FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

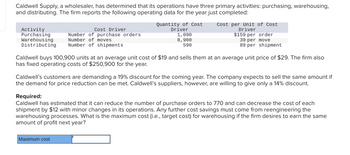

Caldwell Supply, a wholesaler, has determined that its operations have three primary activities: purchasing, warehousing, and distributing. The firm reports the following operating data for the year just completed: Caldwell buys 100,900 units at an average unit cost of $19 and sells them at an average unit price of $29. The firm also has fixed operating costs of $250,900 for the year. Caldwell's customers are demanding a 19% discount for the coming year. The company expects to sell the same amount if the demand for price reduction can be met. Caldwell's suppliers, however, are willing to give only a 14% discount. Required: Caldwell has estimated that it can reduce the number of purchase orders to 770 and can decrease the cost of shipment by $12 with minor changes in its operations. Any further cost savings must come from reengineering the warehousing processes. What is the maximum cost (i.e., target cost) for warehousing if the firm desires to earn the same amount of profit next year?

Transcribed Image Text:Caldwell Supply, a wholesaler, has determined that its operations have three primary activities: purchasing, warehousing,

and distributing. The firm reports the following operating data for the year just completed:

Activity

Purchasing

Warehousing

Distributing

Cost Driver

Number of purchase orders

Number of moves

Number of shipments

Quantity of Cost

Driver

1,090

8,900

590

Cost per Unit of Cost

Driver

$159 per order

39 per move

89 per shipment

Caldwell buys 100,900 units at an average unit cost of $19 and sells them at an average unit price of $29. The firm also

has fixed operating costs of $250,900 for the year.

Caldwell's customers are demanding a 19% discount for the coming year. The company expects to sell the same amount if

the demand for price reduction can be met. Caldwell's suppliers, however, are willing to give only a 14% discount.

Required:

Caldwell has estimated that it can reduce the number of purchase orders to 770 and can decrease the cost of each

shipment by $12 with minor changes in its operations. Any further cost savings must come from reengineering the

warehousing processes. What is the maximum cost (i.e., target cost) for warehousing if the firm desires to earn the same

amount of profit next year?

Maximum cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vision Company sells optical equipment. Blitz Company manufactures special glass lenses. Vision orders 11,400 lenses per year, 200 per week, at $35 per lens. Blitz covers all shipping costs. Vision earns 25% on its cash investments. The purchase-order lead time is 2.5 weeks. Vision sells 225 lenses per week. The following data are available: Relevant ordering costs per purchase order $41.25 Relevant insurance, materials handling, breakage, and so on, per year $ 4.50 What is the economic order quantity for Vision? a. 328 lenses b. 457 lenses c. 161 lenses d. 266 lensesarrow_forwardSk8 Company produces skateboards and purchases 20,000 units of a wheel bearing each year at a cost of $1 per unit. Sk8 requires a 15% annual rate of return on investment. In addition, the relevant carrying cost (for insurance, materials handling, breakage, etc.) is $0.17 per unit per year. The relevant ordering cost per purchase order is $38.40. Q. Assume that demand is uniform throughout the year and known with certainty so there is no need for safety stocks. The purchase-order lead time is half a month. Calculate Sk8’s reorder point for the wheel bearing.arrow_forwardMarwick's Pianos, Incorporated, purchases pianos from a manufacturer for an average cost of S 1,507 per unit and then sells them to retail customers for an average price of $2,600 each. The company's selling and administrative costs for a typical month are presented below: Costs Cost Formula Selling: Advertising $937 per month Sales salaries and commissions $4,790 per month, plus 5% of sales Delivery of pianos to customers $61 per piano sold Utilities $645 per month Depreciation of sales facilities $5,027 per month Administrative: Executive salaries $13,534 per month Insurance $710 per month Clerical $2,535 per month, plus $41 per piano sold Depreciation of office equipment $928 per month During August, Marwick's Pianos, Incorporated, sold and delivered 63 pianos. Required: Prepare a traditional format income statement for August. Prepare a contribution format income statement for August. Show costs and revenues on both a total and a per - unit basis down through contribution margin.arrow_forward

- Sunn Company manufactures a single product that sells for $145 per unit and whose variable costs are $143 per unit. The company's annual fixed costs are $638,000. The sales manager predicts that next year's annual sales of the company's product will be 40,800 units at a price of $208 per unit. Variable costs are predicted to increase to $148 per unit, but fixed costs will remain at $638,000. What amount of income can the company expect to earn under these predicted changes? Prepare a contribution margin income statement for the next year. SUNN COMPANY Contribution Margin Income Statement $ per unit Contribution margin Unitsarrow_forwardPlease fill out this chartarrow_forwardMarwick's Pianos, Inc., purchases pianos from a large manufacturer and sells them at the retail level. The pianos cost, on the average, $2,450 each from the manufacturer. Marwick's Pianos Inc, sells pianos to its customer at an average price of $3,125 each. The selling and administrative costs that the company incurs in a typical month are presented below:Costs Cost FormulaSelling:Advertising $700 per monthSales salaries asnd commissions $950 per month, plus 8% of salesDelivery of pianos to customers $30 per piano soldUtilities $350 per monthDepreciation of sales facilities $800 per monthAdministrative:Executive salaries $2,500 per monthInsurance $400 per monthClerical $1,000 per month, plus $20 per piano soldDepreciation of office equipment $300 per monthDuring August, Marwick's Pianos, Inc., sold and delivered 40 pianos.Required:1. Prepare an income statement for Marwick's Pianos, Inc. for August. Use the traditional format, with costs organized by function.2. Redo (1) above, this…arrow_forward

