Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is horizon industries opereting leverage?

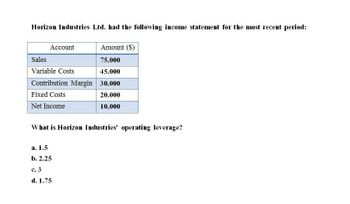

Transcribed Image Text:Horizon Industries Ltd. had the following income statement for the most recent period:

Account

Sales

Variable Costs

Amount ($)

75,000

45,000

Contribution Margin 30,000

Fixed Costs

Net Income

20,000

10,000

What is Horizon Industries' operating leverage?

a. 1.5

b. 2.25

c. 3

d. 1.75

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Provide correct answer general accountingarrow_forwardThe CVP income statements shown below are available for Blossom Company and Crane Company. Blossom Co. $600,000 320,000 Sales revenue Variable costs Contribution margin Fixed costs Operating income (a1) Blossom Co. Calculate the degree of operating leverage for each company. (Round answer to 2 decimal places, e.g. 15.25.) Crane Co. 280,000 180,000 $100,000 Save for Later Crane Co. $600.000 120,000 480,000 380,000 $100,000 Operating leverage Attempts: 0 of 1 used Submit Answerarrow_forwardFinancial accounting questionsarrow_forward

- The single-column CVP income statements shown below are available for Wildhorse Company and Blossom Company, Sales Variable costs Contribution margin Fixed costs Net income Wildhorse Wildhorse Co. Blossom $495,000 239,000 256,000 1000 156,000 $100,000 Blossom Co. Degree of Operating Leverage $495,000 (a1) Compute the degree of operating leverage for each company. (Round answers to 2 decimal places, e.g. 1.15.) $ 51,000 444,000 344,000 $100,000 (b) Assuming that sales revenue increases by 10% (due to a 10% increase in the number of units sold), prepare a single-plumn CVP income statement for each company. Wildhorse Company $ tA $ Blossom Companyarrow_forwardThe February contribution format income statement of Tipton Corporation appears below: O 0.27 O 6.79 O 3.70 Sales O 0.15 Variable expenses The degree of operating leverage is closest to: Contribution margin Fixed expenses Net operating income. $ $ 211,200 96,000 115,200 84,100 31,100arrow_forward1. The following CVP income statements are available for ABC Company and XYZ Company. АВС Companу Sales Variable costs Contribution margin Fixed costs Operating income CVP I/S for 2020 $500,000 300,000 200,000 180,000 $ 20,000 XYZ Company CVP I/S for 2020 $500,000 180,000 320,000 300,000 $ 20,000 (a) Compute the break-even point in dollars and the margin of safety ratio for each company. (b) Compute the degree of operating leverage for each company. (c) Assuming that sales revenue decreases by 20%, prepare a CVP income statement for each company- (d) Assuming that sales revenue increases by 20%, calculate the operating incomes of the two companies without preparing income statement. (Use DOL) www www ww wwwarrow_forward

- The following CVP income statements are available for Wildhorse Corp. and Blossom, Inc. Wildhorse Corp. Blossom, Inc. Sales revenue $854,000 $854,000 * Variable costs 396,500 228,750 Contribution margin 457,500 625,250 Fixed costs 305,000 472,750 Net income $152,500 $152,500 (a) Compute the degree of operating leverage for each company. (Round answers to 1 decimal place, e.g. 15.5.) Degree of Operating Leverage Wildhorse Blossomarrow_forwardGeneral accounting questionsarrow_forwardNet Income Planning Selected operating data for Oakbrook Company in four independent situations are shown below. Fill in the blanks for each independent situation. Sales Variable expense Fixed expense Net income (loss) before tax Units sold Unit contribution margin Contribution margin ratio $ $ A $350,000 0 a. 0 b. $25,000 30,000 $5.20 $ B 0 C. $ $ $111,000 $62,000 $15,000 0 d. $7.00 C 0 e. 0 f. $ $53,200 $28,800 0.4 D $520,000 0 g. $178,000 $(22,000) 0 h.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College