Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Give me answer

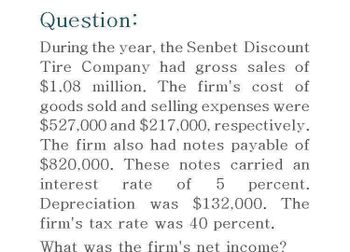

Transcribed Image Text:Question:

During the year, the Senbet Discount

Tire Company had gross sales of

$1.08 million. The firm's cost of

goods sold and selling expenses were

$527,000 and $217,000, respectively.

The firm also had notes payable of

$820,000. These notes carried an

interest rate of 5 percent.

Depreciation was $132,000. The

firm's tax rate was 40 percent.

What was the firm's net income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardAns.arrow_forwardHelp mearrow_forward

- Raghubhaiarrow_forwardDuring the year, the Senbet Discount Tire Company had gross sales of $1.09 million. The company's cost of goods sold and selling expenses were $578,000 and $231,000, respectively. The company also had notes payable of $700,000. These notes carried an interest rate of 6 percent. Depreciation was $108,000. The tax rate was 23 percent. a. What was the company's net income? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What was the company's operating cash flow? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) a. Net income b. Operating cash flowarrow_forwardDuring the year, the Senbet Discount Tire Company had gross sales of $1.24 million. The company’s cost of goods sold and selling expenses were $593,000 and $246,000, respectively. The company also had notes payable of $850,000. These notes carried an interest rate of 5 percent. Depreciation was $123,000. The tax rate was 23 percent. a. What was the company’s net income? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar amount, e.g., 1,234,567.) b. What was the company’s operating cash flow? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar amount, e.g., 1,234,567.)arrow_forward

- For the past year, Momsen Limited had sales of $45,017, interest expense of $3,308, cost of goods sold of $15,434, selling and administrative expense of $11,101, and depreciation of $5,400. If the tax rate was 21 percent, what was the company's net income? Multiple Choice $6,842 $4,541, $9,774 $7,721arrow_forwardFor the past year, Momsen, Ltd., had sales of $44,042, interest expense of $2,918, cost of goods sold of $14,559, selling and administrative expense of $10,626, and depreciation of $4,675. If the tax rate was 35 percent, what was the company's net income?arrow_forwardG. R. Edwin Inc. had sales of $5.88 million during the past year. The cost of goods sold amounted to $2.8 million. Operating expenses totaled $2.57 million, and interest expense was $30,000. Use the corporate tax rates shown in the popup window, Taxable Income Marginal Tax Rate $0−$50,000 15% $50,001−$75,000 25% $75,001−$100,000 34% $100,001−$335,000 39% $335,001−$10,000,000 34% $10,000,001−$15,000,000 35% $15,000,001−$18,333,333 38% Over $18,333,333 35% , to determine the firm's tax liability. What are the firm's average and marginal tax rates?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning