FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

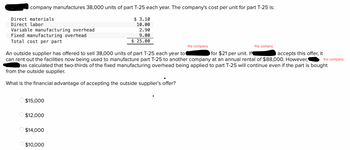

Transcribed Image Text:company manufactures 38,000 units of part T-25 each year. The company's cost per unit for part T-25 is:

Direct materials

$ 3.10

10.00

Direct labor

Variable manufacturing overhead

2.90

9.00

Fixed manufacturing overhead

Total cost per part

$ 25.00

the company

the comany

the company

An outside supplier has offered to sell 38,000 units of part T-25 each year to

for $21 per unit. If¶

accepts this offer, it

can rent out the facilities now being used to manufacture part T-25 to another company at an annual rental of $88,000. However,

has calculated that two-thirds of the fixed manufacturing overhead being applied to part T-25 will continue even if the part is bought

from the outside supplier.

What is the financial advantage of accepting the outside supplier's offer?

$15,000

$12,000

$14,000

$10,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Steve company produces 30000 units of parts each year for use on its production line. The cost per units of the part S6: Direct material $3.60 Direct labor $10.00 Variable manufacturing overhead $2.40 Fixed manufacturing overhead $9.00 Total cost per part$25.00 An outside supplier has offered to sell 30000 units of the part each year at a product company at $21.00 per part. If the products company accepts this offer, the facilities now being used to manufacturer the parts could be rented by another company at the annual rent of $80,000.00. However, the products have determined that two-thirds of the fixed manufacturing overhead being applied to the part would continue even if the part S6 was purchased by an outside supplier. What is the advantage or disadvantage of accepting the outside supplier's offer? and how much ?arrow_forwardEvery year Blue Industries manufactures 7,300 units of part 231 for use in its production cycle. The per unit costs of part 231 are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total (a) $3.00 Total relevant cost to make $ 11.00 Net relevant cost to buy $ 8.00 Cullumber, Inc., has offered to sell 7,300 units f part 231 to Blue for $33 per unit. If Blue accepts Cullumber's offer, its freed-up facilities could be used to earn $10,700 in contribution margin by manufacturing part 240. In addition, Blue would eliminate 50% of the fixed overhead applied to part 231. 10.00 $32.00 Calculate total relevant cost to make and net cost to buy.arrow_forwardPOPOL Company manufactures 100,000 units of Part P yearly as a major component for one of its finished goods. The current report shows the breakdown of the total manufacturing costs of Part P: Direct materials P120,000 Direct labor 80,000 Variable overhead 40,000 Fixed overhead 160,000 Kupa Company, a third party entity, has submitted a proposal to sell POPOL 100,000 units of Part P annually. If POPOL started sourcing these from outside, the plant and equipment currently used to product Part P can be used to manufacture other products of POPOL. This will yield potential savings of P10,000 related to lease production capability to support…arrow_forward

- Vandenberg, Inc., produces and sells two products: a ceiling fan and a table fan. Vandenbergplans to sell 30,000 ceiling fans and 70,000 table fans in the coming year. Product price and costinformation includes: Ceiling Fan Table FanPrice $60 $15Unit variable cost $12 $7Direct fixed cost $23,600 $45,000Common fixed selling and administrative expenses total $85,000.Required:1. What is the sales mix estimated for next year (calculated to the lowest whole number foreach product)?2. Using the sales mix from Requirement 1, form a package of ceiling fans and table fans.How many ceiling fans and table fans are sold at break-even?3. Prepare a contribution-margin-based income statement for Vandenberg, Inc., based on theunit sales calculated in Requirement 2.4. What if Vandenberg, Inc., wanted to earn operating income equal to $14,400? Calculate thenumber of ceiling fans and table…arrow_forwardShine Engine Company manufacturers Part A which is used in several of its engine models. Monthly production costs for 1,000 units are as follows: Direct materials sh. 40,000 Direct labour 10,000 Variable overhead costs 30,000 Fixed overhead costs 20,000 Total costs 100,000 It is estimated that 10% of the fixed overhead costs assigned to Part A will no longer be incurred if the company purchases Part A from the outside supplier. The company has the option of purchasing the part from an outside supplier at sh. 85 per…arrow_forwardPlease help me with this questionarrow_forward

- Rain Incorporated currently manufactures part QX100, which is used in several products produced by the company. Monthly production costs for 10,000 units of QX100 are as followarrow_forwardRoyal Company manufactures 10,000 units of Part R-3 each year. At this level of activity, the cost per unit for Part-R-3 follows: Direct materials Direct labour $14.40 21.00 Variable manufacturing overhead Fixed manufacturing overhead 9.60 25.00 $70.00 Total cost per part An outside supplier has offered to sell 10,000 units of Part R-3 each year to Royal Company for $54 per part. If Royal Company accepts this offer, the facilities now being used to manufacture Part R-3 could be rented to another company at an annual rental of $150,000. However, Royal Company has determined that $15 of the fixed manufacturing overhead being applied to Part R-3 would continue even if the part was purchased from the outside supplier. Required: Compute the net dollar advantage or disadvantage of accepting the outside supplier's offer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education