FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

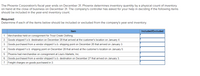

Transcribed Image Text:The Phoenix Corporation's fiscal year ends on December 31. Phoenix determines inventory quantity by a physical count of inventory

on hand at the close of business on December 31. The company's controller has asked for your help in deciding if the following items

should be included in the year-end inventory count.

Required:

Determine if each of the items below should be included or excluded from the company's year-end inventory.

Item

Included/Excluded

1

Merchandise held on consignment for Trout Creek Clothing.

2. Goods shipped f.o.b. destination on December 28 that arrived at the customer's location on January 4.

3. Goods purchased from a vendor shipped f.o.b. shipping point on December 26 that arrived on January 3.

4. Goods shipped f.o.b. shipping point on December 28 that arrived at the customer's location on January 5.

5. Phoenix had merchandise on consignment at Lisa's Markets, Inc.

6. Goods purchased from a vendor shipped f.o.b. destination on December 27 that arrived on January 3.

7. Freight charges on goods purchased in 3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shankar Company uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 2 for $48,000, with terms 4/10, n/30. On February 10, the company pays on account for the inventory. Required: (a) Determine the financial statement effects for the inventory purchase on account on February 2. (b) Determine the financial statement effects for the payment on February 10. Complete this question by entering your answers in the tabs below. Required a Required b Determine the financial statement effects for the inventory purchase on account on February 2. (Amounts to be deducted should minus sign.) Revenues Income Statement Expenses Net Incomearrow_forwardA čompany uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 9, 2021, for $57,000 and then sells this inventory on account on March 7, 2021, for $74,000. Record the transactions for the purchase and sale of the inventory. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list EX: ...... Record the purchase of inventory on account. 2 Record the sale of inventory on account. Record the cost of inventory sold. Credit Note : journal entry has been entered %3D View general journal Clear entry Record entryarrow_forwardShankar Company uses a periodic system to record inventory transactions. The company purchases inventory on account on February 2 for $37,000, with terms 3/10, n/30. On February 10, the company pays on account for the inventory. Record the inventory purchase on February 2 and the payment on February 10. Note: If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. View transaction list Journal entry worksheet P 2 Record the purchase of inventory on account. Note: Enter debits before credits. Date February 02 Record entry General Journal Clear entry Debit Credit View general journalarrow_forward

- A company uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 9, 2021, for $50,000 and then sells this inventory on account on March 7, 2021, for $70,000. Record the transactions for the purchase and sale of the inventory. (If no entry is required for a particular transaction/event select "No Journal Entry Required" in the first account field.)arrow_forwardi need requirement 1- a onlyarrow_forwardNittany Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1: Units Unit Cost Inventory, December 31, prior year 1,980 $7 For the current year: Purchase, March 21 5,090 9 2,970 10 Purchase, August 1 Inventory, December 31, current year 4,100 Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods. Note: Round "Average cost per unit" to 2 decimal places and final answers to nearest whole dollar amount.arrow_forward

- es N Required information [The following information applies to the questions displayed below.] The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Nelson Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: Depreciation Expense-Store Equipment, Sales Salaries Expense, Rent Expense-Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. Cash Merchandise inventory Store supplies Prepaid insurance Store equipment Accumulated depreciation-Store equipment Accounts payable Common stock Retained earnings Dividends NELSON COMPANY Unadjusted Trial Balance January 31 Sales. Sales discounts Sales returns and allowances Cost of goods sold Depreciation expense-Store equipment Sales salaries expense Office salaries expense Insurance expense Rent expense-Selling space Rent expense-Office space Store supplies expense Advertising expense…arrow_forward[The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 270 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Assume the perpetual inventory system is used. Required: Activities Beginning inventory Sales Purchase Sales Purchase Totals Specific Identification Purchase Date January 1 January 20 January 30 Complete this question by entering your answers in the tabs below. FIFO Activity Units Acquired at Cost 180 units @ $10.50 = LIFO Available for Sale Beginning inventory Purchase Purchase 110 units 270 units @ 560 units # of units 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. 2. Determine the cost assigned to ending inventory…arrow_forwardPlease help with Question Aarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education