FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

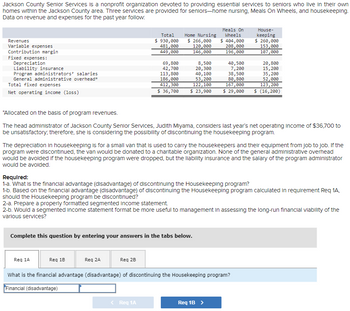

Transcribed Image Text:Jackson County Senior Services is a nonprofit organization devoted to providing essential services to seniors who live in their own

homes within the Jackson County area. Three services are provided for seniors-home nursing, Meals On Wheels, and housekeeping.

Data on revenue and expenses for the past year follow:

Revenues

Variable expenses

Contribution margin

Fixed expenses:

Depreciation

Liability insurance

Program administrators' salaries

General administrative overhead*

Total fixed expenses

Net operating income (loss)

Req 1A

Total

$ 930,000

481,000

449,000

Req 1B

69,800

42,700

Req 2A

113,800

186,000

412,300

$ 36,700

Req 2B

Home Nursing

$ 266,000

120,000

146,000

Complete this question by entering your answers in the tabs below.

8,500

20,300

40,100

53,200

122, 100

$ 23,900

Req 1A

*Allocated on the basis of program revenues.

The head administrator of Jackson County Senior Services, Judith Miyama, considers last year's net operating income of $36,700 to

be unsatisfactory; therefore, she is considering the possibility of discontinuing the housekeeping program.

Meals On

Wheels

$ 404,000

208,000

196,000

The depreciation in housekeeping is for a small van that is used to carry the housekeepers and their equipment from job to job. If the

program were discontinued, the van would be donated to a charitable organization. None of the general administrative overhead

would be avoided if the housekeeping program were dropped, but the liability insurance and the salary of the program administrator

would be avoided.

40,500

7,200

Required:

1-a. What is the financial advantage (disadvantage) of discontinuing the Housekeeping program?

1-b. Based on the financial advantage (disadvantage) of discontinuing the Housekeeping program calculated in requirement Req 1A,

should the Housekeeping program be discontinued?

2-a. Prepare a properly formatted segmented Income statement.

2-b. Would a segmented income statement format be more useful to management in assessing the long-run financial viability of the

various services?

House-

keeping

$ 260,000

153,000

107,000

Req 1B >

20,800

15, 200

38,500

80,800

167,000

$ 29,000 $ (16,200)

What is the financial advantage (disadvantage) of discontinuing the Housekeeping program?

Financial (disadvantage)

35,200

52,000

123, 200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- D Question 32 Given an ROE of 17.8%, EM of 2.6, Sales of $1.8M, TAT of 2.1, find Net Income. O $75,282 O $58,680 O $67,390 O $88,020 2.5arrow_forwardAaBbC AaBbCcI AaBbC AaBbCcl AaBbCc AaBbCcL O Find x A A E=EE E E Replace 1 Normal Title 1 No Spac... Heading 1 Heading 2 Heading 3 Heading 4 Select ont Paragraph Styles Editing QUESTION 3 Penco Ltd. operates a defined benefit pension scheme for all of its employees. The closing balances on the scheme assets and liabilities, at 31 December 2016, were S60 million and $64 million respectively. Penco's actuary has provided the following information that has yet to be accounted for in the year-ended 31 December 2017. $m Current service cost 9. Past service cost 8. Contributions paid in Benefits paid out 6. 66 Fair value of plan asset 75 Fair value of plan liabilities 5% Yield on high quality corporate bonds Required Calculate the amounts that will appear in the financial statements of Penco for the year-ended 31 December 2017. D. Focus 28°C Sunny ^ D G EG 61 37 121arrow_forwardDATE OF PAY PERIOD ENDING 20- 20 PAYMENT NET СК. EARNINGS DEDUCTIONS EMPLOYEE MAR. TOTAL NAME ALLOW RATE SOC. SEC. FED. INC. STATE INC. HOSP. INS OTHERS TOTAL PAY NO. NUMBER STATUS HOURS REGULAR OVERTIME TOTAL MED. TAX TAX TAX TAX 10 2 3 6. 9. 10 11 10 12 11 13 14 13 15 14 16 17 15 18 16 17 18 25 12 7.arrow_forward

