Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

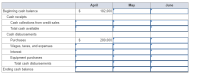

| Here are some important figures from the budget of Crenshaw, Inc., for the second quarter of 2019. |

| April | May | June | ||||||||||

| Credit sales | $ | 689,000 | $ | 598,000 | $ | 751,000 | ||||||

| Credit purchases | 302,000 | 282,000 | 338,000 | |||||||||

| Cash disbursements | ||||||||||||

| Wages, taxes, and expenses | 137,000 | 129,000 | 179,000 | |||||||||

| Interest | 15,600 | 15,600 | 15,600 | |||||||||

| Equipment purchases | 53,500 | 6,600 | 248,000 | |||||||||

|

The company predicts that 5 percent of its credit sales will never be collected, 35 percent of its sales will be collected in the month of the sale, and the remaining 60 percent will be collected in the following month. Credit purchases will be paid in the month following the purchase. In March 2019, credit sales were $561,000. |

|

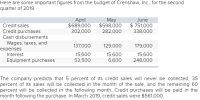

Using this information, complete the following cash budget: (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.)

|

|

Transcribed Image Text:Here are some important figures from the budget of Crenshaw, Inc., for the second

quarter of 2019.

April

$689,000

302,000

May

$598,000

June

$ 751,000

338,000

Credit sales

Credit purchases

Cash disbursements

282,000

Wages, taxes, and

137,000

129,000

179,000

expenses

Interest

15,600

53,500

15,600

6,600

15,600

248,000

Equipment purchases

The company predicts that 5 percent of its credit sales will never be collected, 35

percent of its sales will be collected in the month of the sale, and the remaining 60

percent will be collected in the following month. Credit purchases will be paid in the

month following the purchase. In March 2019, credit sales were $561,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Prepare a budgeted quarterly income statement and balance sheet for the first quarter of 2021. ABC Co. has been requested to prepare a quarterly budgeted income statement for 2021. The regional manager expects that sales in the first quarter of 2021 will increase in volume by 10% over the same quarter of the preceding year and will then increase by 5% for each succeeding quarter in 2021. The corporate head office has requested that the regional manager maintain an inventory in pesos equal to 16% of the next quarter's sales. Quarterly purchases average 45% of quarterly sales. Budgeted ending inventory on December 31, 2020, is P8,000. Quarterly salaries are P7,200 plus 10% of sales. All salaries are classified as sales salaries. Other quarterly expenses are estimated to be as follows: Rent expense P4,400 Depreciation on office equipment P2,000 Utilities expense…arrow_forwardLB Enterprises (LB) is preparing its budget for the first quarter of 2019. LB's balance sheet as of December 31, 2018 is as follows: Assets Liabilities Cash $5,000 Accounts Payable $9500 Accounts Recievable 28,000 Inventories Direct Materials 8,100 Finished Goods (500 Units) 16,870 Stockholders Equity Equipment - gross 45,000 Accumulated depreciation 15.000 Common Stock $15,000 Net Equipment 30,000 Retained Earnings 63,470 Total Assets $87,970 Total Liabilities and $87,960 Equity LB sells one product for $45/unit. The Company forecasts that it will sell 2,000; 1,500; 1,600; and 1,700 units in January, February, March and April, respectively. • Sales to customers are all on credit. 40% of the cash for these sales is collected in the month of the sale and the remaining 60% is collected in the following month. LB wants finished goods inventory equal to 25% of the next month's sales on hand at the end of each month. LB wants direct materials equal to 75% of the current month's production…arrow_forwardHere are some important figures from the budget of Nashville Nougats, Incorporated, for the second quarter of 2022: April May $ 402,000 179,000 $ 351,000 167,000 Credit sales Credit purchases Cash disbursements Wages, taxes, and expenses Interest Equipment purchases Beginning cash balance Cash receipts Cash collections from credit sales Total cash available Cash disbursements The company predicts that 5 percent of its credit sales will never be collected, 35 percent of its sales will be collected in the month of the sale, and the remaining 60 percent will be collected in the following month. Credit purchases will be paid in the month following the purchase. In March 2022, credit sales were $329,000. Purchases Wages, taxes, and expenses Interest 79,700 9,400 33,000 Using this information, complete the following cash budget. Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. Equipment purchases Total cash disbursements Ending cash…arrow_forward

