FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

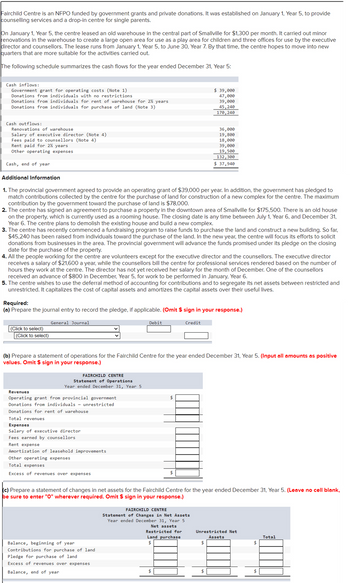

Transcribed Image Text:Fairchild Centre is an NFPO funded by government grants and private donations. It was established on January 1, Year 5, to provide

counselling services and a drop-in centre for single parents.

On January 1, Year 5, the centre leased an old warehouse in the central part of Smallville for $1,300 per month. It carried out minor

renovations in the warehouse to create a large open area for use as a play area for children and three offices for use by the executive

director and counsellors. The lease runs from January 1, Year 5, to June 30, Year 7. By that time, the centre hopes to move into new

quarters that are more suitable for the activities carried out.

The following schedule summarizes the cash flows for the year ended December 31, Year 5:

Cash inflows:

Government grant for operating costs (Note 1)

Donations from individuals with no restrictions

Donations from individuals for rent of warehouse for 2½ years

Donations from individuals for purchase of land (Note 3)

$ 39,000

47,000

39,000

45,240

170,240

Cash outflows:

Renovations of warehouse

Salary of executive director (Note 4)

Fees paid to counsellors (Note 4)

Rent paid for 2½ years

Other operating expenses

Cash, end of year

Additional Information

36,000

19,800

18,000

39,000

19,500

132,300

$ 37,940

1. The provincial government agreed to provide an operating grant of $39,000 per year. In addition, the government has pledged to

match contributions collected by the centre for the purchase of land for construction of a new complex for the centre. The maximum

contribution by the government toward the purchase of land is $78,000.

2. The centre has signed an agreement to purchase a property in the downtown area of Smallville for $175,500. There is an old house

on the property, which is currently used as a rooming house. The closing date is any time between July 1, Year 6, and December 31,

Year 6. The centre plans to demolish the existing house and build a new complex.

3. The centre has recently commenced a fundraising program to raise funds to purchase the land and construct a new building. So far,

$45,240 has been raised from individuals toward the purchase of the land. In the new year, the centre will focus its efforts to solicit

donations from businesses in the area. The provincial government will advance the funds promised under its pledge on the closing

date for the purchase of the property.

4. All the people working for the centre are volunteers except for the executive director and the counsellors. The executive director

receives a salary of $21,600 a year, while the counsellors bill the centre for professional services rendered based on the number of

hours they work at the centre. The director has not yet received her salary for the month of December. One of the counsellors

received an advance of $800 in December, Year 5, for work to be performed in January, Year 6.

5. The centre wishes to use the deferral method of accounting for contributions and to segregate its net assets between restricted and

unrestricted. It capitalizes the cost of capital assets and amortizes the capital assets over their useful lives.

Required:

(a) Prepare the journal entry to record the pledge, if applicable. (Omit $ sign in your response.)

(Click to select)

(Click to select)

General Journal

Debit

Credit

(b) Prepare a statement of operations for the Fairchild Centre for the year ended December 31, Year 5. (Input all amounts as positive

values. Omit $ sign in your response.)

FAIRCHILD CENTRE

Statement of Operations

Year ended December 31, Year 5

Revenues

Operating grant from provincial government

Donations from individuals - unrestricted

Donations for rent of warehouse

Total revenues

Expenses

Salary of executive director

Fees earned by counsellors

Rent expense

Amortization of leasehold improvements

Other operating expenses

Total expenses

Excess of revenues over expenses

$

ta.

$

LA.

(c) Prepare a statement of changes in net assets for the Fairchild Centre for the year ended December 31, Year 5. (Leave no cell blank,

be sure to enter "O" wherever required. Omit $ sign in your response.)

