FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please provide correct option of this general accounting question

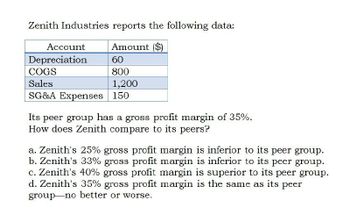

Transcribed Image Text:Zenith Industries reports the following data:

Account

Amount ($)

Depreciation

60

COGS

800

Sales

1,200

SG&A Expenses

150

Its peer group has a gross profit margin of 35%.

How does Zenith compare to its peers?

a. Zenith's 25% gross profit margin is inferior to its peer group.

b. Zenith's 33% gross profit margin is inferior to its peer group.

c. Zenith's 40% gross profit margin is superior to its peer group.

d. Zenith's 35% gross profit margin is the same as its peer

group no better or worse.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What company is better in short-term and whyarrow_forwardCalculate the gross profit margin?arrow_forwardPrepare a comparative income statement for 20X2 and 20X1 using vertical analysis, and| Problem 2 VERTICAL ANALYSIS. The Lyons Corporation reported the following income stateme data: 20X2 20X1 Net sales $400.000 $250.000 Cost of goods sold $280.000 S160.000 Operating expenses S75.000 $56.000 Requirement: Prepare a comparative income statement for 20X2 and 20X1 using vertical analysis, ana evaluate the results.arrow_forward

- Subject:arrow_forwardVincenzo Corporation is a manufacturer with four product lines. Below is some financial information about each of the four product lines. Required:Calculate, explain, and determine which of the segments are reportable based on the:a. Revenue testb. Operating profit (loss) testc. Identifiable assets testd. 75 percent combined revenue testarrow_forwardThe following information relates to a company for two periods: year 1; profit- GHC131250, sales- GHC1375000; year 2; profit- 225000, sales- GHC1750000. What is the sales level to earn a profit of GHC262500? O A. GHC2000000 OB. GHC1500000 OC. GHC1900000 D. GHC1000000arrow_forward

- ABC company has NOA of $23,046. Its comparable companies show the following financial data: Company Operating value NOA $23,046 $29,828 $32.956 LBJ $36412 $29,828 $18,923 MLK $34,277 $26,449 NDR $20,932 What is ABC company's operating value? Assume an equally weighted average is used in the multiple method. $14,702arrow_forwardCompany X is competing with company Y. These are their ratios: x y Total Asset Trunover .462 .361 Inventory Turnover 30.23 37.40 Accounts Receivable n/a n/a Based on Asset Utilization/Management Efficiency, which company is doing better when compared to the other?arrow_forwardThe following are the income statements for Ace and Diamond Companies. Diamond $ 76,000 49,000 45,600 21,000 30,400 9,500 12,500 $ 11,500 $ 17,900 What are the net income percentages for Ace and Diamond, respectively? Revenue Cost of goods sold Gross margin Operating expenses Net income Multiple Choice 6.09% and 4.25% 16.4% and 23.6% 1.83% and 1.70% 30% and 40% Ace $ 70,000arrow_forward

- This topic is about CVP Analysis. Check the photo for the problemarrow_forwardChambliss Corp.'s total assets at the end of last year were $265,000 and its EBIT was 62,500. What was its basic earning power (BEP)? Select the correct answer. a. 22.88% b. 24.28% c. 23.58% d. 24.98% e. 22.18%arrow_forwardP5-5A Profitability Analysis Kolby Enterprise reports the following information on its income statement: net sales 250,000, cost of goods sold 150,000, selling expenses 50,000, Administrative expenses 10,000, other income 15,000, other expense 10,000. Required Calculate Kolby's gross profit percentage and return on sales ratio. Explain what each ratio tells us about Kolby's performance. Kolby is planning to add a new product and expects net sales to be $45,000 and cost of goods to be 38,000. No other income or expand are expected to change. How will this affect Kolby's gross profit percentage and return on sales ratio? What do you advise regarding the new product offering?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education