FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

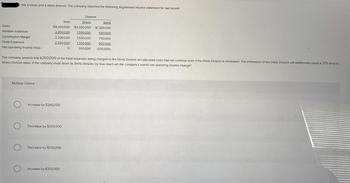

Transcribed Image Text:has a shoes and a shirts division. The company reported the following segmented Income statement for last month:

Sales

Variable expenses

Contribution Margin

Fixed Expenses

Net operating Income (loss)

Multiple Choice

O

O

O

Division

Shoes

Shirts

$4,200,000 $3,000,000 $1,200,000

2.000.000

1.500.000

1,500,000

1.300.000

200,000

O

The company predicts that $200,000 of the fixed expenses being charged to the Shirts Division are allocated costs that will continue even if the Shirts Division is eliminated. The elimination of the Shirts Division will additionally cause a 20% drop in

Shoes Division sales. If the company shuts down its Shirts Division, by how much will the company's overall net operating income change?

2,200,000

2.200.000

Increase by $240,000

Decrease by $300,000

Total

Decrease by $330,000

Increase by $330,000

0

500.000

700,000

900.000

(200,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The income statement for the RUN-84979 company, an atletic shoe retailer, for the first quarter of the year is presented below: RUN-84979 Income Statement Sales $151,200 54,600 96,600 Cost of goods sold Gross margin Selling and administrative expenses Selling Administration $45,400 29,096 74,496 Net operating income $ 22,104 On average, an athletic shoe sells for $72. Variable selling expenses are $14 per athletic shoe, and the remaining selling expenses are fixed. The variable administrative expenses are 8% of sales with the remainder being fixed. How much is the total contribution margin for RUN-84979 for the first quarter?arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Total Department Hardware Linens Sales $4,200,000 $3,090,000 $1,110,000 Variable expenses 1,240,000 840,000 400,000 Contribution margin 2,960,000 2,250,000 710,000 Fixed expenses 2,300,000 1,470, 000 830,000 Net operating income (loss) $ 660,000 $ 780,000 $ (120,000) A study indicates that $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 11% decrease in the sales of the Hardware Department. Required: What is the financial advantage ( disadvantage) of discontinuing the Linens Department?arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Fixed expenses Contribution margin Net operating income (loss) 1,307,000 Department Total $ 4,210,000 Hardware $ 3,040,000 Linens $ 1,170,000 403,000 767,000 840,000 $ (73,000) 2,903,000 2,290,000 $ 613,000 904,000 2,136,000 1,450,000 $ 686,000 A study indicates that $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 15% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage)arrow_forward

- Tike Industries is an apparel company that makes and sells both casual wear and sportswear. Here are data for the current year: Sales revenue Variable costs Contribution margin Traceable fixed costs Segment margin Common fixed costs Operating income Total $ 1,000,000 745,000 $255.000 (80,000) $175,000 (90,000) $85,000 Casual wear $ 450,000 388,000 $62,000 (25,000) $37,000 (42,000) S(5,000) Sportswear 5 pts $ 550,000 357,000 $193,000 (55,000) $138,000 (48,000) $90,000 Tike's accountant allocated the common fixed costs between the product lines based on sales revenue. Tike plans to discontinue the production of casual wear and use the freed-up capacity to triple the production and sale of sportswear. Although this will eliminate the traceable fixed costs for casual wear, the traceable fixed costs for sportswear will double. If Tike discontinues the casual wear product line, what would be the amount of the increase in Tike's operating income? Round to the nearest whole dollar and do not…arrow_forwardCalculate the Return on Investment from the following responsibility report data using total revenue as the base: Responsibility report data Account Actual Revenues Clothing revenue $473,158 Clothing accessories revenue 18,757 Expenses Associates wages $41,704 Managers wages 22,906 Cost of clothing sold 254,631 Cost of accessories sold 5,969 Equipment/fixture repairs 960 Utilities 1,539 Round to two decimal places. Be sure to enter the answer as a percentage but do not include the % sign.arrow_forwardThe following monthly data are available for the Phelps Company: Product A Product B $150,000 $130,000 Variable expenses $91,000 $104,000 Contribution margin $59,000 $26,000 Fixed expenses Operating income The break-even sales for the month for the company are: Sales Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a $203,000 Product C $90,000 $27,000 $63,000 foonnnn. Total $370,000 $222,000 $148,000 $55,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education