FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

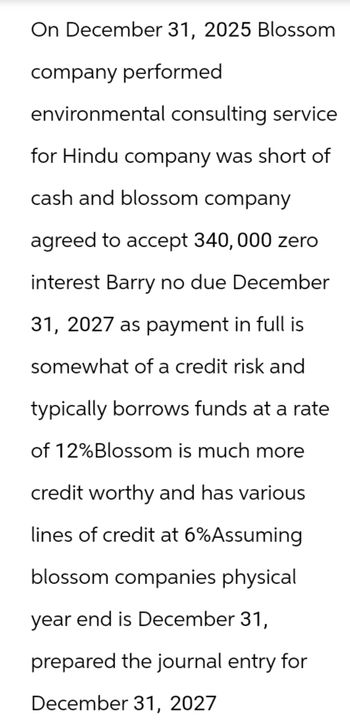

Transcribed Image Text:On December 31, 2025 Blossom

company performed

environmental consulting service

for Hindu company was short of

cash and blossom company

agreed to accept 340,000 zero

interest Barry no due December

31, 2027 as payment in full is

somewhat of a credit risk and

typically borrows funds at a rate

of 12% Blossom is much more

credit worthy and has various

lines of credit at 6%Assuming

blossom companies physical

year end is December 31,

prepared the journal entry for

December 31, 2027

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- On December 31, 2020, Monty Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Monty Co. agreed to accept a $296,600 zero-interest-bearing note due December 31, 2022, as payment in full. Hayduke is somewhat of a credit risk and typically borrows funds at a rate of 12%. Monty is much more creditworthy and has various lines of credit at 6%. Prepare the journal entry to record the transaction of December 31, 2020, for the Monty Co. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Date Account Titles and Explanation Dec. 31, 2020 eTextbook and Media List of Accounts Assuming Monty Co's fiscal year-end is December 31, prepare the journal entry for December 31, 2021. (Round…arrow_forwardNonearrow_forwardBeta made a 4%, $20,000, 2-year loan to Alpha on July 1. The interest will be received when the loan is repaid. What adjusting journal entry should be recorded on December 31 (end of year)? Group of answer choices Debit Interest Receivable 600 and credit Interest Revenue 600 Debit Interest Receivable 400 and credit Interest Revenue 400 The correct answer is not listed. Debit Interest Receivable 800 and credit Interest Revenue 800 Debit Interest Receivable 1, 600 and credit Interest Revenue 1, 600arrow_forward

- tell me why the answer is cash and notes payable (last solution on multiple choice) as opposed to the other onesarrow_forwardPlease answer practice problemarrow_forwardRequirement 4. Record the payment of the note payable (principal and interest) on its maturity date. (Record debits first, then credits. Exclude explanations from journal entries.) ss attached thanks 4y1 4arrow_forward

- HANDOUT PROBLEM for CURRENT LIABILITIES I. Prepare journal entries for the following transactions which took place in 2021. Sold various products for $180,000 on account. The products cost $85,000. Sales a. tax in your area is 8%. Your company uses a periodic inventory system. Your sales in part "a" included an offer for cash rebates of 2% of the $180,000 total sales price if the customer answers a short five-question internet survey. b. с. On November 1, 2021, your company collected $12,000 of rent on your extra office. The rent covers the six-month period from November 1, 2021 through April 30, 2022. Recorded $62,000 of wages earned by employees including $9,000 of d. withholding taxes, $4,000 of FICA taxes, and $2,800 of health insurance benefits. There were no other deductions from the employees' paychecks. e. Recorded EMPLOYER taxes on the wages in "a." Unemployment is a total of 3% of the gross earnings. f. On December 1, 2021, your company received notice that you were being…arrow_forwardKelly Jones and Tami Crawford borrowed $10,500 on a 7-month, 8% note from Gem State Bank to open their business, Oriole’s Coffee House. The money was borrowed on June 1, 2022, and the note matures January 1, 2023. Prepare the entry to accrue the interest on June 3 Date Account Titles and Explanation Debit Credit June 30arrow_forwardPlease don't give solution in an image format thanksarrow_forward

- NEED HELP WITH II. III. IV.arrow_forwardK McKean Company has a three-month, $16,000, 6% note receivable from L. Stow that was signed on June 1, 2016. Stow defaults on the loan on September 1. Journalize the entry for McKean to record the default of the loan. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table.) Date 2016 Sept. 1 Accounts Debit Credit HOarrow_forwardPlease provide correct solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education