Concept explainers

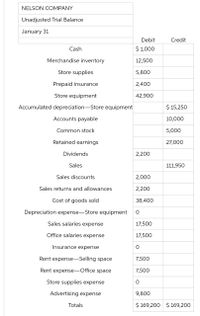

The following unadjusted

Additional Information:

Store supplies still available at fiscal year-end amount to $1,750.

Expired insurance, an administrative expense, is $1,400 for the fiscal year.

Depreciation expense on store equipment, a selling expense, is $1,525 for the fiscal year.

To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,900 of inventory is still available at fiscal year-end.

Required:

1. Using the above information, prepare

2. Prepare a multiple-step income statement for the year ended January 31 that begins with gross sales and includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses.

3. Prepare a single-step income statement for the year ended January 31.

4. Compute the

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

- Marigold Corp. uses a perpetual inventory system. The company had the following inventory transactions in April. April 3 Purchased merchandise from DeVito Ltd. for $33,000, terms 2/10, n/30, FOB shipping point. The appropriate company paid freight costs of $750 on the merchandise purchased on April 3. Purchased supplies on account for $5,400. Returned merchandise to DeVito and received a credit of $4,200. The merchandise was returned to inventory for future resale. 6 7 30 Paid the amount due to DeVito in full.arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Nelson Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: Depreciation Expense—Store Equipment, Sales Salaries Expense, Rent Expense—Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. NELSON COMPANY Unadjusted Trial Balance January 31 Debit Credit Cash $ 20,050 Merchandise inventory 12,000 Store supplies 5,400 Prepaid insurance 2,600 Store equipment 42,800 Accumulated depreciation—Store equipment $ 19,750 Accounts payable 15,000 Common stock 3,000 Retained earnings 29,000 Dividends 2,300 Sales 115,550 Sales discounts 2,000 Sales returns and allowances 2,050 Cost of goods sold 38,000…arrow_forwardOffice Supplies Express uses a perpetual inventory system. Journalize the following sales transactions for this company. Explanations are not required. July 3 Sold $15,400 of merchandise on account, credit terms are 2/10, n/30. Cost of goods is $9,300. July 7 Received a $750 sales return from the customer. Cost of the goods is $435. July 12 Office Supplies receives payment for the customer for the amount due from the July 3 sale.arrow_forward

- Corona Company's perpetual inventory records indicate that $199,240 of merchandise should be on hand on October 30, 20Y1. The physical inventory indicates that $181,310 of merchandise is actually on hand. Journalize the adjusting entry for the inventory shrinkage for Corona Company for the year ended October 30, 20Y1. Assume that the inventory shrinkage is a normal amount. If an amount box does not require an entry, leave it blank.arrow_forwardRequired information [The following information applies to the questions displayed below.] The following unadjusted trial balance is prepared fiscal year-end for Nelson Company. Nelson Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: Depreciation Expense-Store Equipment, Sales Salaries Expense, Rent Expense-Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. NELSON COMPANY Unadjusted Trial Balance January 31 Cash. Merchandise inventory Debit $18,200 13,000 Credit Store supplies 5,100 Prepaid insurance 2,500 Store equipment 42,700 Accumulated depreciation-Store equipment $ 19,700 Accounts payable 13,000 Common stock 5,000 Retained earnings 26,000 Dividends 2,100 Sales 116,550 Sales discounts 1,850 Sales returns and allowances 2,300 Cost of goods sold 38,000 Depreciation expense-Store equipment 0 Sales salaries expense 13,650 Office salaries expense 13,650…arrow_forwardTravis Company purchased merchandise on account from a supplier for $12,000, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period. Under a perpetual inventory system, record the journal entries required for the above transactions. If an amount box does not require an entry, leave it blank.arrow_forward

- The Phoenix Corporation's fiscal year ends on December 31. Phoenix determines inventory quantity by a physical count of inventory on hand at the close of business on December 31. The company's controller has asked for your help in deciding if the following items should be included in the year-end inventory count. Required: Determine if each of the items below should be included or excluded from the company's year-end inventory. Item Included/Excluded 1 Merchandise held on consignment for Trout Creek Clothing. 2. Goods shipped f.o.b. destination on December 28 that arrived at the customer's location on January 4. 3. Goods purchased from a vendor shipped f.o.b. shipping point on December 26 that arrived on January 3. 4. Goods shipped f.o.b. shipping point on December 28 that arrived at the customer's location on January 5. 5. Phoenix had merchandise on consignment at Lisa's Markets, Inc. 6. Goods purchased from a vendor shipped f.o.b. destination on December 27 that arrived on January 3.…arrow_forwardBarkley Company’s adjusted trial balance on March 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: Sales Salaries Expense, Rent Expense—Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. Beginning merchandise inventory was $37,500. Supplementary records of merchandising activities for the year ended March 31 reveal the following itemized costs. Invoice cost of merchandise purchases . $138,500 Purchases returns and allowances $6,700 Purchases discounts received . . . . . . . . . . . . . . . . . 2,950 Costs of transportation-in . 5,750 Required 1. Compute the company’s net sales for the year. 2. Compute the company’s total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. 4. Prepare a single-step…arrow_forwardShankar Company uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 2 for $48,000, with terms 4/10, n/30. On February 10, the company pays on account for the inventory. Required: (a) Determine the financial statement effects for the inventory purchase on account on February 2. (b) Determine the financial statement effects for the payment on February 10. Complete this question by entering your answers in the tabs below. Required a Required b Determine the financial statement effects for the inventory purchase on account on February 2. (Amounts to be deducted should minus sign.) Revenues Income Statement Expenses Net Incomearrow_forward

- Prepare the journal entries to record the following transactions on Wildhorse Company’s books using a perpetual inventory system. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) (a) On March 2, Windsor Company sold $947,600 of merchandise to Wildhorse Company on account, terms 3/10, n/30. The cost of the merchandise sold was $534,200. (b) On March 6, Wildhorse Company returned $105,700 of the merchandise purchased on March 2. The cost of the merchandise returned was $68,600. (c) On March 12, Windsor Company received the balance due from Wildhorse Company. No. Date Account Titles and Explanation Debit Credit (a) choose a transaction date March 2March 6March 12 enter an account title…arrow_forwardJournalize entries for the following related transactions of Lilly Heating & Air Company who uses the net method under a perpetual inventory system. (If an amount box does not require an entry, leave it blank.) a. Purchased $36,000 of merchandise from Schell Co. on account, terms 1/10, n/30.arrow_forwardNovelty Furnishings Company's perpetual inventory records indicate that $755,000 of merchandise should be on hand on November 30, 20Y1. The physical inventory indicates that $742,000 of merchandise is actually on hand. Journalize the adjusting entry for the inventory shrinkage for Novelty Furnishings Company for the year ended November 30, 20Y1. Assume that the inventory shrinkage is a normal amount. Refer to the chart of accounts for the exact wording of the account titles. CNOW jourmals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. 立arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education