Concept explainers

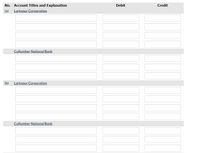

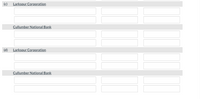

Larkspur Corporation is having financial difficulty and therefore has asked Cullumber National Bank to restructure its $6.05 million note outstanding. The present note has 3 years remaining and pays a current rate of interest of 10%. The present market rate for a loan of this nature is 12%. The note was issued at its face value.

The following are four independent situations. Prepare the

| (a) | Cullumber National Bank agrees to take an equity interest in Larkspur by accepting common stock valued at $3,756,000 in exchange for relinquishing its claim on this note. The common stock has a par value of $1,757,000. | |

| (b) | Cullumber National Bank agrees to accept land in exchange for relinquishing its claim on this note. The land has a book value of $3,181,000 and a fair value of $4,194,000. | |

| (c) | Cullumber National Bank agrees to modify the terms of the note, indicating that Larkspur does not have to pay any interest on the note over the 3-year period. | |

| (d) | Cullumber National Bank agrees to reduce the principal balance due to $5,041,667 and require interest only in the second and third year at a rate of 10%. |

Please fill in all the boxes depicted in both images- thank you!

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 8 images

- Rex Corporation accepted a $3,500, 5%, 120-day note dated August 8 from Regis Company in settlement of a past bill. On October 11, Rex discounted the note at Park Bank at 6%. (Use Days in a year table.) a. What is the note's maturity value? (Use 360 days a year. Do not round intermediate calculations. Round your final answer to the nearest cent.) Maturity value b. What is the discount period? Discount period days c. What is the bank discount? (Use 360 days a year. Do not round intermediate calculations. Round your final answer to the nearest cent.) Bank discount d. What proceeds does Rex receive? (Use 360 days a year. Do not round intermediate calculations. Round your final answer to the nearest cent.) Proceeds receivedarrow_forwardNelson Co. issued a $80,000, 90-day, discounted note to Community Bank. The discount rate is 5%. At maturity, assuming a 360-day year, the borrower will pay how much?arrow_forwardi need the answer quicklyarrow_forward

- 1. Compute the amount of interest during 2021, 2022, and 2023 for the following note receivable: On May 31, 2021, Washington State Bank loaned $260,000 to Paul Mara on a two-year, 12% note. 2. Which party has a(n): (a) note receivable? (b) note payable? (c) interest revenue? (d) interest expense? 3. How much in total would Washington State Bank collect if Paul Mara paid off the note early on November 30, 2021? 1. Compute the amount of interest during 2021, 2022, and 2023 for the following note receivable: On May 31, 2021, Washington State Bank loaned $260,000 to Paul Mara on a two-year, 12% note. (Round the interest amounts to the nearest whole dollar.) Year 2021 2022 2023 Amount of interestarrow_forwardOn December 31, 2020, Monty Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Monty Co. agreed to accept a $296,600 zero-interest-bearing note due December 31, 2022, as payment in full. Hayduke is somewhat of a credit risk and typically borrows funds at a rate of 12%. Monty is much more creditworthy and has various lines of credit at 6%. Prepare the journal entry to record the transaction of December 31, 2020, for the Monty Co. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Date Account Titles and Explanation Dec. 31, 2020 eTextbook and Media List of Accounts Assuming Monty Co's fiscal year-end is December 31, prepare the journal entry for December 31, 2021. (Round…arrow_forwardOn January 1, Year 1, Mahoney Company borrowed $168,000 cash from Sun Bank by issuing a 5-year, 8% term note. The principal and interest are repaid by making annual payments beginning on December 31, Year 1. The annual payment on the loan equals $42.077, What is the amount of principal repayment included in the payment made on December 31, Year 1? Multiple Choice Ο Ο Ο Ο $13,440 $37.467 $40,725 $28,637arrow_forward

- On March 1, 2020 Giant Jumbo Clown Costumes borrowed money from Second Friendly National Bank by issuing a $125,000, 180-day, non-interest bearing note. The note was discounted on a 13.5% basis. Assume 360 days in a year. Required: Compute the following: 1. How much money did Giant Jumbo receive? 2. What was the total amount of interest paid? 3. What is the effective 180-day interest rate on this note payable? 4. What is the approximate annual effective interest rate on this note payable? 5. Record the journal entry(ies)for the issuance of the note.arrow_forward10, please read the question carefully and follow the instructions. thanksarrow_forwardGive me correct answerarrow_forward

- On December 31, 2020, Larkspur Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Larkspur Co. agreed to accept a $ 252,100 zero-interest-bearing note due December 31, 2022, as payment in full. Hayduke is somewhat of a credit risk and typically borrows funds at a rate of 10%. Larkspur is much more creditworthy and has various lines of credit at 6%.Click here to view factor table. https://education.wiley.com/content/Kieso_Intermediate_Accounting_17e/media/simulations/interest_rate_tables.pdfarrow_forwardRex Corporation accepted a $4,000, 6%, 120-day note dated August 8 from Regis Company in settlement of a past bill. On October 11, Rex discounted the note at Park Bank at 7%. (Use Days in a year table.) a. What is the note's maturity value? Note: Use 360 days a year. Do not round intermediate calculations. Round your final answer to the nearest cent. Maturity value b. What is the discount period? Discount period c. What is the bank discount? Note: Use 360 days a year. Do not round intermediate calculations. Round your final answer to the nearest cent. Bank discount days d. What proceeds does Rex receive? Note: Use 360 days a year. Do not round intermediate calculations. Round your final answer to the nearest cent. Proceeds receivedarrow_forwardOn January 26, Nova Co. borrowed cash from Conrad Bank by issuing a 90-day note with a face amount of \( \$ 44, 400 \). Assume a 360-day year. a. Determine the proceeds of the note, assuming the note carries an interest rate of \(8\% \). b. Determine the proceeds of the note, assuming the note is discounted at \(8\% \),arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education