FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

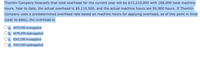

Transcribed Image Text:Thomlin Company forecasts that total overhead for the current year will be $15,210,000 with 169,000 total machine

hours. Year to date, the actual overhead is $9,110,500, and the actual machine hours are 95,900 hours. If Thomlin

Company uses a predetermined overhead rate based on machine hours for applying overhead, as of this point in time

(year to date), the overhead is

Oa. $479,500 overapplied

Ob. $479,500 underapplied

c. $365,500 overapplied

Od. $365,500 underapplied

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Henkes Corporation bases its predetermined overhead rate on the estimated labor-hours for the upćoming year. At the beginning of the most recently completed year, the company estimated the labor-hours for the upcoming year at 80,000 labor-hours. The estimated variable manufacturing overhead was $10.70 per labor-hour and the estimated total fixed manufacturing overhead was $1,440,000. The actual labor-hours for the year turned out to be 84,000 labor-hours. Required: Compute the company's predetermined overhead rate for the recently completed year. (Round your answer to 2 decimal places.) Predetermined overhead rate per labor-hourarrow_forwardCullumber Company estimates that annual manufacturing overhead costs will be $768,000. Estimated annual operating activity bases are: direct labor cost $588,800, direct labor hours 40,000 and machine hours 80,000. The actual manufacturing overhead cost for the year was $769,280 and the actual direct labor cost for the year was $583,680. Actual direct labor hours totaled 39,800 and machine hours totaled 79,000. Cullumber applies overhead based on direct labor hours. Compute the predetermined overhead rate and determine the amount of manufacturing overhead applied. Determine if overhead is over- or underapplied and the amount. (Round predetermined overhead rate to 2 decimal places, e.g. 15.25 and all other answers to O decimal places, e.g. 1,525.) Predetermined overhead rate $ Manufacturing overhead applied $ $ per direct labor hourarrow_forwardStrong Company applies overhead based on machine hours. At the beginning of 2018, the company estimated that manufacturing overhead would be OMR 120,000, and machine hours would total 15,000. By 2018 year-end, actual overhead totaled OMR 140,000, and actual machine hours were 20,000. On the basis of this information, the 2018 predetermined overhead rate was:arrow_forward

- Pocono Cement Forms expects $700,000 in overhead during the next year. It does not know whether it should apply overhead on the basis of its anticipated direct labor hours of 50,000 or its expected machine hours of 25,000. Determine the product cost under each predetermined allocation rate if the last job incurred $1,560 in direct material cost, 102 direct labor hours, and 85 machine hours. Wages are paid at $15 per hour. Labor Hours Machine Hours Cost of the job $ $arrow_forwardKingsley Products estimated that direct labor for the year would be 64,000 hours. The company also estimated that the fixed overhead cost for the year would be $160,000. They further estimated the variable overhead cost to be $4.00 per direct labor-hour. All overhead at Kingsley Products is applied on the basis of direct labor-hours. During the year, fixed overhead costs were exactly as planned ($160,000). Variable overhead was incurred at $4.50 per direct labor-hour. Underapplied overhead for the year was calculated as $18,000. Required: How many direct labor-hours were worked during the period? Note: Do not round intermediate calculations. Direct labor-hoursarrow_forwardWinston Company estimates that total factory overhead for the following year will be $1,347,500. The company has decided that the basis for applying factory overhead should be machine hours, which are estimated to be 38,500 hours. The actual total machine hours for the year were 54,300 hours. The actual factory overhead for the year was $1,927,000. Enter the amount as a positive number. a. Determine the total factory overhead applied. Round to the nearest dollar. b. Compute the over- or underapplied factory overhead for the year. c. Journalize the entry to transfer the over- or underapplied factory overhead to cost of goods sold. If an amount box does not require an entry, leave it blank.arrow_forward

- Winston Company estimates that total factory overhead for the following year will be $880,400. The company has decided that the basis for applying factory overhead should be machine hours, which are estimated to be 28,400 hours. The actual total machine hours for the year were 54,800 hours. The actual factory overhead for the year was $1,723,000. Enter the amount as a positive number. Question Content Area a. Determine the total factory overhead applied. Round to the nearest dollar.fill in the blank b. Compute the over- or underapplied factory overhead for the year.fill in the blank c. Journalize the entry to transfer the over- or underapplied factory overhead to cost of goods sold. If an amount box does not require an entry, leave it blank. Debit Credit Cost of goods sold Factory Overheadarrow_forwardhe Thomlin Company forecasts that total overhead for the current year will be $11,385,000 with 164,000 total machine hours. Year to date, the actual overhead is $7,616,000 and the actual machine hours are 93,000 hours. If the Thomlin Company uses a predetermined overhead rate based on machine hours for applying overhead, as of this point in time (year to date), the overhead is Round the factory overhead rate to the nearest dollar before multiplying by the number of hours.arrow_forwardplease solve for overhead rate per direct labor cost, overhead rate per direct labor hour, and overhead rate per machine hourarrow_forward

- Cavy Company estimates that the factory overhead for the following year will be $2,034,500. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 31,300 hours. The machine hours for the month of April for all of the jobs were 2,830. If the actual factory overhead for April totaled $180,455, determine the over- or underapplied amount for the month. Enter the amount as a positive number.arrow_forwardThe Thomlin Company forecasts that total overhead for the current year will be $11,764,000 with 180,000 total machine hours. Year to date, the actual overhead is $7,870,000 and the actual machine hours are 83,000 hours. If the Thomlin Company uses a predetermined overhead rate based on machine hours for applying overhead, as of this point in time (year to date), the overhead is Round the factory overhead rate to the nearest dollar before multiplying by the number of hours. a.$3,217,500 overapplied b.$3,217,500 underapplied c.$2,475,000 underapplied d.$2,475,000 overappliedarrow_forwardCavy Company estimates that total factory overhead costs for the following year will be $994,000. The company has decided that the basis for applying factory overhead should be machine hours, which are estimated to be 35,500 hours. Compute the predetermined factory overhead rate.fill in the blank 1 of 1$ per machine hourarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education