FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

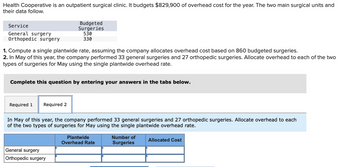

Transcribed Image Text:Health Cooperative is an outpatient surgical clinic. It budgets $829,900 of overhead cost for the year. The two main surgical units and

their data follow.

Service

General surgery

Orthopedic surgery

1. Compute a single plantwide rate, assuming the company allocates overhead cost based on 860 budgeted surgeries.

2. In May of this year, the company performed 33 general surgeries and 27 orthopedic surgeries. Allocate overhead to each of the two

types of surgeries for May using the single plantwide overhead rate.

Budgeted

Surgeries

530

330

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

In May of this year, the company performed 33 general surgeries and 27 orthopedic surgeries. Allocate overhead to each

of the two types of surgeries for May using the single plantwide overhead rate.

General surgery

Orthopedic surgery

Plantwide

Overhead Rate

Number of

Surgeries

Allocated Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Mack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of March follow: Department Fabricating Finishing Repair Quality Control From: Service department costs Repair Quality control Total Direct Costs Repair $ 132,600 94,200 40,200 242,740 Proportion of Services Used by Quality Control 0 0.3 Repair 0.3 0 Fabricating Finishing Required: Use the reciprocal method to allocate the service costs. (Matrix algebra is not required.) Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amounts. Quality Control Cost Allocation To: 0.5 0.1 0.2 0.6 Fabricating Finishingarrow_forwardHistorically, McCullough has used one predetermined overhead rate based on the number of patient-days (each night that a patient spends in the hospital counts as one patient-day) to allocate overhead costs to patients. For the most recent period, this predetermined rate was based on three estimates—fixed overhead costs of $17,960,000, variable overhead costs of $110 per patient-day, and a denominator volume of 20,000 patient-days.Recently a member of the hospital’s accounting staff has suggested using two predetermined overhead rates (allocated based on the number of patient-days) to improve the accuracy of the costs allocated to patients. The first overhead rate would include all overhead costs within the Intensive Care Unit (ICU) and the second overhead rate would include all Other overhead costs. Information pertaining to these two cost pools and two of the hospital’s patients—Patient A and Patient B—is provided below: ICU Other Total Estimated number of patient-days…arrow_forwardCrede Inc. has two divisions. Division A makes and sells student desks. Division B manufactures and sells reading lamps. Each desk has a reading lamp as one of its components. Division A can purchase reading lamps at a cost of $10.10 from an outside vendor. Division A needs 11,100 lamps for the coming year. Division B has the capacity to manufacture 49,600 lamps annually. Sales to outside customers are estimated at 38,500 lamps for the next year. Reading lamps are sold at $12.09 each. Variable costs are $6.87 per lamp and include $1.41 of variable sales costs that are not incurred if lamps are sold internally to Division A. The total amount of fixed costs for Division B is $75,900. Consider the following independent situations. What should be the minimum transfer price accepted by Division B for the 11,100 lamps and the maximum transfer price paid by Division A? (Round answers to 2 decimal places, e.g. 15.25.) Per unit Minimum transfer price accepted by Division B $_ Maximum transfer…arrow_forward

- Silven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity $138,000 Number of setups 10,200 Number of orders 92,400 Machine hours 18,480 Receiving hours phones with the following expected activity demands: Setting up equipment Ordering materials Machining Receiving Silven produces two models of cell Model X 5,000 80 200 6,600 385 Units completed Number of setups Number of orders Machine hours Receiving hours Required: Model Y 10,000 40 400 4,950 770 120 600 11,550 1,155arrow_forwardUsing the sequential method, Pone Hill Company allocates Janitorial Department costs based on square footage serviced. It allocates Cafeteria Department costs based on the number of employees served. It has determined to allocate Janitorial costs before Cafeteria costs. It has the following information about its two service departments and two production departments, Cutting and Assembly: Number of Employees 20 10 60 20 Costs Janitorial Department $450,000 Cafeteria Department 200,000 Cutting Department 1,500,000 Assembly Department 3,000,000 Square Feet 100 10,000 2,000 8,000 The percentage (proportional) usage of the Janitorial Department by the Cutting Department is Oa. 20% Ob. 9.9% Oc. 80% Od. 10%arrow_forwardPronghorn's Medical operates three support departments and two operating units, Surgery and ER. The support departments are allocated based on the hours used. The cost of operating the accounting (acct), administration (admin), and human resources (HR) departments is $258900, $147700, and $70800, respectively. Information on the hours used are as follows: Acct Admin HR Surgery ER Hours in Acct 20 48 360 220 Hours in Admin 16 8 120 80 Hours in HR 8 4 65 130 What are the total costs allocated from the accounting department to the operating units? (Do not round the intermediate calculations.) O $0. O $275878. O $273926. O $264975.arrow_forward

- Cheyenne's Medical operates three support departments and two operating units, Surgery and ER. The support departments are allocated based on the hours used. The cost of operating the accounting (acct), administration (admin), and human resources (HR) departments is $271000, $158300, and $68800, respectively. Information on the hours used are as follows: Acct Admin HR Surgery ER Hours in Acct 20 48 360 220 Hours in Admin 16 8 120 80 Hours in HR 8 4 65 130 What are the total costs allocated to the surgery department from the supporting departments? (Do not round the intermediate calculations.) O $280035. O $282405. O $256681. O $0.arrow_forwardand media purchases (air time and ad space). Overhead is allocated to each project as a percentage of media purchases. The predetermined overhead rate is 45% of media purchases. On August 1, the four advertising projects had the following accumulated costs: Vault Bank Take Off Airlines Sleepy Tired Hotels Tastee Beverages Total During August, The Fly Company incurred the following direct labor and media purchase costs related to preparing advertising for each of the four accounts: Vault Bank Take Off Airlines Sleepy Tired Hotels Tastee Beverages Total a. b. pur req b. ( At the end of August, both the Vault Bank and Take Off Airlines campaigns were completed. The costs of completed campaigns are debited to the cost of services account. C. August 1 Balances $81,400 24,400 57,000 35,000 $197,800 a. Journalize the summary entry to record the direct labor costs for the month. If an amount box does not require an entry, leave it blank. app ani c. C d. of V ami d. ( Direct Labor $55,300…arrow_forwardUramilabenarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education