FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:es

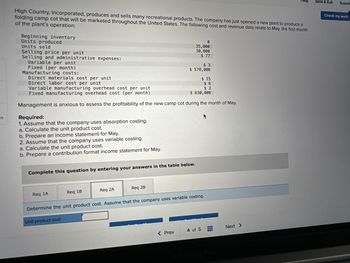

High Country, Incorporated, produces and sells many recreational products. The company has just opened a new plant to produce a

folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month

of the plant's operation:

Beginning inventory

Units produced

Units sold

Selling price per unit

Selling and administrative expenses:

Variable per unit

Fixed (per month)

Required:

1. Assume that the company uses absorption costing.

a. Calculate the unit product cost.

Manufacturing costs:

Direct materials cost per unit

$15

Direct labor cost per unit

$ 6

$3

Variable manufacturing overhead cost per unit

Fixed manufacturing overhead cost (per month)

$ 630,000

Management is anxious to assess the profitability of the new camp cot during the month of May.

b. Prepare an

come statement for May.

2. Assume that the company uses variable costing.

a. Calculate the unit product cost.

b. Prepare a contribution format income statement for May.

Req 1A

Complete this question by entering your answers in the table below.

Req 1B

Req 2A

0

35,000

30,000

$ 77

Req 2B

$ 3

$570,000

< Prev

Determine the unit product cost. Assume that the company uses variable costing.

Unit product cost

4 of 5

Next >

Save & Exit

Submit

Check my work

Transcribed Image Text:S

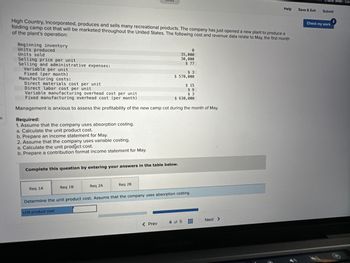

High Country, Incorporated, produces and sells many recreational products. The company has just opened a new plant to produce a

folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month

of the plant's operation:

Beginning inventory

Units produced

Units sold

Selling price per unit

Selling and administrative expenses:

Variable per unit

Fixed (per month)

A

Manufacturing costs:

Required:

1. Assume that the company uses absorption costing.

a. Calculate the unit product cost.

Direct materials cost per unit

$ 15

Direct labor cost per unit

$6

Variable manufacturing overhead cost per unit

$3

Fixed manufacturing overhead cost (per month)

$ 630,000

Management is anxious to assess the profitability of the new camp cot during the month of May.

b. Prepare an income statement for May.

2. Assume that the company uses variable costing.

a. Calculate the unit product cost.

b. Prepare a contribution format income statement for May.

Complete this question by entering your answers in the table below.

Req 1A

Req 1B

Req 2A

Req 2B

0

35,000

30,000

$77

$ 3

$ 570,000

< Prev

Determine the unit product cost. Assume that the company uses absorption costing.

Unit product cost

4 of 5

Help

Next >

Save & Exit

Chapter Seven-Con

Submit

Check my work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You are Capable of Amazing Things (YCAT) is in the process of determining how their costs behave. Cost information for the previous four months is provided below. Month Total Costs Total Units June $92,000 3,300 units July $124,000 4,200 units August $103,000 2,900 units September $118,000 4,500 units YCAT sells each unit for an average unit selling price of $46. Their normal operations are between 2,500 and 5,000 produced units each month. Using the provided information, answer the following questions. What is the October profit if 4,800 units are produced?arrow_forward! Required information [The following information applies to the questions displayed below.] O'Brien Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. During its first year of operations, O'Brien produced 98,000 units and sold 74,000 units. During its second year of operations, it produced 80,000 units and sold 99,000 units. In its third year, O'Brien produced 90,000 units and sold 85,000 units. The selling price of the company's product is $78 per unit. Req 4A 4. Assume the company uses absorption costing and a LIFO inventory flow assumption (LIFO…arrow_forwardHigh Country, Incorporated, produces and sells many recreational products. The company just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation: Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit Fixed (per month) Manufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead cost (per month) Required: 1. Assume the company uses absorption costing. a. Calculate the camp cot's unit product cost. b. Prepare an income statement for May. 2. Assume the company uses variable costing. a. Calculate the camp cot's unit product cost. b. Prepare a contribution format income statement for May. 0 46,000 41,000 $83 $4 $ 565,000 $ 16 $ 8 $1 $ 782,000 Complete this question by entering your answers in…arrow_forward

- The Macon Company uses the high-low method to determine its cost equation. The following information was gathered for the past year: Machine Hours Direct Labor Costs Busiest month (June) 24,000 $ 282,400 Slowest month (December) 18,000 $ 220,000 If Macon expects to use 20,000 machine hours next month, what are the estimated direct labor costs?arrow_forwardneed help pleasearrow_forwardThe following information pertains to the first year of operation for Crystal Cold Coolers Inc.: Number of units produced Number of units sold Unit sales price Direct materials per unit Direct labor per unit Variable manufacturing overhead per unit Fixed manufacturing overhead per unit ($224,000/2,800 units) Total variable selling expenses ($11 per unit sold) Total fixed general and administrative expenses Complete this question by entering your answers in the tabs below. Required: Prepare Crystal Cold's full absorption costing income statement and variable costing income statement for the year. Full Absorption Costing 2,800 2,400 340 60 45 13 80 Variable Costing $ 26,400 $ 60,000arrow_forward

- The following information pertains to the first year of operation for Crystal Cold Coolers Inc.: Number of units produced Number of units sold Unit sales price Direct materials per unit Direct labor per unit Variable manufacturing overhead per unit Fixed manufacturing overhead per unit ($224,000/2,800 units) Total variable selling expenses ($11 per unit sold) Total fixed general and administrative expenses Complete this question by entering your answers in the tabs below. Full Absorption Costing LA LA LA LA LA Variable Costing $ $ $ Required: Prepare Crystal Cold's full absorption costing income statement and variable costing income statement for the year. 2,800 2,400 340 60 45 13 80 $ 26,400 $ 60,000arrow_forward[The following information applies to the questions displayed below] Diego Company manufactures one product that is sold for $80 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 40,000 units and sold 35,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense $24 $14 $2 $4 $ 800,000 $ 496,000 The company sold 25,000 units in the East region and 10,000 units in the West region. It determined that $250,000 of its fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the remaining $96,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to…arrow_forwardMunabhaiarrow_forward

- Subject: Acountingarrow_forwardNamco Inc. is a large company that segments its business into cost and profit centers. The Cost center for the manufacture of Product M2T incurred the following costs in October: Direct Labor: $25/unit Direct Materials: $80/unit Variable Overhead: $15/unit Traceable Fixed Costs: $62,000 Common Fixed Costs: $100,000 Sales were 2,000 units in October. Each unit sells for $210. The M2T Department is being evaluated on overall profitability. In September, the department margin was $100,000. By how much did the department margin increase or decrease in October? Select one: a. $100,000 decrease b. $18,000 increase c. $82,000 decrease d. $118,000 increase e. $80,000 increasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education