FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

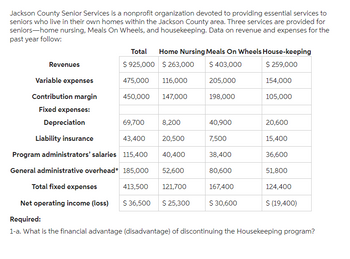

Transcribed Image Text:Jackson County Senior Services is a nonprofit organization devoted to providing essential services to

seniors who live in their own homes within the Jackson County area. Three services are provided for

seniors-home nursing, Meals On Wheels, and housekeeping. Data on revenue and expenses for the

past year follow:

Revenues

Total

$ 925,000 $263,000

475,000

116,000

450,000 147,000

Home Nursing Meals On Wheels House-keeping

$ 403,000

$ 259,000

205,000

Variable expenses

Contribution margin

Fixed expenses:

Depreciation

69,700

8,200

Liability insurance

43,400

20,500

Program administrators' salaries 115,400 40,400

General administrative overhead* 185,000

52,600

Total fixed expenses

Net operating income (loss)

413,500 121,700

$ 36,500 $ 25,300

198,000

40,900

7,500

38,400

80,600

167,400

$ 30,600

154,000

105,000

20,600

15,400

36,600

51,800

124,400

$ (19,400)

Required:

1-a. What is the financial advantage (disadvantage) of discontinuing the Housekeeping program?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1arrow_forward1. A not-for-profit hospital performs services in the current year at a charge of $1 million. Of this amount, $200,000 is viewed as charity care services because no collection was expected at the time of the work. Additionally, officials expect another $94,000 to be bad debts. What should the hospital report as net patient service revenues? Select one: a.$906,000 b.$1,000,000 c.$706,000 d.$800,000 2. In the accounting for health care providers, what are third-party payors? Select one: a.Friends and relatives who pay the medical costs of a patient. b.Doctors who reduce fees for indigent patients. c.Insurance companies and other groups that pay a significant portion of the medical fees in the United States. d.Charities that supply medicines to hospitals and other health care providers. 3.What is a contractual adjustment? Select one: a.A year-end journal entry to recognize all of a health care entity's remaining receivables. b.An increase in a patient's…arrow_forwardThree not-for-profit organizations operate separately in Central City. The most established entity, Central Support, has been around for over 100 years and generates by far the largest amount of dona-tions. Central Kidz. Zone was founded 30 years ago and generates less than half of what Central Support brings in. Central Emergency Aid was founded just 20 years ago and provides relief to those in the most urgent of cir-cumstances. Central Emergency Aid is building its donation network and is already close to the level of Central Kidz Zone in terms of fundraising dollars.Until last year, all three entities operated separately —separate staff, separate spaces, and separate work plans. Then last year, discussions began to coordinate some of their administrative efforts for efficiency pur-poses, recognizing that each could benefit if they were willing to give up a bit of comfort.Each entity is paying the following amount annually to rent administrative space and cover the cost of…arrow_forward