- Information pertaining to Noskey Corporation’s sales revenue follows: November 2018(Actual) December 2018(Budgeted) January 2019(Budgeted) Cash sales $ 130,000 $ 130,000 $ 80,000 Credit sales 300,000 430,000 220,000 Total sales $ 430,000 $ 560,000 $ 300,000 Management estimates 5% of credit sales to be uncollectible. Of collectible credit sales, 60% is collected in the month of sale and the remainder in the month following the month of sale. Purchases of inventory each month include 70% of the next month’s projected total sales (stated at cost) plus 30% of projected sales for the current month (stated at cost). All inventory purchases are on account; 25% is paid in the month of purchase, and the remainder is paid in the month following the month of purchase. Purchase costs are approximately 60% of the selling price. Required: Determine for Noskey: 1. Budgeted cash collections in December 2018 from November 2018 credit…arrow_forwardPreparing an operating budget—sales budget; inventory, purchases and COGS budget and S&A expense budget Ballard Office Supply’s March 31, 2018, balance sheet follows: The budget committee of Ballard Office Supply has assembled the following data. Sales in April are expected to be $160,000. Ballard forecasts that monthly sales will increase 2% over April sales in May. June’s sales will increase by 4% over April sales. July sales will increase 20% over April sales. Ballard maintains inventory of $7,000 plus 25% of the cost of goods sold budgeted for the following month. Cost of goods sold equal 50% of sales revenue. Monthly salaries amount to $3,000. Sales commissions equal 5% of sales for that month. Other monthly expenses are as follows: Rent: $3,400 Depreciation: $800 Insurance: $300 Income tax: $1,500 Requirements Prepare Ballard’s sales budget for April and May 2018. Round all calculations to the nearest dollar. Prepare Ballard’s inventory, purchases, and cost of goods…arrow_forwardPrepare a cash budget for the month ended May 31, 2019. Campton Company anticipates a cash balance of $89,000 on May 1, 2019. The following budgeted transactions for May 2019 present data related to anticipated cash receipts and cash disbursements: 1. For May, budgeted cash sales are $65,000 and budgeted credit sales are $505,000. (Credit sales for April were $450,000.) In the month of sale, 40% of credit sales are collected, with the balance collected in the month following sale. 2. Budgeted merchandise purchases for May are $285,000. (Merchandise purchases in April were $240,000.) In the month of purchase, 70% of merchandise purchases are paid for, and the balance is paid for in the following month. 3. Budgeted cash disbursements for salaries and operating expenses for May total $170,000. 4. During May, $25,000 of principal repayment and $4,000 of interest payment are due to the bank. 5. A $20,000 income tax deposit is due to the federal government during May. 6. A new delivery…arrow_forward

- A company has the following information: The production budget for the six-month period to 30 June 2022 shows that the cost of rawmaterials to be used in that period will be P331,000. Required: Calculate the cash that will be paid to suppliers during the six-month period to 30 June 2022.arrow_forwardPlease show work2 and follow instructionsarrow_forwardDengerarrow_forward

- A company is working on their budgets for the year 2021. The table below has a few of their expectations for 2021. Accounts Payable on April 1 Inventory purchases in March Inventory purchases in April Inventory purchases in May $3,110 $3,659 $6,782 $6,580 Inventory purchases in $6,518 June Inventory purchases in July $7,725 Historically, this company's payment pattern for inventory purchases has been 100% on account which then get paid 15% in the month of purchase and the remainder one month following the purchase. The Accounts Payable on April 1 is the result of inventory purchases in March 2020 and thus is expected to be paid according to the pattern described above. How much should this company expect in Cash Payments for the month of May? (round to the nearest whole dollar/input code 0)arrow_forwardIn May 2022, the budget committee of Concord Stores assembles the following data in preparation of budgeted merchandise purchases for the month of June. 1. 2. 3. 4. (a) Expected sales: June $430,000, July $516,000. Cost of goods sold is expected to be 75% of sales. Desired ending merchandise inventory is 30% of the following (next) month's cost of goods sold. The beginning inventory at June 1 will be the desired amount. Your answer is correct. Compute the budgeted merchandise purchases for June. (b) Budgeted Cost of Goods Sold Add V Total Less V CONCORD STORES Merchandise Purchases Budget For the Month Ending June 30, 2022 Desired Ending Merchandise Inventory Beginning Merchandise Inventory Required Merchandise Purchases eTextbook and Media V CONCORD STORES Budgeted Income Statement (Partial) $ Prepare the budgeted multiple-step income statement for June through gross profit. $ $ 322500 116100 438600 (96750) 341850 Attempts: 2 of 3 usedarrow_forwardPreparing an operating budget Clipboard Office Supply's March 31, 2020, balance sheet follows: CLIPBOARD OFFICE SUPPLY Balance Sheet March 31, 2020 Assets Current Assets: Cash $ 28,000 Accounts Receivable 11,500 Merchandise Inventory 15,000 Prepaid Insurance 1,000 Total Current Assets $ 55,500 Property, Plant, and Equipment: Equipment and Fixtures 55,000 Less: Accumulated Depreciation (20,000) 35,000 Total Assets $ 90,500 Liabilities Current Liabilities: Accounts Payable $ 10,500 Salaries and Commissions Payable 1,200 Total Liabilities $ 11,700 Stockholders' Equity Common Stock 25,000 Retained Earnings 53,800 Total Stockholders' Equity 78,800 Total Liabilities and Stockholders' Equity $ 90,500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education