FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

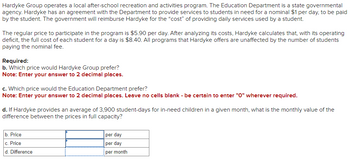

Transcribed Image Text:Hardyke Group operates a local after-school recreation and activities program. The Education Department is a state governmental

agency. Hardyke has an agreement with the Department to provide services to students in need for a nominal $1 per day, to be paid

by the student. The government will reimburse Hardyke for the "cost" of providing daily services used by a student.

The regular price to participate in the program is $5.90 per day. After analyzing its costs, Hardyke calculates that, with its operating

deficit, the full cost of each student for a day is $8.40. All programs that Hardyke offers are unaffected by the number of students

paying the nominal fee.

Required:

b. Which price would Hardyke Group prefer?

Note: Enter your answer to 2 decimal places.

c. Which price would the Education Department prefer?

Note: Enter your answer to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.

d. If Hardyke provides an average of 3,900 student-days for in-need children in a given month, what is the monthly value of the

difference between the prices in full capacity?

b. Price

c. Price

d. Difference

per day

per day

per month

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- At the beginning of the fall semester beauty state university a public university, billed tuition and fees at a gross amount of $4,800,000. of this amount, the university awarded a scholarship of $250,000 and $50,000 was believed to be uncollectible. The University also offered a generous tuition discount for the dependents of its employees. An additional $300,000 of the gross amount was awarded as employer provided tuition discounts. 1. Record the journal entry for the billing described above. 2. Assume that the transactions described above were in the summer instead of the fall. The billing was on June 25, fiscal year end is June 30, and the semester does not begin until July 15. How would the journal entries differ? 3. How would the journal entries in #1 differ for a private, nonprofit university?arrow_forward2-17. Finn Fixes is a new charity that repairs donated cars for use by unemployed job seekers. Finn collects the cars from area junkyards. The first year Finn is in operation, jobs programs bought cars from the organization for $60,000. They paid Finn $45,000 during the year and owe $15,000. Finn uses donated, unskilled labor and free garage space at a local high school. Its only cost is for parts. Total parts cost $58,000 for the year. During that first year Finn paid its parts suppliers $52,000. It owes its suppliers the balance. What is the profit or loss to Finn Fixes on a cash basis? What is the profit or loss to Finn Fixes on an accrual basis? If Finn Fixes were to stop operating at the end of the first year but received payment from the jobs programs and paid its suppliers, what would its cash budget for the next year be? How much cash would Finn Fixes have on hand at the end of the second year? How does that amount compare to its budgeted accrual basis profit or loss for the…arrow_forwardA nongovernmental not-for-profit animal shelter receives contributed services from the following individuals valued at their normal billing rate: Board members volunteer to prepare books for audit 4,500 Registered nurse volunteers as receptionist 3,000 Teacher provides volunteer dog walking 2,000 What amount should the shelter record as contribution revenue? A.) $7,500 B.) $4,500 C.) $6,500 D.) $9,500arrow_forward

- Jackson County Senior Services is a nonprofit organization devoted to providing essential services to seniors who live in their own homes within the Jackson County area. Three services are provided for seniors-home nursing, Meals On Wheels, and housekeeping. Data on revenue and expenses for the past year follow: Revenues Variable expenses Contribution margin Fixed expenses: Depreciation Liability insurance Program administrators' salaries General administrative overhead* Total fixed expenses Net operating income (loss) Req 1A Total $ 930,000 481,000 449,000 Req 1B 69,800 42,700 Req 2A 113,800 186,000 412,300 $ 36,700 Req 2B Home Nursing $ 266,000 120,000 146,000 Complete this question by entering your answers in the tabs below. 8,500 20,300 40,100 53,200 122, 100 $ 23,900 Req 1A *Allocated on the basis of program revenues. The head administrator of Jackson County Senior Services, Judith Miyama, considers last year's net operating income of $36,700 to be unsatisfactory; therefore, she…arrow_forwardThe government has imposed a fine on JJ’s Place. The fine calls for annual payments of $60,000 one year from now, $70,000 two years from now, $75,000 three years from now, and $50,000 four years from now. The government plans to invest the funds until the final payment is collected and then donate the entire amount, including the investment earnings, to help the local community shelter. The government will earn 7.5 percent on the funds held. How much will the community shelter receive four years from today? Group of answer choices $328,572 $236,875 $277,491 $286,057 $281,748arrow_forwardLilly County, faced with the prospect of declining revenues, decides it can save money by doingall printing in-house. The county creates the Lilly Printing Fund (an Internal Service Fund),directs departments to fulfill their bulk printing needs through that Fund, and directs departmentsto pay the Fund promptly to minimize its operating cash flow needs.The Fund had the following transactions and events during 2021:1. Received a $12,000 loan on January 2 from the county’s General Fund to be repaid in fourequal annual installments of $3,000, starting December 31, 2021, with interest at the rateof 1 percent per annum on the outstanding balance. The specified purpose of the loan is toallow the Lilly Printing Fund to purchase equipment for $9,600 and to use the balance of $2,400to meet operating cash flow needs.2. Purchased reproduction equipment for $9,600 on January 2, using cash provided.The equipment has an estimated useful life of 4 years.3. Purchased paper and supplies for $9,000 on…arrow_forward

