FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Transcribed Image Text:The budget committee of Clipboard Office Supply has assembled the following data.

Sales in April are expected to be $48,000. Clipboard forecasts that monthly sales will

a.

increase 5% over April sales in May. June's sales will increase by 10% over April sales. July

sales will increase 15% over April sales. Cash receipts are 80% in the month of the sale and

20% in the month following the sale.

b. Clipboard maintains inventory of $9,000 plus 25% of the cost of goods sold budgeted for

the following month. Cost of goods sold equal 50% of sales revenue. Purchases are paid 40%

in the month of the purchase and 60% in the month following the purchase.

c. Monthly salaries amount to $6,000. Sales commissions equal 5% of sales for that month.

Salaries and commissions are paid 60% in the month incurred and 40% in the following

month.

d. Other monthly expenses are as follows:

Rent: $2,800, paid as incurred Depreciation: $300

Insurance: $100, expiration of prepaid amount Income tax: $1,700, paid as incurred

Requirements

1. Prepare Clipboard's sales budget for April and May 2020. Round all amounts to the nearest dollar.

2. Prepare Clipboard's inventory, purchases, and cost of goods sold budget for April and May.

3. Prepare Clipboard's selling and administrative expense budget for April and May.

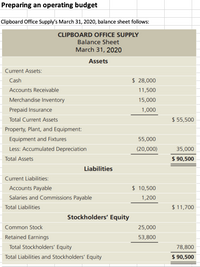

Transcribed Image Text:Preparing an operating budget

Clipboard Office Supply's March 31, 2020, balance sheet follows:

CLIPBOARD OFFICE SUPPLY

Balance Sheet

March 31, 2020

Assets

Current Assets:

Cash

$ 28,000

Accounts Receivable

11,500

Merchandise Inventory

15,000

Prepaid Insurance

1,000

Total Current Assets

$ 55,500

Property, Plant, and Equipment:

Equipment and Fixtures

55,000

Less: Accumulated Depreciation

(20,000)

35,000

Total Assets

$ 90,500

Liabilities

Current Liabilities:

Accounts Payable

$ 10,500

Salaries and Commissions Payable

1,200

Total Liabilities

$ 11,700

Stockholders' Equity

Common Stock

25,000

Retained Earnings

53,800

Total Stockholders' Equity

78,800

Total Liabilities and Stockholders' Equity

$ 90,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume a company is preparing a budget for its first two months of operations. During the first and second months it expects credit sales of $40,000 and $77,000, respectively. The company expects to collect 30% of its credit sales in the month of the sale and the remaining 70% in the following month. What is the expected cash collections from credit sales during the first month?arrow_forwardThe controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: October September October November $125,000 $154,000 $201,000 53,000 66,000 72,000 76,000 48,000 44,000 46,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, Insurance, and property tax expense represent $6,000 of the estimated monthly manufacturing costs. The annual Insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Sales Manufacturing costs Selling and administrative expenses Capital expenditures Current assets as of September 1 include…arrow_forwardPrimary Co. has budgeted sales of $228,000 in October and $312,000 in November. The company expects it will collect 70% of cash from sales in the month of the sale. The remaining 30% of cash will be collected the next month. What is the expected cash to be collected in November? $68,400 $286,800 $312,000 $253,200arrow_forward

- Markham Company has completed its sales budget for the first quarter of Year 2. Projected credit sales for the first four months of the year are shown below: January February March April $ 20,000 $ 26,000 $ 35,000 $ 38,000 The company's past records show collection of credit sales as follows: 40% in the month of sale and the balance in the following month. The total cash collection from receivables in March is expected to be: Multiple Choice $29,600. $22,100. $31,850. $35,000.arrow_forwardDove Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business are $243,000, $308,000, and $429,000, sell 25% of its merchandise for cash. Of sales on account, 70% are expected to be collected respectively, for September, October, and November. The company expects in the month of the sale and 30% in the month following the sale. The cash collections expected in October are a. $293,375 b. $221,080 Oc. $269,680 Od. $282,680 ?arrow_forwardNuthatch Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business September, October, and November are $239,000, $309,000, and $419,000, respectively. The company expects to sell 30% of its merchandise for cash. Of sales on account, 80% are expected to be collected in the month of the sale and 20% in the month following the sale. The cash collections expected in October from accounts receivable are estimated to be a. $173,040 b. $206,500 c. $139,580 d. $247,800arrow_forward

- Dove Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business are $245,000, $302,000, and $402,000, respectively, for September, October, and November. The company expects to sell 25% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month of the sale and 30% in the month following the The cash collections expected in October are O & $267,120 O & $218120 Oc $278,520 O d. $289.175arrow_forwardThe controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: September October November $89,000 $109,000 $146,000 37,000 47,000 31,000 33,000 Sales Manufacturing costs Selling and administrative expenses Capital expenditures The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $7,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of September 1 include cash of $34,000, marketable…arrow_forwardManu has forecast sales to be $32,000 in February, $41,400 in March, $53,200 in April, and $58,600 in May. 64% of sales are on made on credit, the rest are for cash. The sales on credit are collected 30% in the month of sale, and 70% the month following. What are the total budgeted cash receipts in March? What is the accounts receivable balance as of April 30 ? Prepare the cash receipts budget Item Calculation Amountarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education