FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

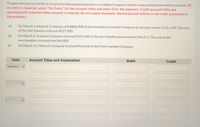

Transcribed Image Text:Prepare the journal entries to record the following transactions on Ivanhoe Company's books using a perpetual inventory system. (If

no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are

automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in

the problem.)

On March 2, Metlock Company sold $882,900 of merchandise to Ivanhoe Company on account, terms 3/10, n/30. The cost

of the merchandise sold was $527,900.

(a)

On March 6, Ivanhoe Company returned $107,600 of the merchandise purchased on March 2. The cost of the

merchandise returned was $66,800.

(b)

(c)

On March 12, Metlock Company received the balance due from Ivanhoe Company.

Date

Account Titles and Explanation

Debit

Credit

March 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- HOW DO I PREPARE A TRANSACTION CHART? On June 10, Wildhorse Company purchased $9,500 of merchandise on account from Novak Company, FOB shipping point, terms 2/10, n/30. Wildhorse pays the freight costs of $590 on June 11. Damaged goods totaling $350 are returned to Novak for credit on June 12. The fair value of these goods is $75. On June 19, Wildhorse pays Novak Company in full, less the purchase discount. Both companies use a perpetual inventory system.arrow_forwardThe following transactions are for Wildhorse Company. 1. On December 3, Wildhorse Company sold $584,300 of merchandise to Swifty Co., on account, terms 2/10, n/30, FOB destination. Wildhorse paid $370 for freight charges. The cost of the merchandise sold was $359,300. 2. On December 8, Swifty Co. was granted an allowance of $21,300 for merchandise purchased on December 3. 3. On December 13, Wildhorse Company received the balance due from Swifty Co. 1. Prepare the journal entries to record these transactions on the books of Wildhorse Company using a perpetual inventory system 2. Assume that Wildhorse Company received the balance due from Swifty Co. on January 2 of the following year instead of December 13. Prepare the journal entry to record the receipt of payment on January 2.arrow_forwardOn March 2, Sandhill Company sold $815,000 of merchandise on account to Monty Company, terms 4/10, n/30. The cost of the merchandise sold was $521,000On March 6, Monty Company returned $81,500 of the merchandise purchased on March 2. The cost of the returned merchandise was $60,300 (Those are for reference, part one and part two) The picture is part 3 and needs to be answeredarrow_forward

- ^ Presented below are transactions related to Concord Corporation. 1. 2. 3. (a) On December 3, Concord Corporation sold $662,200 of merchandise on account to Sarasota Co., terms 4/10, n/30, FOB shipping point. The cost of the merchandise sold was $351,200. On December 8, Sarasota Co. was granted an allowance of $26,600 for merchandise purchased on December 3. On December 13, Concord Corporation received the balance due from Sarasota Co. Prepare the journal entries to record these transactions on the books of Concord Corporation using a perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Dec. 3 Dec. 8 > Account Titles and Explanation (To record credit sale) norcal_archives_20....zip W QCA 5.docx W Debit response essay.docx 1 Creditarrow_forwardShore Co. sold merchandise to Blue Star Co. on account, $112,000, terms FOB shipping point, 2/10, n/30. The cost of the goods sold is $67,200. Shore Co. paid freight of $1,800. Journalize the entries for Shore and Blue Star for the sale, purchase, and payment of amount due. Refer to the appropriate company’s Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Shore Co. General Ledger ASSETS 110 Cash 121 Accounts Receivable-Blue Star Co. 125 Notes Receivable 130 Inventory 140 Office Supplies 141 Store Supplies 142 Prepaid Insurance 180 Land 192 Store Equipment 193 Accumulated Depreciation-Store Equipment 194 Office Equipment 195 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 218 Sales Tax Payable 219 Customer Refunds Payable 220 Unearned Rent 221 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 313 Income Summary…arrow_forwardInformation related to Blossom Company is presented below. On April 5, purchased merchandise on account from Swifty Company for $27,900, terms 3/10, net/30, FOB shipping point. On April 6, paid freight costs of $400 on merchandise purchased from Swifty. On April 7, purchased equipment on account for $30,500. On April 8, returned $3,800 of merchandise to Swifty Company. On April 15, paid the amount due to Swifty Company in full. 1. 2 3. 4. 5. Prepare the journal entries to record these transactions on the books of Blossom Company under a perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation No. 1. N 2. 3. 4. 5. Debit Creditarrow_forward

- A company purchased $8, 200 of merchandise on June 15th with terms of 3/10, n/45. on June 20, it returned $410 of that merchandise. on June 24th it paid the balance owed for the merchandise taking any discount it was entitled to. The cash paid ok june 24th is a) 8, 200 b) 7, 790 c) 7,556 d) 7,597 e) 7, 954arrow_forwardOn December 29 of the current year, Sabre Company sold merchandise for $4, 000 on credit terms, 3/10, n/60. Its accounting period ends December 31. Required Provide the following entries under the gross method. a. To record the merchandise sale. Omit the cost of goods sold entry. b. To record collection of the account, assuming collection took place on January 5 of next year. c. To record collection of the account, assuming collection took place on February 15 of next year. Note: If a line in a journal entry isn't required for a transaction, select "N/A" as the account name and leave the Dr. or Cr. answer blank (zero). 0arrow_forwardOn March 12, Klein Company sold merchandise in the amount of $7,800 to Babson Company, with credit terms 2/10, n30. The cost of the items sold is $4,500. Klein uses PERPETUAL inventory system and the GROSS METHOD of accounting for sales. Babson pays the invoice on March 17th and takes the appropriate discount. What is the journal entry Klein makes on March 17th?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education