FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

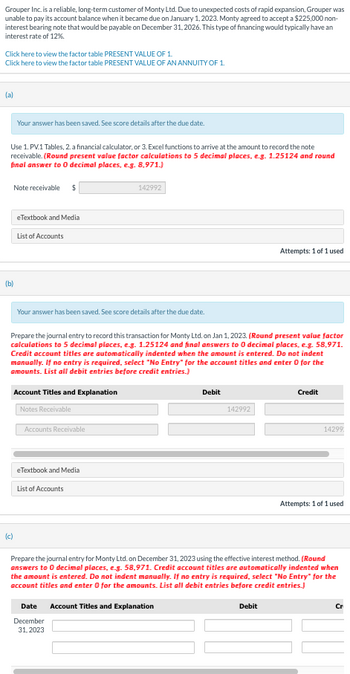

Transcribed Image Text:Grouper Inc. is a reliable, long-term customer of Monty Ltd. Due to unexpected costs of rapid expansion, Grouper was

unable to pay its account balance when it became due on January 1, 2023. Monty agreed to accept a $225,000 non-

interest bearing note that would be payable on December 31, 2026. This type of financing would typically have an

interest rate of 12%.

Click here to view the factor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1.

(a)

Use 1. PV.1 Tables, 2. a financial calculator, or 3. Excel functions to arrive at the amount to record the note

receivable. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and round

final answer to 0 decimal places, e.g. 8,971.)

Your answer has been saved. See score details after the due date.

Note receivable $

(b)

eTextbook and Media

(c)

List of Accounts

Your answer has been saved. See score details after the due date.

Account Titles and Explanation

Notes Receivable

Prepare the journal entry to record this transaction for Monty Ltd. on Jan 1, 2023. (Round present value factor

calculations to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 58,971.

Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the

amounts. List all debit entries before credit entries.)

Accounts Receivable

142992

eTextbook and Media

List of Accounts

Date

December

31, 2023

Debit

142992

Attempts: 1 of 1 used

Debit

Credit

14299

Prepare the journal entry for Monty Ltd. on December 31, 2023 using the effective interest method. (Round

answers to 0 decimal places, e.g. 58,971. Credit account titles are automatically indented when

the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the

account titles and enter 0 for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

Attempts: 1 of 1 used

Cr

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- On January 1, 2022, Slack Company finished legal services and accepted in exchange a 5% $400,000 promissory note with a due date of December 31, 2024. Interest is receivable on January 1 of each year. Notes with similar risk have a market rate of interest of 10%. Set financial calculators to zero decimal place. Required: (a) Determine the value of the following: N = Answer 1 Question 3 I/Y = Answer 2 Question 3 PMT = $Answer 3 Question 3 FV = $Answer 4 Question 3 (b) The present value of the note was $Answer 5 Question 3 (c) Prepare a Schedule of Note Discount/Premium Amortization for Slack Company under the effective interest method. Slack Company Schedule of Note Discount/Premium Amortization Effective Interest Method Date Cash Interest Amortized Amount Carrying Value of Note Jan 1, 2022 $Answer 6 Question 3 Dec 31, 2022 $Answer 7 Question 3 $Answer 8 Question 3 $Answer 9 Question 3 Answer 10 Question 3 Dec 31,…arrow_forwardCurrent Attempt in Progress Riverbed Corp. was experiencing cash flow problems and was unable to pay its $104,000 account payable to Martinez Corp. when it fell due on September 30, 2023. Martinez agreed to substitute a one-year note for the open account. The following two options were presented to Riverbed by Martinez: Option 1: A one-year note for $104,000 due September 30, 2024. Interest at a rate of 9% would be payable at maturity. Option 2: A one-year non-interest-bearing note for $113,360. The implied rate of interest is 9%. Assume that Martinez has a December 31 year end.arrow_forwardOn January 1, Windsor, Inc. sold used equipment with a cost of $17,000 and a carrying amount of $2,300 to Swifty Corporation in exchange for a $5,100, three-year non-interest-bearing note receivable. Although no interest was specified, the market rate for a loan of that risk would be 7%. Assume that Windsor follows IFRS. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. (a) Prepare the entry to record the sale of Windsor's equipment and receipt of the note. (Round answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Notes Receivable Accumulated Depreciation - Equipment Equipment 1700 Gain on Disposal of Equipmentarrow_forward

- Company A is currently cash-constrained, and must make a decision about whether to delay paying one of its suppliers, or taking out a loan. They owe the supplier $23345, and they can borrow the money from Bank A, which has offered to lend the firm $23345 for 2 month(s) at an APR (compounded) of 15%. The bank will require a (no-interest) compensating balance of 7% of the face value of the loan and will charge a $216 loan origination fee, which means Hand-to-Mouth must borrow even more than the $23345. Compute the EAR of the loan. Give typing answer with explanation and conclusionarrow_forwardWhat is the forecasted current portion of bank loan on comfy homes 2018 pro forma financial statements. The $45000 current portion of the bank loan will be paid in December 31, 2018. Of the $255000 in long term debt, another $45000 comes due on December 31, 2019. Comfy home does not plan to obtain any additional loans in 2018. The interest rate for comfy homes borrowing has declined to 6%. It is expected to be the average rate of interest for comfy home short and long term borrowings in 2018. Revenues believe to increase 30% in 2018.arrow_forwardTBTF Bank makes a 3 year interest only loan to AFC Inc of $2,350,000.00. The interest rate on the loan is ¡ (52) = 12.500%, and the payments will be made quarterly. TBTF reinvests the payments at an interest rate of ¡(26) = 14.250%. At maturity, what is TBTF Bank's annual ROI over the lifetime of the loan? (AFC does not default.) a. 11.289% b. 12.241% C. 13.601% d. 14.009% e. 12.377%arrow_forward

- On May 3, 2020, Leven Corporation negotiated a short-term loan of $660,000. The loan is due October 1, 2020, and carries a 5.40% interest rate. Use ordinary interest to calculate the interest. What is the total amount Leven would pay on the maturity date? (Use Days in a year table.) Note: Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardPlease do not give solution in image format ? And Fast answering please and explain proper steps by Step.arrow_forwardThe Patel Company has several financial issues to solve. As the company’s Financial Analyst you have been asked to answer the following 2 questions: Their bank will lend them $100,000 for 90 days at a cost of $1,200 interest. What is the company’s effective annual rate? A major supplier has granted credit terms of 1/10 N120. Assuming the company can borrow any amount of money at the rate you have calculated above (in part 1), should the company take the discount? (Your answer must be supported with a calculation of the cost of not taking the discount – using either simple or effective annual rate)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education