- The City of Evansville operated a summer camp program for at-risk youth. Businesses and nonprofit organizations sponsor one or more youth by paying the registration fee for program participants. The following Schedule of Cash Receipts and Disbursements summarizes the activity in the program's bank account for the year. 1. At the beginning of 2020, the program had unrestricted cash of $30,000. Cash receipts: Registration fees Borrowing from bank Total deposits Cash disbursements: Wages Payroll taxes Insurance (paid monthly) Purchase of bus Interest on bank note Total checks Excess of receipts over disbursements Cash Basis 12 months $134,000 60,000 194,000 74,000 9,900 6,900 69,000 1,800 161,600 $ 32,400 2. The loan from the bank is dated April 1 and is for a five-year period. Interest (6 percent annual rate) is paid on October 1 and April 1 of each year, beginning October 1, 2020. 3. The bus was purchased on April 1 with the proceeds provided by the bank loan and has an estimated useful…arrow_forwardArlington Town uses an Internal Service Fund to account for its motor poolactivities. You have the following information:Automobiles: The Motor Pool uses two 6-passenger vans, each costing $90,000and each estimated to have a 5-year life when they were acquired in 2020.Driver salaries: The Motor Pool has a driver-administrator, who earns $90,000a year, and a driver, who earns $70,000.The town uses a rate of 33 percent (to cover benefits, including pensions)for planning purposes.Insurance: In 2020, the town purchased a 3-year automobile accident policyat a cost of $12,000.Fuel and maintenance costs: Based on experience, the driver-administratorestimates that total fuel and maintenance costs for the year will be $16,000.Billing units: To simplify its record keeping, the Motor Pool charges a fixed priceper trip. Arlington’s budget office estimates it will provide 1,600 trips to thetown’s departments in 2021.Arlington Town had the following transactions and events during January 2021:1.…arrow_forwardIS IT PART OF THE COUNTY? Harland County is in a financially distressed area within the state of Missouri. In hopes of enticing business to the county, the state legislature appropriates $3 million to start an industrial development commission. The federal government provides an additional $1 million. The state appoints 15 individuals to a board to oversee the operations of this commission. Harland County officials name five additional members. The commission begins operations by raising funds from local citizens and businesses. Over the past 12 months, it received $700,000 in donations and pledges. The county provides clerical assistance and allows the commission to use one wing of a county office building for its headquarters. The Harland County government must approve the commission's annual operating budget. The county will also cover any deficits that might occur.During the current period, the commission spent $2.4 million and achieves notable success. Several large companies…arrow_forward

- The City of Meringen operates a central garage through an internal service fund to provide garage space and repairs for all city-owned and operated vehicles. The central garage fund was established by a contribution of $200,000 from the general fund, when the building was acquired several years ago. The postclosing trail balance at June 30, 2014, was as follows: Debit Credit Cash $ 150,000 Due from general fund $ 20,000 Inventory of materials and supplies $ 80,000 Land $ 60,000 Building $ 200,000 Accumulated depreciation-building $ 10,000 Machinery and equipment $ 56,000 Accumulated depreciation-machinery $ 12,000 and equipment $ 38,000 Vouchers payable $ 200,000 Contribution from general fund $ 306,000 Net position $…arrow_forwardanswer in text form please (without image)arrow_forwardTheodore County uses a General Fund, a Special Revenue Fund, and an Enterprise Fund. The Special Revenue Fund is financed by a grant from the state to provide care for the elderly. The Enterprise Fund provides bus service both to the public and to government agencies. Prepare entries to record these transactions. Identify the funds involved in each case. a. The Enterprise Fund bills the Special Revenue Fund $15,000 for bus service provided to the elderly. b. The General Fund receives an electricity bill for $20,000 and prepares a voucher to pay the bill. The General Fund then bills the Special Revenue Fund for $3,000, representing the portion of the electricity bill applicable to the senior citizens building. C. The Enterprise Fund is short of cash to pay its bills. The General Fund lends the Enterprise Fund $50,000 in cash, which will be repaid before the end of the year. d. The General Fund pays cash of $100,000 to the Enterprise Fund as a subsidy to help meet the operating costs of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education