) b. What are the free cash flows for this project for years 1 and 2? (Click on the following icon in order to copy its contents into a spreadsheet.) Revenues Operating Expenses (other than depreciation) Depreciation Increase in Net Working Capital Capital Expenditures Marginal Corporate Tax Rate Year 1 126.8 42.5 25.9 3.3 26.5 21 % Year 2 165.1 62.5 26.5 7.4 35.4 21 %arrow_forwardElmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) b. What are the free cash flows for this project for years 1 and 2? a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) Calculate the incremental earnings of this project below: (Round to one decimal place.) Incremental Earnings Forecast (millions) Sales Operating Expenses Depreciation EBIT Income tax at 21% Unlevered Net Income Year 1 Year 2 $ $ SA $ 69 $ GA 67 69 $ $ $ 6969 $ $ SAarrow_forwardA company is considering a new project with the following estimates: Price per Unit = $125; Variable Costs per Unit = $40; Annual Fixed Costs = $350,000; Annual Number of Units Sold = 3,000. The company believes all estimates are accurate only to within +12%. Assume you were peforming scenario analysis and computing the proposed project's expected annual operating cash flows under the worst-case scenario. What amount would you use in your analysis for total annual cash outflow from variable costs? Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit any commas and the $ sign in your response. For example, an answer of $1,000.50 should be entered as 1000.50.arrow_forward

- You are analyzing a project and have developed the following estimates: unit sales = 2,150, price per unit = $84, variable cost per unit = $57, fixed costs per year = $13,900. The depreciation is $8,300 a year and the tax rate is 35 percent. What effect would an increase of $1 in the selling price have on the operating cash flow?arrow_forwardA firm is considering a project that will generate perpetual after-tax cash flows of $16,500 per year beginning next year. The project has the same risk as the firm's overall operations and must be financed externally. Equity flotation costs 14 percent and debt issues cost 3 percent on an after - tax basis. The firm's D/E ratio is 0.5. What is the most the firm can pay for the project and still earn its required return?arrow_forwardA company is considering investing in a new project that requires an initial investment of $1,000,000. The projected cash flows from the project are as follows: Year 1: $300,000 Year 2: $400,000 Year 3: $500,000 Year 4: $600,000 The company's required rate of return for similar projects is 12%. What is the Net Present Value (NPV) of the project? What is the Internal Rate of Return (IRR) of the project? YOU MUST SHOW CALCULATIONS TO BACK UP YOUR SELECTION. -$100,000// 12% $250,000 // 10% $250,000 // 14% $350,000 // 14% $50,000 // %14arrow_forward

- A firm is considering a project that will generate perpetual after-tax cash flows of $16,500 per year beginning next year. The project has the same risk as the firm's overall operations and must be financed externally. Equity flotation costs 14 percent and debt issues cost 3 percent on an after-tax basis. The firm's D/E ratio is 0.5. What is the most the firm can pay for the project and still earn its required return? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar. Maximum the firm can payarrow_forwardElmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars) a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) b. What are the free cash flows for this project for years 1 and 2?arrow_forwardTrovato Corporation is considering a project that would require an investment of $68,000. No other cash outflows would be involved. The present value of the cash inflows would be $89,080. The profitability index of the project is closest to (Ignore income taxes.):arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT