ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

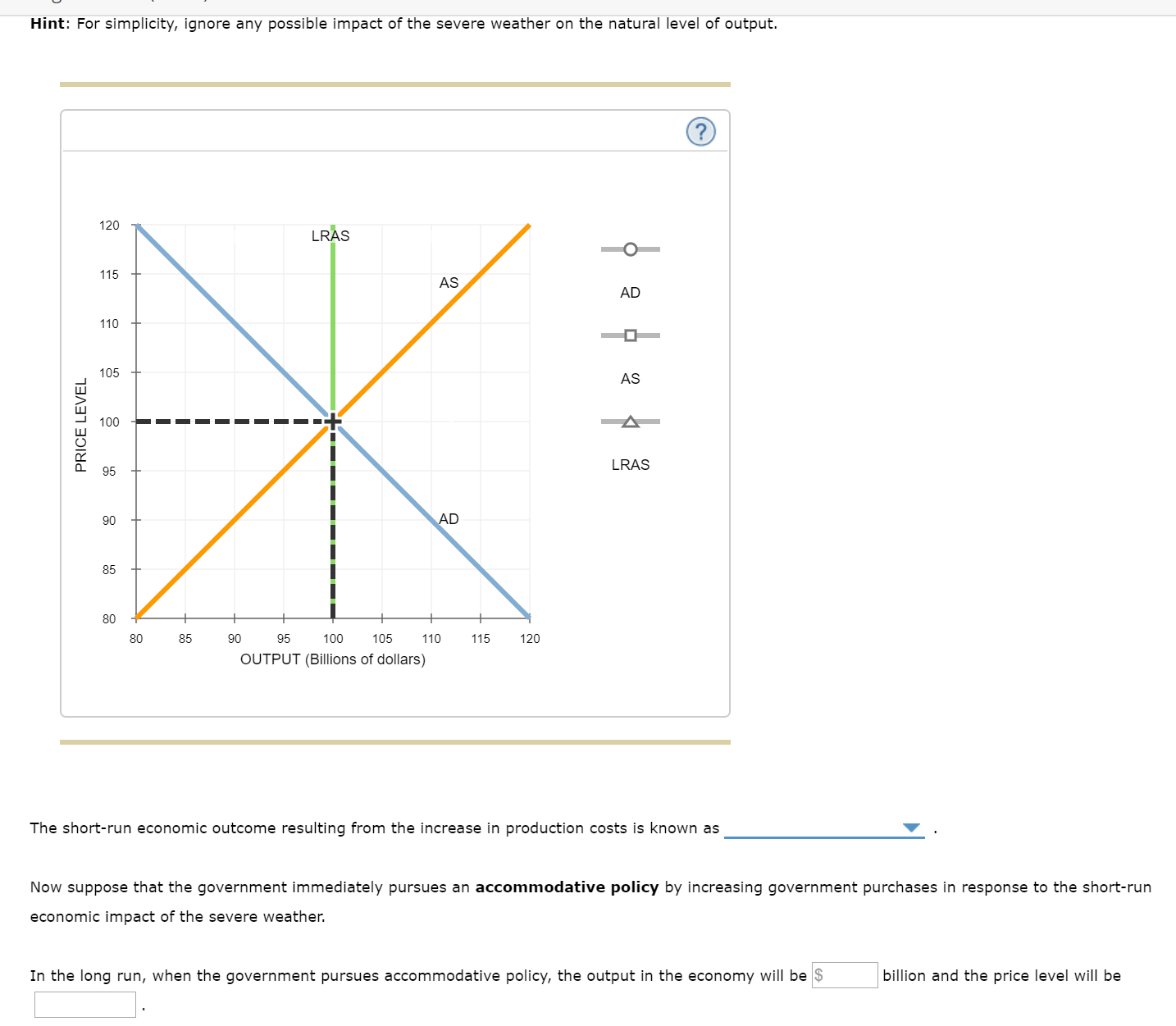

The following graph shows the short-run aggregate supply curve (ASAS), the aggregate demand curve (ADAD), and the long-run aggregate supply curve (LRASLRAS) for a hypothetical economy. Initially, the expected price level is equal to the actual price level, and the economy is in long-run equilibrium at its natural level of output, $100 billion.

Suppose a bout of severe weather drives up agricultural costs, increases the costs of transporting goods and services, and increases the costs of producing goods and services in this economy.

Use the graph to help you answer the questions about the short-run and long-run effects of the increase in production costs that follow. (Note: You will not be graded on any adjustments made to the graph.)

Hint: For simplicity, ignore any possible impact of the severe weather on the natural level of output

Transcribed Image Text:Hint: For simplicity, ignore any possible impact of the severe weather on the natural level of output.

120

LRAS

115

AS

AD

110

105

AS

100

LRAS

95

AD

90

85

80

80

85

90

95

100

105

110

115

120

OUTPUT (Billions of dollars)

The short-run economic outcome resulting from the increase in production costs is known as

Now suppose that the government immediately pursues an accommodative policy by increasing government purchases in response to the short-run

economic impact of the severe weather.

In the long run, when the government pursues accommodative policy, the output in the economy will be $

billion and the price level will be

PRICE LEVEL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Complete the following table by matching the macroeconomic assumptions about aggregate supply to the appropriate school of thought. Assumption Classical Keynesian Only an increase in aggregate demand can move an economy out of a recession and back to potential real GDP quickly. Product prices and wages tend to be inflexible. The following graph shows the aggregate demand (ADAD) and aggregate supply (ASAS) curves for a hypothetical economy that is currently operating below its full-employment output level. That is, the economy is currently in a recession. The aggregate supply curve (ASAS) in this diagram is consistent with the view of aggregate supply. According to this viewpoint, the government should spending in response to the recession. Shift the appropriate curve on the graph to illustrate the impact of this change in government spending. ADASPRICE LEVELREAL GDP (Trillions of dollars)AD AS The prescribed…arrow_forwardThe following graph shows the aggregate demand (AD) curve in a hypothetical economy. At point A, the price level is 140, and the quantity of output demanded is $300 billion. Moving down along the aggregate demand curve from point A to point B, the price level falls to 120, and the quantity of output demanded rises to $500 billion. 170 100 180 140 130 120 110 AD 100 00 100 200 300 400 B00 700 OUTPUT (Billians of dollars) As the price level falls, the cost of borrowing money will , causing the quantity of output demanded to Additionally, as the price level falls, the impact on the domestic interest rate will cause the real value of the dollar to in foreign exchange markets. The number of domestic products purchased by foreigners (exports) will therefore and the number of foreign products purchased by domestic consumers and firms (imports) will Net exports will therefore causing the quantity of domestic output demanded toarrow_forwardH1.arrow_forward

- 2. The theory of liquidity preference and the downward-slopingaggregate demand curve Suppose the money market for some hypothetical economy is given by the following graph, which plots the money demand and money supply curves. Assume the central bank in this economy (the Fed) fixes the quantity of money supplied. Suppose the price level increases from 90 to 105. Shift the appropriate curve on the graph to show the impact of an increase in the overall price level on the market for money. INTEREST RATE (Percent) 18 15 12 8 3 0 0 20 Money Supply Money Demand 40 60 80 MONEY (Billions of dollars) 100 120 Money Demand Money Supply Following the price level increase, the quantity of money demanded at the initial interest rate of 9% will be supplied by the Fed at this interest rate. As a result, individuals will attempt to bonds and other interest-bearing assets, and bond issuers will realize that they restored in the money market at an interest rate of % than the quantity of money their money…arrow_forwardThe total expenditure in Macroland begins with these initial levels (in trillions of dollars): autonomous consumption=1, Investment = 2; Net Exports = 0, T=2, and MPC = 0.75. Assume that equilibrium has been achieved. Suddenly there is an external shock and as a result investment goes down to 1. What is the change in GDP? Use the base model to answer this question. Equilibrium GDP goes down by 1 Equilibrium GDP goes up by 1 Equilibrium GDP goes up by 4 Equilibrium GDP goes down by 4arrow_forwardquestion 1 onlyarrow_forward

- Identify how each of the following changes will affect Aggregate Demand An increase in consumers disposable income A decrease in Investment spending due to pessimistic forecasts concerning the future A global pandemic resulting in business closures and an increase in the unemployment level The federal government increases spending on roads, bridges, and school repairs The federal government reduces the federal income tax resulting in an increase in household disposable incomearrow_forwardWhich of the following states is equivalent to saying that we are in a short-run equilibrium? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a There is no unplanned changes in inventories. b Investment (I) is equal to Planned Investment Spending (Ip). Income is equal to aggregate expenditures. d All of the above.arrow_forwardIn this aggregate demand model, which one of the following statements correctly describes the economy if it is at point Y on the diagram? 1 - The economy is at the full employment equilibrium 2- There are forces that are tending to make income (output) fall. 3-There are forces that are tending to make income (output) rise. 4-The economy is in equilibrium at less than full employment.arrow_forward

- Suppose AE = 0.50 Y + 500. If GDP = $1,000, and There will be excess supply, so inventory will accumulate and firms will reduce output next period. There will be excess demand, so inventory will shrink and firms will increase output next period. There will be neither excess demand nor excess supply, so Y = $1,000 is the equilibrium level of GDP.arrow_forwardConsider a fictional economy that is operating at its long-run equilibrium. The following graph shows the aggregate demand (AD) curve and short-run aggregate supply (AS) curve for the economy. The long-run aggregate supply curve is represented by a vertical line at the potential GDP level of $6 trillion. The economy is initially producing at potential GDP. Suppose that fiscal authorities decide to decrease marginal tax rates. Assume that this change in marginal tax rates is perceived as a long-term change. Shift the appropriate curves to illustrate the supply-side view of the fiscal policy effect on output and the price level. Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back to its original position, just drag it a little farther. 120 Potential GDP AS 100 PRICE LEVEL 60 80 60 40 40 20 20 0 0 2 4 6 8 AD 10 12 QUANTITY OF OUTPUT (Trillions of dollars) AD 1 AS Potential GDP True or…arrow_forwardLRAS, LRAS₂2 A. B. C. D. E. A B C E D LL AD₁ SRAS₁ W SRAS2 AD2 Real GDP (Y) Based on the figure, which of the following would cause the long-run equilibrium point to change from point B to point D? The population has aged and there are fewer people in the labor force. Firms and workers expected the price level to rise. The economy experienced an increase in government spending. The economy was in an expansion and has adjusted. The country's overall productivity increased.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education