FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

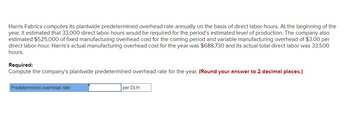

Transcribed Image Text:Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the

year, it estimated that 33,000 direct labor-hours would be required for the period's estimated level of production. The company also

estimated $525,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per

direct labor-hour. Harris's actual manufacturing overhead cost for the year was $688,730 and its actual total direct labor was 33,500

hours.

Required:

Compute the company's plantwide predetermined overhead rate for the year. (Round your answer to 2 decimal places.)

Predetermined overhead rate

per DLH

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Thomlin Company forecasts that total overhead for the current year will be $11,661,000 with 181,000 total machine hours. Year to date, the actual overhead is $7,739,000 and the actual machine hours are 98,000 hours. The predetermined overhead rate based on machine hours is Round the factory overhead rate to the nearest dollar before multiplying by the number of hours.arrow_forwardA company estimates its manufacturing overhead will be $882,760 for the next year. What is the predetermined overhead rate if the allocation base is 77,626 estimated machine hours? Round to the nearest hundredth, two decimals.arrow_forwardItranscript Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 27,000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $548,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $4.00 per direct labor-hour. Harris's actual manufacturing overhead cost for the year was $714,898 and its actual total direct labor was 27,500 hours. Required: Compute the company's plantwide predetermined overhead rate for the year. (Round your answer to 2 decimal places.) Predetermined overhead rate per DLHarrow_forward

- The Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 10,200 9,200 12,200 Units to be produced 11,200 Each unit requires 0.25 direct labor-hours and direct laborers are paid $11.00 per hour. In addition, the variable manufacturing overhead rate is $1.60 per direct labor-hour. The fixed manufacturing overhead is $82,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $22,000 per quarter. Required: 1. Calculate the company's total estimated direct labor cost for each quarter of the upcoming fiscal year and for the year as a whole. 2. and 3. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Req 1…arrow_forwardHenke corporation bases its predetermined overhead rate on the estimated labor hours for the upcoming year. At the beginning of the most recently completed year, the company estimated the labor hours for the upcoming year at 69,000 labor hours. The estimated variable manufacturing overhead was $7.30 per labor hour and the estimated total fix manufacturing overhead was $1,380,000. The actual labor hours for the year turned out to be 73,000 labor hours. Compute the company's predetermined overhead rate for the recently completed yeararrow_forwardCavy Company estimates that the factory overhead for the following year will be $1,699,200. The company has determined that the basis for applying factory overhead will be machine hours, which is estimated to be 28,800 hours. There are 1,660 machine hours for all of the jobs in the month of April. What amount will be applied to all of the jobs for the month of April?arrow_forward

- A company estimates its manufacturing overhead will be $617,864 for the next year. What is the predetermined overhead rate if the allocation base is 1,091,428 budgeted direct labor expense? Round to the nearest hundredth, two decimals.arrow_forwardABC Inc. computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 25,000 direct labor hours would be required for the period's estimated level of production. The company also estimated $520,000 of fixed manufacturing cost for the coming period and variable manufacturing overhead of $4 per direct labor-hour. ABC's actual manufacturing overhead cost for the year was $671,925 and its actual total direct labor was 25,500 hours. Compute the company's plantwidew predetermined overhead rate for the year.arrow_forwardThomlin Company forecasts that total overhead for the current year will be $11,649,000 with 153,000 total machine hours. Year to date, the actual overhead is $7,535,000 and the actual machine hours are 82,000 hours. The predetermined overhead rate based on machine hours is Round the factory overhead rate to the nearest dollar before multiplying by the number of hours.arrow_forward

- Norwall Company's budgeted variable manufacturing overhead cost is $1.05 per machine-hour and its budgeted fixed manufacturing overhead is $27,094 per month. The following information is available for a recent month: a. The denominator activity of 8,740 machine-hours is used to compute the predetermined overhead rate. b. At a denominator activity of 8,740 machine-hours, the company should produce 3,800 units of product. c. The company's actual operating results were: Number of units produced Actual machine-hours Actual variable manufacturing overhead cost Actual fixed manufacturing overhead cost Required: 1. Compute the predetermined overhead rate and break it down into variable and fixed cost elements. Note: Round your answers to 2 decimal places. 1. Predetermined overhead rate 1. Variable element 4,220 10,050 2. Compute the standard hours allowed for the actual production. 3. Compute the variable overhead rate and efficiency variances and the fixed overhead budget and volume…arrow_forwardFanning Corporation estimated its overhead costs would be $22,100 per month except for January when it pays the $207,120 annual insurance premium on the manufacturing facility. Accordingly, the January overhead costs were expected to be $229,220 ($207,120 + $22,100). The company expected to use 7,700 direct labor hours per month except during July, August, and September when the company expected 9,700 hours of direct labor each month to build inventories for high demand that normally occurs during the Christmas season. The company’s actual direct labor hours were the same as the estimated hours. The company made 3,850 units of product in each month except July, August, and September, in which it produced 4,850 units each month. Direct labor costs were $23.10 per unit, and direct materials costs were $10.30 per unit.Required Calculate a predetermined overhead rate based on direct labor hours. Determine the total allocated overhead cost for January, March, and August. Determine the…arrow_forwardHarris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 44,000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $558,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. Harris's actual manufacturing overhead cost for the year was $773,491 and its actual total direct labor was 44,500 hours. Required: Compute the company's plantwide predetermined overhead rate for the year. (Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education