- Caring Shop is a gift shop located in The Natural History Museum. Caring shop has annual sales revenue of $850,000. Additionally, the Natural History museum has investment income of $550,000 from its endowment, and an annual operating budget of $3 million. Both the income from the gift shop and the endowment income are used to support the exempt purpose of the museum. The balance of funding required for annual operations is provided through admission fees. Dan Nolan, a new board member, does not understand why the museum is subject to tax at all, particularly because all of the entity's profits are used in carrying out the mission of the museum. As the museum treasurer, write a letter to Dan Nolan explaining the reason for the tax consequences.arrow_forwardPrepare journal entries for the City of Pudding's governmental funds to record the following transactions, first for fund financial statements and then for government-wide financial statements. A new truck for the sanitation department was ordered at a cost of $107,250. The city print shop did $3,600 worth of work for the school system (but has not yet been paid). A(n) $14 million bond was issued at face value to build a new road. The city transfers cash of $185,000 from its general fund to provide permanent financing for a municipal swimming pool that will be maintained as an enterprise fund. The truck ordered in (a) is received but at an actual cost of $109,650. Payment is not made at this time. The city transfers cash of $33,600 from its general fund to a capital projects fund. The city receives a state grant of $30,000 that must be spent to promote recycling by the citizens. The first $5,650 of the state grant received in (g) is expended as intended.arrow_forward4. A non-profit domestic hospital has the following data during the year 2x18: Gross income from hospital operation Operating Expenses (excluding depreciation for the new hospital building) Rent income of commercial space, hospital ground floor, net of 5% withholding taxes Interest on bank deposit, net of 20% withholding tax Dividend income from a domestic corporation P2,000,000 500,000 190,000 40,000 100,000 An additional hospital building was built and finished on June 30, 2X18 at the cost of P4,000,000 with a depreciable life of 25 years. a. Compute the income tax still due and payable in 2X18. b. Assume the hospital was organized for profit, compute the income tax still due and payable in 2X18. 4arrow_forward

- Following are several unrelated transactions involving a hospital. The hospital has a contractual agreement with a lender requiring that $400,000 in cash be set aside to meet its future debt payment. The hospital accrued $1,200,000 in patient service revenues. Charity services of $500,000 also were provided. Contractual adjustments total $600,000. An increase of $50,000 was recorded for bad debts. Recently retired nurses volunteered to assist with a spike in patient demand due to an infectious disease outbreak. The value of these services was estimated to be $200,000, and the hospital normally would have purchased these specialized services. An endowment contribution of $1,900,000 was received. Investments held by the hospital increased in fair value by $45,000. The hospital purchased $840,000 in equipment with resources that had been contributed in prior years for such a purchase. Record the $400,000 cash receipt to be reinvested in investments to meet its future debt payment.…arrow_forwardDuring the current year, a voluntary health and welfare organization receives $800,000 in unrestricted pledges. Of this amount, $300,000 has been designated by donors for use next year to support operations in the pharmacy. what amount of unrestricted support should the organizations recognize in its current-year financial statements? A.) $800,000 B.) $700,000 C.) $500,000 D.) $400,000arrow_forwardAccounting for contributions with donor restrictions On January 1, the first day of the fiscal year, a member of a nonprofit hospital's board of directors passed away. His will provided a $96,250 contribution to the hospital to upgrade the skills of its nurses. During January, the hospital spent $41,250 to train the nurses. Prepare journal entries to record the transactions. If no adjustment is necessary, select 'No debit (or credit) entry needed' in the account fields and enter 0 in the amount fields. Account Debit Credit Cash 96,250 Restricted donor contribution revenue 96,250 To record contribution. Nurse training expense 41,250 Cash 41,250 v To record tralning costs. Net assets without donor restrictions, Reclassifications in 41,250 Net assets with donor restrictions, Reclassifications out 55,000 x To record reclassification. > >arrow_forward

- Prepare journal entries to record the following transactions and events that occurred in the village of Kowitt Gorge during the calendar year 2022:1. The village commissioners adopted the following budget:arrow_forwardOnly typed solutionarrow_forward10-15. Jefferson Animal Rescue is a private not-for-profit clinic and shelter for abandoned domesticated animals, chiefly dogs and cats. At the end of 2019, the organization had the following account balances: [See attached image] The following took place during 2020: 1. Additional supplies were purchased on account in the amount of $16,050.2. Unconditional (and unrestricted) pledges of support were received totaling $95,000. In light of a declining economy, 4 percent is expected to be uncollectible. The remainder is expected to be collected in the current year.3. Supplies used for animal care amounted to $17,200.4. Payments made on accounts payable amounted to $17,100.5. Cash collected from pledges totaled $90,500.6. Salaries were paid in the amount $47,500. Included in this amount is the accrued wages payable at the end of 2019. (The portion of wages expense attributable to administrative expense is $15,000 and fund-raising expense is $2,000. The remainder is for animal care.)7.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education