Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

General accounting

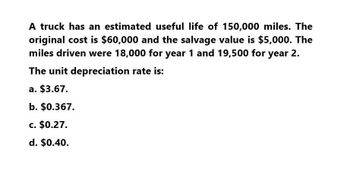

Transcribed Image Text:A truck has an estimated useful life of 150,000 miles. The

original cost is $60,000 and the salvage value is $5,000. The

miles driven were 18,000 for year 1 and 19,500 for year 2.

The unit depreciation rate is:

a. $3.67.

b. $0.367.

c. $0.27.

d. $0.40.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for 120,000 miles. Montello uses the units-of-production depreciation method and in year one it expects to use the truck for 23,000 miles. Calculate the annual depreciation expense.arrow_forwardA machine costing 350,000 has a salvage value of 15,000 and an estimated life of three years. Prepare depreciation schedules reporting the depreciation expense, accumulated depreciation, and book value of the machine for each year under the double-declining-balance and sum-of-the-years-digits methods. For the double-declining-balance method, round the depreciation rate to two decimal places.arrow_forwardAn assembly line conveyor system with a 5-year life is to be depreciated by the DDB method. The conveyor units had a first cost of $30,000 with a$9000 salvage value. The annual operating cost allocated to the conveyor is $7000 per year. The book value at the end of year 2 is closest to:a. $6,480b. $10,800c. $12,400d. $18,000arrow_forward

- A motorized cultivator with a first cost of $28,000 and salvage value of 25% of the first cost is depreciated by the DDB method over a 5-year period. If the operating cost is $43,000 per year, the depreciation charge for year 2 is closest to:a. $18,000b. $11,200c. $6700d. $4030arrow_forwardNeed answer pleasearrow_forwardOriginal cost of a machine was Rs. 2,52,000; Salvage value was 12,000. Useful Life was 6 years, Annual depreciation under Straight Line Method will be: 1. 42,000 2. 40,000 3. 30,000 4. 28,000arrow_forward

- The cost of the building is OMR 20,000. The salvage value OMR 2,000. Estimated useful life of the building is 15 years. Which of the following is the annual depreciation expense under a straight line method? a. OMR 2,000 b. OMR 1,500 c. OMR 1,200 d. OMR 1,800arrow_forwardA machine with a cost of $480,000 has an estimated salvage value of $30,000 and an estimated useful life of 5 years or 15,000 hours. It is to be depreciated using the units-of-activity method of depreciation. What is the amount of depreciation for the second full year, during which the machine was used 5,000 hours? Select one: a. $160,000 b. $130,000 c. $90,000 d. $150,000 Drago Company purchased equipment on January 1, 2016, at a total invoice cost of $1,200,000. The equipment has an estimated salvage value of $30,000 and an estimated useful life of 5 years. What is the amount of accumulated depreciation at December 31, 2017, if the straight-line method of depreciation is used? Select one: a. $234,000 b. $468,000 c. $240,000 d. $480,000 Sargent Corporation bought equipment on January 1, 2017. The equipment cost $360,000 and had an expected salvage value of $60,000. The life of the equipment was estimated to be 6 years. Assuming straight-line deprecation, the book value of…arrow_forwardرA machine costs RO 40,000 with a salvage value of RO 20,000. The expected life of the machine is 38000 hours in six years. In the first year, the machine is used for 4000 hours. In the second year, 6000 hours and 8000 hours on the third year. What is the depreciation at the end of the second year by using units of production method? a. RO 5120 b. RO 3120 c. RO 2080 d. RO 4160arrow_forward

- Copy equipment was acquired at the beginning of the year at a cost of $37,120 that has an estimated residual value of $3,400 and an estimated useful life of 5 years. It is estimated that the machine will output an estimated 1,124,000 copies. This year, 295,000 copies were made. a. Determine the depreciable cost. $4 b. Determine the depreciation rate. Round your answer to two decimal places. per copy c. Determine the units-of-output depreciation for the year. $4 %24 %24arrow_forwardPlease help me with show all calculation thankuarrow_forwardThe cost of a machine is 18,000 with a salvage value of RO 4270 at the end of its life of five years. Applying written down value method, the depreciation for the second year is ______________. a. RO 4500 b. RO 3375 c. RO 10125 d. RO 13500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,