FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

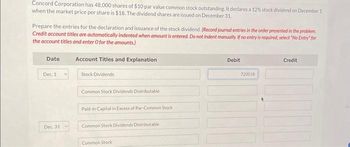

Transcribed Image Text:Concord Corporation has 48,000 shares of $10 par value common stock outstanding. It declares a 12% stock dividend on December 1

when the market price per share is $18. The dividend shares are issued on December 31.

Prepare the entries for the declaration and issuance of the stock dividend. (Record journal entries in the order presented in the problem.

Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for

the account titles and enter O for the amounts.)

Date

Dec. 1

Dec. 31

Account Titles and Explanation

Stock Dividends

Common Stock Dividends Distributable

Paid-in Capital in Excess of Par-Common Stock

Common Stock Dividends Distributable

Common Stock

Debit

720018

Credit

000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- On March 15, American eagle declares a quarterly cash dividend of $0.035 per-share payable on April 13 to all stockholders of record on March 30. Record American Eagle‘s declaration and payment of cash dividends for its 228 million shares. (If no entry is required for a transaction/event, select “ no journal entry required” in the first account field enter your answer in dollars not in millions)arrow_forwardClothing Frontiers began operations on January 1 and engages in the following transactions during the year related to stockholders' equity. January 1 Issues 700 shares of common stock for $34 per share. April 1 Issues 110 additional shares of common stock for $38 per share. 2. Record the transactions, assuming Clothing Frontiers has either $1 par value or $1 stated value common stock. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 Record the issuance of 700 shares of common stock for $34 per share. Note: Enter debits before credits. Date General Journal Debit Credit January 01arrow_forwardOn January 1, 2022, the stockholders' equity section of Bramble Corporation shows common stock ($6 par value) $1,800,000; paid-in capital in excess of par $1,050,000; and retained earnings $1,230,000. During the year, the following treasury stock transactions occurred. Mar. 1 Purchased 51,000 shares for cash at $15 per share. 1 Sold 12,000 treasury shares for cash at $17 per share. Sold 10,000 treasury shares for cash at $14 per share. July Sept. 1arrow_forward

- On August 1, Pharoah Company buys 1,000 shares of BCN common stock for $32,000 cash. On December 1, the stock investments are sold for $33,900 in cash. Journalize the purchase and sale of the common stock. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Creditarrow_forwardTamarisk, Inc. issues 9,400 shares of $106 par value preferred stock for cash at $110 per share. Journalize the issuance of the preferred stock. (Credit account titles are automatically Indented when amount Is entered. Do not Indent manually. If no entry Is requlred, select "No Entry" for the account titles and enter o for the amounts.)arrow_forwardgarrow_forward

- Haresharrow_forwardFlounder Limited issued 1,930 common shares for $61,760. (a) Prepare Flounder's journal entry if the shares have no par value. (List debit entry before credit entry. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardPlease answer question correctlyarrow_forward

- On May 1, Carla Vista Corporation purchased 2,400 shares of its $10 par value common stock at a cash price of $12/share. On July 15, 850 shares of the treasury stock were sold for cash at $18/share. Journalize the two transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) No. Account Titles and Explanation Debit Creditarrow_forwardSubject:- accountingarrow_forwardOn June 1, Metlock, Inc. issues 1,300 shares of no-par common stock at a cash price of $8 per share. Journalize the issuance of the shares. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit June 1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education