- A r Duilding G Cash Y H Z 1 Depreciation Expense AA J Dividends BB K Equipment EE L Federal Income Tax Withheld Payable FF M Federal Unemployment Taxes Payable GG N FICA Taxes Payable HH O Income Summary II P Income Taxes Payable JJ Q Interest Expense KK R Interest Payable LL S Land MM T Land Improvement NN Unearned Rent Revenue Cost of Goods Sold INOLES Payable Payroll Tax Expense Rent Revenue Example of Answer: G3000D B2000D GG5000C Retained Earnings Salaries and Wages Expense Sales Sales Returns Service Revenues Sales Taxes Payable Shipping Expense State Income Tax Withheld Payable State Unemployment Taxes Payable Supplies Tax Expense Where each box represents a journal entry line. In the first box, G denotes Cash account, 3000 is the amount, D stands for debit. In the second box: B denotes Accounts Receivable account, 2000 is the amount, D stands for debit. And in third box: GG denotes Service Revenues, 5000 is the amount, and C stands for credit. The letters are in the capital.…arrow_forwardNAME Barney, R. S. Fisk, M. C. Hayes, W. O. Lee, L. B. Parks, S. J Tempy, E. B. EARNINGS EARNINGS EARNINGS UNEMPLOYMENT SECURITY MEDICARE 1,932.00 1,932.00 1,932.00 1,932.00 567.00 567.00 567.00 567.00 483.00 483.00 483.00 483.00 679.00 679.00 679.00 679.00 578.00 578.00 578.00 578.00 546.00 546.00 546.00 546.00 4.785.00 4,785.00 4,785.00 4,785.00 DATE ..... 20-- Jan. 7 Assume that the payroll is subject to an employer's Social Security tax of 6.2 percent on the first $118,500 and a Medicare tax of 1.45 percent on all earnings. Also assume that the federal unemployment tax is 0.6 percent, and that the state unemployment tax is 5.4 percent of the first $7,000. 1,932.00 567.00 483.00 Give the entry in general journal form to record the payroll tax expense. If an amount box does not require an entry, leave it blank. If required, round your intermediate calculations and final answers to the nearest cent and use the rounded answers in subsequent computations. 679.00 578.00 546.00 4,785.00…arrow_forwardSh19arrow_forward

- Help pleasearrow_forwardAneesh Bird Cope DeSpears Others Estimated percentage uncollectible Total estimated uncollectibles (a) Customer (b) No. Total (1) $ 23,400 36,100 56,000 35,000 Date Not Yet Due $ 41,518 $36,100 5,100 125,100 94,600 $275,600 $135,800 3% $ 4,074 1-30 $10,600 $12,800 5,500 15,500 Account Titles and Explanation Number of Days Past Due 7% $2,212 31-60 15,000 $31,600 $27,800 $45,400 At December 31, 2021, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $11,500. 61-90 12% $45,400 24% $3,336 $ 10,896 Journalize the following events and transactions in the year 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Over 90 (1) March 1, a $1,100 customer balance originating in 2021 is judged uncollectible. (2) May 1, a check for $1,100 is received from the customer whose account was written off as uncollectible on March 1.…arrow_forwardRizio Company purchases a machine for $12,300, terms 2/10, n/60, FOB shipping point. Rizio paid within the discount period and took the $246 discount. Transportation costs of $278 were paid by Rizio. The machine required mounting and power connections costing $850. Another $401 is paid to assemble the machine, and $40 of materials are used to get it into operation. During installation, the machine was damaged and $330 worth of repairs were made. Complete the below table to calculate the cost recorded for this machine.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education