FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

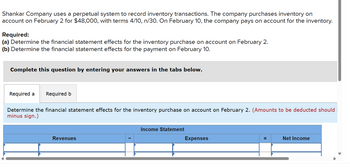

Transcribed Image Text:Shankar Company uses a perpetual system to record inventory transactions. The company purchases inventory on

account on February 2 for $48,000, with terms 4/10, n/30. On February 10, the company pays on account for the inventory.

Required:

(a) Determine the financial statement effects for the inventory purchase on account on February 2.

(b) Determine the financial statement effects for the payment on February 10.

Complete this question by entering your answers in the tabs below.

Required a Required b

Determine the financial statement effects for the inventory purchase on account on February 2. (Amounts to be deducted should

minus sign.)

Revenues

Income Statement

Expenses

Net Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardTravis Company purchased merchandise on account from a supplier for $14,000, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period. Under a perpetual inventory system, journalize these transactions. If an amount box does not require an entry, leave it blank. a. b.arrow_forwardCheese Factory uses a perpetual inventory system. The following activities occurred during May: • May 2 - Cheese Factory purchased $45,000 worth of inventory, on credit terms 3/10 n/30. . May 5 - Cheese Factory returned $5,000 worth of that inventory to the supplier. • May 9 - Cheese Factory paid for the inventory, taking advantage of all available discounts. Required: Prepare the journal entries to record the transactions above using the gross method. Use the MSWord link for the table to write your journal entries. After you have written the journal entries on the table in the MSWord document provided, put your name below the table on the document, save the document and then upload it to this problem in the upload space provided at the bottom of this box.arrow_forward

- Global Company sold merchandise for $11,700 on account. The cost of the items sold was $7,900. If the company uses the perpetual inventory system, which of the following best reflects the journal entry that should be prepared to record this transaction? Debit Credit A. Sales revenue 11,700 Accounts receivable 11,700 Cost of goods sold 7,900 Merchandise inventory 7,900 B. Accounts receivable 11,700 Merchandise inventory 7,900 Sales revenue 3,800 C. Accounts receivable 3,800 Sales revenue 3,800 D. Accounts receivable 11,700 Sales revenue 11,700 Cost of goods sold 7,900 Merchandise inventory 7,900 Group of answer choices A. B. C. D.arrow_forwardThe following purchase transactions occurred during the last few days of Whilczel Company's business year, which ends October 31, or in the first few days after that date. A periodic inventory system is used. · An invoice for P6,000, terms FOB shipping point, was received and entered November 1. The invoice shows that the material was shipped October 29, but the receiving report indicates receipt of goods on November 3. · An invoice for P2,700, terms FOB destination, was received and entered November 2. The receiving report indicates that the goods were received October 29. · An invoice for P3,150, terms, FOB shipping point, was received October 15, but never entered. Attached to it is a receiving report indicating that the goods were received October 18. Across the face of the receiving report is the following notation: "Merchandise not of the same quality as ordered - returned for credit October 19". · An invoice for P3,600 terms FOB shipping…arrow_forwardOn October 5, your company buys and receives inventory costing $5,900, on terms 2/30, n/60. On October 20, your company pays the amount owed relating to the October 5 purchase.Prepare the journal entries needed on October 5 and 20, assuming the company uses a perpetual system and records purchase discounts using the gross method.arrow_forward

- Haresharrow_forwardTeal Mountain, Inc. uses a perpetual inventory system. Its beginning inventory consists of 200 units that cost $ 220 each. During August, the company purchased 255 units at $ 220 each, returned 4 units for credit, and sold 375 units at $ 340 each. Journalize the August transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.)arrow_forwardWilliam & Company uses a perpetual inventory system. The following information is available for November: Nov. 1 4 7 10 (a) 12 Balance Purchase Purchase Sale Sale Nov. 12 Units Date Account Titles Nov. 4 20 40 40 (20) (50) Assume all sales and purchases are on credit. Purchase Sales Price Price Prepare journal entries to record the November 4 purchase and the November 12 sale using FIFO. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) $5.00 $5.50 $9.00 (To record sales on account) (To record cost of goods sold) $8.00 $8.00 Debit Creditarrow_forward

- Travis Company purchased merchandise on account from a supplier for $12,300, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period. Under a perpetual inventory system, record the journal entries required for the above transactions. If an amount box does not require an entry, leave it blank. a. b.arrow_forwardCurrent Attempt in Progress Prepare the necessary journal entries to record the following transactions, assuming Cullumber Company uses a perpetual inventory system. (a) Cullumber sells $57,500 of merchandise, terms 1/10, n/30. The merchandise cost $39,220. (b) The customer in (a) returned $5,300 of merchandise to Cullumber. The merchandise returned cost $3,710. (c) Cullumber received the balance due within the discount period. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Transactions Account Titles and Explanation (a) (To record credit sale.) (To record cost of goods sold.) Debit Credit SUarrow_forwardAssume that Pronghorn Company uses a periodic inventory system and has these account balances: Purchases $451.600, Purchase Returns and Allowances $14,600, Purchase Discounts $9,500, and Freight-In $18,500. Assume also that Pronghorn Company has beginning inventory of $69,200. ending inventory of $98,500, and net sales of $747,600. Determine the amounts to be reported for cost of goods sold and gross profit. Cost of goods sold $ Gross profitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education