FAIRCHILD CENTRE

Statement of Changes in Net Assets

Year ended December 31, Year 5

Balance, beginning of year

Contributions for purchase of land

Pledge for purchase of land

Excess of revenues over expenses

Balance, end of year

Net assets

Restricted for

Land purchase

Unrestricted Net

Assets

$

$

++

$

$

$

Total

+A.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- This year Southfork began work on a senior center to hold activities for its growing senior citizen population. It is to be financed by a $5,000,000 bond issue, a $500,000 grant, and a $500,000 General Fund transfer. The following transactions occurred during the current year: The General Fund transferred $500,000 to the Senior Center Capital Projects Fund. A plot of land was purchased for $400,000 in cash. (This cost had not been encumbered.) Preliminary planning and engineering costs of $95,000 were vouchered. (This cost had not been encumbered.) A contract was signed with Sunset Construction Company for the major part of the project on a bid of $4,950,000. The $5,000,000 bonds were issued at par. Temporary investments were purchased at a cost of $3,500,000. A payable was recorded for a $49,500 billing from the Water and Sewer enterprise fund for the cost of extending water pipes to the new building. (This cost had not been encumbered.) An invoice in the amount of $1,500,000 was…arrow_forwardJackson County Senior Services is a nonprofit organization devoted to providing essential services to seniors who live in their own homes within the Jackson County area. Three services are provided for seniors-home nursing, Meals On Wheels, and housekeeping. Data on revenue and expenses for the past year follow: Home Meals On House- keeping $ 924,000 $ 267,000 $ 405,000 $ 252,000 157,000 95,000 Total Nursing Wheels Revenues Variable expenses 477,000 447,000 115,000 152,000 205,000 200,000 Contribution margin Fixed expenses: Depreciation Liability insurance Program administrators' salaries General administrative overhead* 69,200 42,500 115,300 184,800 411,800 8,400 20,200 40,200 40,200 7,200 38,800 20,600 15,100 36,300 53,400 122,200 81,000 167,200 50,400 122,400 Total fixed expenses Net operating income (loss) $ 35,200 $ 29,800 $ 32,800 $ ( 27,400) *Allocated on the basis of program revenues.arrow_forwardA volunteer has been asked to drop off some supplies at a facility housing victims of a hurricane evacuation. The volunteer would like to bring at least 240 bottles of water, 117 first aid kits, and 83 security blankets on his visit. The relief organization has a standing agreement with two companies that provide victim packages. Company A can provide packages of 21 water bottles, 9 first aid kits, and 7 security blankets at a cost of $2. Company B can provide packages of 8 water bottles, 5 first aid kits, and 3 security blankets at a cost of $1.50. How many of each package should the volunteer pick up to minimize the cost? What amount does the relief organization pay? Answer Enter the value in the first box and the ordered pair in the second box. Minimum Cost of S Minimum Cost at Tables Keypad Keyboard Shortcutsarrow_forward

- A local chapter of the Society for Protection of the Environment benefited from the voluntary services of two attorneys. One served as a member of the Society's board of directors, performing tasks comparable to other directors. During the year, he attended 20 hours of meetings. The other drew up a lease agreement with a tenant in a building owned by the Society. She spent five hours on the project. The billing rate of both attorneys is $200 per hour. In the year in which the services were provided, the Society should recognize revenues from contributed services ofarrow_forwardJackson County Senior Services is a nonprofit organization devoted to providing essential services to seniors who live in their own homes within the Jackson County area. Three services are provided for seniors-home nursing, Meals On Wheels, and housekeeping. Data on revenue and expenses for the past year follow: Revenues Variable expenses Contribution margin Fixed expenses: Depreciation Liability insurance. Program administrators' salaries General administrative overhead* Total fixed expenses Net operating income (loss) Total $ 924,000 469,000 455,000 70,500 43,500 114,100 184,800 412,900 $ 42,100 Home Nursing $ 264,000 119,000 145,000 8,900 20,300 40,200 52,800 122, 200 $ 22,800 Meals On Wheels $ 409,000 194,000 215,000 40,800 7,300 38,800 81,800 168, 700 House- keeping $ 251,000 156,000 95,000 20,800 15,900 35,100 50,200 122,000 $ 46,300 $ (27,000) *Allocated on the basis of program revenues. The head administrator of Jackson County Senior Services, Judith Miyama, considers last…arrow_forwardIshak Center for Families, a nonprofit organization, receives $300,000 from a donor who requires that the Center raise $300,000 in matching funds, or the Center will have to return the $300,000. What journal entry would the Center record upon receipt of the gift? Debit cash $150,000; credit deferred revenue $300,000 Debit cash $300,000; credit contribution revenue with donor restrictions $300,000 Debit cash $300,000; credit contribution revenue without donor restrictions $300,000 No entry would be recordedarrow_forward

- In response to a petition signed by the property owners of Riverdale Subdivision, the city of Pewaukee will oversee the installation of sidewalks, curbs, and gutters in the subdivision, to be accounted for in the city’s capital projects fund. Pewaukee reports on a calendar-year basis. Construction is estimated to cost $900,000 and will be financed by a $100,000 county grant, a $50,000 transfer from the city’s general fund, and special assessments of $750,000 to be levied against subdivision property owners. One-third of the levy is to be due on February 1 of each year, starting with 2018. The first $250,000 installment will be received by the capital projects fund directly. The remaining installments will be collected by the debt service fund and will be used to service the related bond debt. The project is to begin on January 15, 2018, and is to take 18 months to complete. It is estimated that 70% of the work will be completed during 2018.To cover construction costs, a 6%, $500,000…arrow_forwardPrepare journal entries to record the transactions.1. Donor A gave a nonprofit a $55,000 cash gift in June, stipulating that the nonprofit could not use the gift until the next fiscal year.2. Donor B gave a nonprofit a $27,500 cash gift in July, telling the nonprofit the gift could be used only for research on a specific project.3. In response to a special fundraising campaign, whereby contributions could be used only for construction of a new warehouse, a large number of individualspromised to make cash contributions totaling $2,200,000 during the current fiscal year. The nonprofit believes it will actually collect 80 percent of the promised cash.4. Donor C gave a nonprofit several investments having a fair value of $3,300,000 in March. Donor C stipulated that the nonprofit must hold the gift in perpetuity,but it could use the income from the gift for any purpose the trustees considered appropriate. Between March and December, the investments produced income of $110,0005. Using the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education