- Currently, OET Corporation sells 350,000 units of widgets a month at a price of $21 a unit. The company currently has a net 30 credit policy. Mr. Ent, the company's financial manager, is evaluating a new credit policy of net 60 for the company. The marketing manager thinks that sales would increase by 10,000 units per month if the company were to switch to the new credit policy. The APR for OET is 13% compounded monthly, and its variable cost per widget is $12. Ignore taxes. Tomorrow, Mr. Ent will be making a presentation on the new proposed credit policy to the CEO of OET. He will be expected to provide answers to the following questions. The net present value of the proposed credit policy switch is O a. $837,692.31 O b. $437,295.90 O $783.926.13 O d. $592,032.32 O. e. $639,284.55arrow_forwardarwick’s Pianos, Inc., purchases pianos from a large manufacturer for an average cost of $1,482 per unit and then sells them to retail customers for an average price of $3,100 each. The company’s selling and administrative costs for a typical month are presented below: Costs Cost Formula Selling: Advertising $ 963 per month Sales salaries and commissions $ 4,816 per month, plus 3% of sales Delivery of pianos to customers $ 59 per piano sold Utilities $ 640 per month Depreciation of sales facilities $ 5,100 per month Administrative: Executive salaries $ 13,519 per month Insurance $ 704 per month Clerical $ 2,471 per month, plus $38 per piano sold Depreciation of office equipment $ 926 per month During August, Marwick’s Pianos, Inc., sold and delivered 58 pianos. Required: 1. Prepare a traditional format income statement for August.2. Prepare a contribution format income statement for August. Show costs and revenues on both a total and a per…arrow_forwardSandhill Traders is one of the largest RV dealers in Austin, Texas, and sells about 2,800 recreational vehicles a year. The cost of placing an order with Sandhill's supplier is $500, and the inventory carrying costs are $260 for each RV. Management likes to maintain safety stock of 12 RVs. Most of its sales are made in either the spring or the fall. How many orders should the firm place this year? (Round intermediate calculations to 1 decimal place, e.g. 15.5 and final answer to 0 decimal places, e.g. 15.)arrow_forward

- Marathon Company makes and sells a single product. The current selling price is $20 per unit. Variable expenses are $12 per unit, and fixed expenses total $59,800 per month. (Unless otherwise stated, consider each requirement separately.) Management is considering a change in the sales force compensation plan. Currently each of the firm's two salespeople is paid a salary of $2,500 per month. Calculate the monthly operating income (or loss) that would result from changing the compensation plan to a salary of $400 per month, plus a commission of $0.75 per unit, assuming a sales volume of 7,350 units per month. Calculate the monthly operating income (or loss) that would result from changing the compensation plan to a salary of $400 per month, plus a commission of $0.75 per unit, assuming a sales volume of 7,200 units per month. Assuming that the sales volume of 7,200 units per month achieved in part g could also be achieved by increasing advertising by $1,000 per month instead of changing…arrow_forwardThe Titan Company provides you with the following information for the current year: Revenues = $2,000,000Cost of goods sold = $750,000 (2/3 of this amount varies with the number of units produced)S&A costs = $200,000 (1/2 of this amount is fixed)Selling price = $40 per unit The company sold 50,000 units of their product in the current year. The company expects unit sales of their product to increase 20% in the next year. Based on the information above, what would be the expected increase to profit before taxes in the coming year?arrow_forwardMarwick’s Pianos, Incorporated, purchases pianos from a large manufacturer for an average cost of $1,509 per unit and then sells them to retail customers for an average price of $2,000 each. The company’s selling and administrative costs for a typical month are presented below: Costs Cost Formula Selling: Advertising $ 952 per month Sales salaries and commissions $ 4,776 per month, plus 5% of sales Delivery of pianos to customers $ 63 per piano sold Utilities $ 663 per month Depreciation of sales facilities $ 5,029 per month Administrative: Executive salaries $ 13,453 per month Insurance $ 686 per month Clerical $ 2,480 per month, plus $42 per piano sold Depreciation of office equipment $ 887 per month During August, Marwick’s Pianos, Incorporated, sold and delivered 57 pianos. Required: 1. Prepare a traditional format income statement for August.2. Prepare a contribution format income statement for August. Show costs and revenues on both a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education