FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

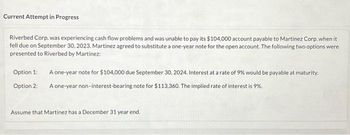

Transcribed Image Text:Current Attempt in Progress

Riverbed Corp. was experiencing cash flow problems and was unable to pay its $104,000 account payable to Martinez Corp. when it

fell due on September 30, 2023. Martinez agreed to substitute a one-year note for the open account. The following two options were

presented to Riverbed by Martinez:

Option 1:

A one-year note for $104,000 due September 30, 2024. Interest at a rate of 9% would be payable at maturity.

Option 2: A one-year non-interest-bearing note for $113,360. The implied rate of interest is 9%.

Assume that Martinez has a December 31 year end.

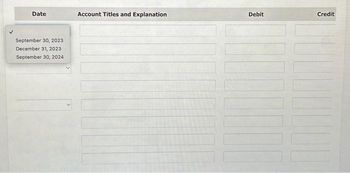

Transcribed Image Text:Date

September 30, 2023

December 31, 2023

September 30, 2024

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CPA Bank Co. loaned P6,750,000 to a borrower on January 1, 2018. The terms of the loan were payment in full on January 1, 2023 plus annual interest payment at 12%. The interest payment was made as scheduled on January 1, 2019. However, due to financial setbacks, the borrower was unable to make the 2020 interest payment. The bank considered the loan impaired and projected the cash flows from the loan on December 31, 2020. The bank has accrued the interest on December 31, 2019, but did not continue to accrue interest for 2020 due to the impairment of the loan. The projected cash flows are: December 31, 2021, P1,125,000; December 31, 2022, P1,500,000; December 31, 2023, P1,875,000 and December 31, 2024, P2,250,000. The present value of 1 at 12% is 0.89 for one period, 0.80 for two periods, 0.71 for three periods and 0.64 for four periods. What is the carrying amount loan receivable as of December 31, 2021?arrow_forwardOn December 31, 2020, Larkspur Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Larkspur Co. agreed to accept a $ 252,100 zero-interest-bearing note due December 31, 2022, as payment in full. Hayduke is somewhat of a credit risk and typically borrows funds at a rate of 10%. Larkspur is much more creditworthy and has various lines of credit at 6%.Click here to view factor table. https://education.wiley.com/content/Kieso_Intermediate_Accounting_17e/media/simulations/interest_rate_tables.pdfarrow_forwardBlue Cells Can contain On December 31, 2017, Short Co. is in financial difficulty and cannot pay a note due that day. It is a $2,000,000 face value note with $200,000 accrued interest payable to Bryan, Inc. The original market rate of interest on the note was 12.58613%. Bryan agrees to forgive the accrued interest, extend the maturity date (two years) to December 31, 2019, and reduce the interest rate to 4%. The present value of the restructured cash flows is $1,712,000 (using the original market rate). Do NOT add rows to the spreadsheet! Discount Cash Premium Interest payable Par Interest expense Discount on bond payable Yes Bonds payable No Loss on redemption Gain on redemptin Cash Interest payable Interest receivable Notes payable Gain on restructuring Loss on restructuring Discount on Note payable Premium on Note payable…arrow_forward

- At January 1, 2018, Brainard Industries, Inc., owed Second BancCorp $12 million under a 10% note due December 31, 2020. Interest was paid last on December 31, 2016. Brainard was experiencing severe financial difficultiesand asked Second BancCorp to modify the terms of the debt agreement. After negotiation Second BancCorpagreed to:a. Forgive the interest accrued for the year just ended.b. Reduce the remaining two years’ interest payments to $1 million each and delay the first payment untilDecember 31, 2019.c. Reduce the unpaid principal amount to $11 million.Required:Prepare the journal entries by Brainard Industries, Inc., necessitated by the restructuring of the debt at (1) January1, 2018; (2) December 31, 2019; and (3) December 31, 2020.arrow_forwardAt January 1, 2024, Mahmoud Industries, Incorporated, owed Second BancCorp $12 million under a 10% note due December 31, 2026. Interest was paid last on December 31, 2022. Mahmoud was experiencing severe financial difficulties and asked Second BancCorp to modify the terms of the debt agreement. After negotiation Second BancCorp agreed to: Forgive the interest accrued for the year just ended. Reduce the remaining two years’ interest payments to $1 million each and delay the first payment until December 31, 2025. Reduce the unpaid principal amount to $11 million. Required: Prepare the journal entries by Mahmoud Industries, Incorporated, necessitated by the restructuring of the debt at (1) January 1, 2024; (2) December 31, 2025; and (3) December 31, 2026.arrow_forwardOn December 31, 2020, Stellar Company signed a $ 1,022,000 note to Pearl Bank. The market interest rate at that time was 11%. The stated interest rate on the note was 9%, payable annually. The note matures in 5 years. Unfortunately, because of lower sales, Stellar’s financial situation worsened. On December 31, 2022, Pearl Bank determined that it was probable that the company would pay back only $ 613,200 of the principal at maturity. However, it was considered likely that interest would continue to be paid, based on the $ 1,022,000 loan.arrow_forward

- On December 31, 2020, Sarasota Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Sarasota Co. agreed to accept a $337,600 zero-interest-bearing note due December 31, 2022, as payment in full. Hayduke is somewhat of a credit risk and typically borrows funds at a rate of 11%. Sarasota is much more creditworthy and has various lines of credit at 5%. Click here to view factor table. (a) Your answer is partially correct. Prepare the journal entry to record the transaction of December 31, 2020, for the Sarasota Co. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Dec. 31, 2020 Account Titles and Explanation Notes Receivable Service Revenue Discount on Notes Receivable Debit…arrow_forwardMax Corp. sold goods for $36,000 on July 17, 2020, and accepted a 12%, 90-day note. On August 1, the note was sold to a bank at a 15% discount rate. Required: a. Compute the proceeds. Assume a 360-day year. b. If the maker dishonored the note at maturity, prepare the entry for Max Corp. assuming $75 of bank protest fees. If an amount box does not require an entry, leave it blank.arrow_forwardOn December 31, 2020, JKL Bank granted a P5,000,000 loan to a borrower with 10% stated rate payable annually and maturing in 5 years. The loan was discounted at the market interest rate of 12%. Unfortunately, the financial condition of the borrower worsened because of lower revenue. On December 31 ,2022, the bank determined that the borrower would pay back only P3,000,000 of the principal at maturity. However, it was considered likely that interest would continue to be paid on the P5,000,000 loan. The present value of 1 at 12% is 0.57 for five periods and 0.71 for three periods. In addition, the present value of an ordinary annuity of 1 at 12% is 3.60 for five periods and 2.40 for three periods. Compute for the impairment loss on loan receivable to be recognized in 2022?arrow_forward

- On January 1, 2020, Ann Price loaned $157773 to Joe Kiger. A zero-interest-bearing note (face amount, $210000) was exchanged solely for cash; no other rights or privileges were exchanged. The note is to be repaid on December 31, 2022. The prevailing rate of interest for a loan of this type is 10%. The present value of $210000 at 10% for three years is $157773. What amount of interest income should Ms. Price recognize in 2020? $44350. $63000. $15777. $21000.arrow_forwardPresent solution in good accounting form.arrow_forwardPlease do not give solution in image format ? And Fast answering please and explain proper steps by Step.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education