FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

2. Record the entry on the date of record.

3.Record the payment of cash dividends.

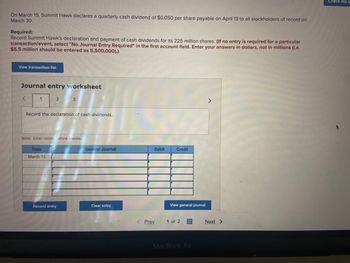

Transcribed Image Text:On March 15, Summit Hawk declares a quarterly cash dividend of $0.050 per share payable on April 13 to all stockholders of record on

March 30.

Required:

Record Summit Hawk's declaration and payment of cash dividends for its 225 million shares. (If no entry is required for a particular

transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e.

$5.5 million should be entered as 5,500,000).)

View transaction list

Journal entry worksheet

1

2

Record the declaration of cash dividends.

Date

March 15

3

Note: Enter debits before credits.

Record entry

General Journal

Clear entry

Debit

< Prev

Credit

View general journal

1 of 2 44

III

MacBook Air

>

Next >

Check my

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 6. Which of the following is a record of all the account balances at the year end, and is used to prepare the final accounts? O aAral batanoe O b) A statement of financial position O c)A statement of cash flows O dj income statementarrow_forwardRosie Dry Cleaning was started on January 1, Year 1. It experienced the following events during its first two years of operation: Events Affecting Year 1 1. Provided $45,000 of cleaning services on account. 2. Collected $39,000 cash from accounts receivable. 3. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Events Affecting Year 2 1. Wrote off a $300 account receivable that was determined to be uncollectible. 2. Provided $62,000 of cleaning services on account. 3. Collected $61,000 cash from accounts receivable. 4. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account.arrow_forwardtopic: double-entry accounting indicate how to increase each of the accounts below (credit or debit) cash- accounts payable- supplies- accounts receivable-arrow_forward

- Discuss the difference in Accrual and Cash Basis for accounting.arrow_forwardThe primary purpose of the balance sheet is to: O measure the net income of a busniess up to a particular point in time. O report the difference between cash inflows and cash outflows for the period. O report the financial position of athe reporting entity at a particular point in time. O report revenues and expenses for a period of time. DEREN 11arrow_forwardAssuming the current ratio equals 2, which of the following would cause the current ratio to increase? O Accrual for payroll. Declaration of cash dividend. O Payment for inventory purchased on account. O Inventory purchased on account.arrow_forward

- Under the accrual basis of accounting - if cash has been received before the revenue has been earned, which of the following journal entries should be recorded? A) Debit Cash, Credit Unearned Revenue. B) Debit Cash, Credit Sales Revenue. C) Debit Unearned Revenue, Credit Cash. D) Debit Cash, Credit Accounts Receivable.arrow_forwardWhat is the current year's accounts payable balance?arrow_forwardWhich of the following entries records receiving the cash payment from a customer for previous services performed on account. (AP = Accounts Payable, AR = Accounts Receivable)arrow_forward

- 1. Match the following terms and definitions. a. Accounts receivable c. Accounts payable (1) Amounts due from customers (2) Amounts owed to suppliers for goods and services purchased (3) Amounts owed to bank Note payablearrow_forwardWhich of the following statements is characteristic of accrual basis accounting? Expenses are recorded when payment is made. Revenue is recognized when payment is received. Transactions are recorded when they occur. The exchange of cash determines timing of revenue recognition.arrow_forwardHarrigan Service Company, Inc., was incorporated by lan Harrigan and five other managers. The following activities occurred during the year: 1. Received $71,400 cash from the managers; each was issued 1,190 shares. 2. Purchased equipment for use in the business at a cost of $50,000; one-fourth was paid in cash and the company signed a note for the balance (due in six months). 3. Signed an agreement with a cleaning service to pay it $690 per week for cleaning the corporate offices, beginning next week. 4. Ian Harrigan borrowed $19,500 for personal use from a local bank, signing a one-year note.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education