FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

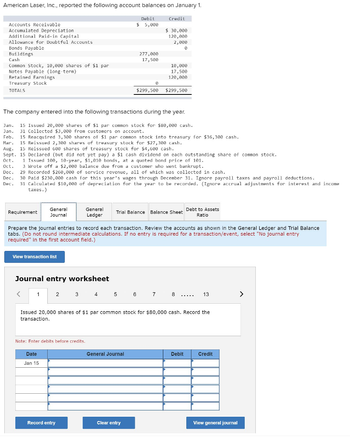

Transcribed Image Text:American Laser, Inc., reported the following account balances on January 1.

Accounts Receivable

Accumulated Depreciation.

Additional Paid-in Capital

Allowance for Doubtful Accounts

Bonds Payable

Buildings.

Cash

Common Stock, 10,000 shares of $1 part

Notes Payable (long-term)

Retained Earnings

Treasury Stock

TOTALS

Requirement

View transaction list

General

Journal

<

Journal entry worksheet

1

The company entered into the following transactions during the year.

Jan.

15 Issued 20,000 shares of $1 par common stock for $80,000 cash.

Jan.

31 Collected $3,000 from customers on account.

15 Reacquired 3,300 shares of $1 par common stock into treasury for $36,300 cash.

Feb.

Mar. 15 Reissued 2,300 shares of treasury stock for $27,300 cash..

Aug. 15 Reissued 600 shares of treasury stock for $4,600 cash.

Sept. 15 Declared (but did not yet pay) a $1 cash dividend on each outstanding share of common stock.

Oct.

1 Issued 100, 10-year, $1,010 bonds, at a quoted bond price of 101.

Oct.

3 Wrote off a $2,000 balance due from a customer who went bankrupt.

Dec.

29 Recorded $260,000 of service revenue, all of which was collected in cash.

Dec.

Dec.

30 Paid $230,000 cash for this year's wages through December 31. Ignore payroll taxes and payroll deductions.

31 Calculated $10,000 of depreciation for the year to be recorded. (Ignore accrual adjustments for interest and income

taxes.)

General

Ledger

2

Date

Jan 15

Prepare the journal entries to record each transaction. Review the accounts as shown in the General Ledger and Trial Balance

tabs. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry

required" in the first account field.)

Note: Enter debits before credits.

Record entry

Debit

$ 5,000

277,000

17,500

0

Credit

General Journal

$ 30,000

120,000

2,000

0

Clear entry

10,000

17,500

120,000

$299,500 $299,500

Trial Balance Balance Sheet Debt to Assets

Ratio

3 4 5 6 7 8

Issued 20,000 shares of $1 par common stock for $80,000 cash. Record the

transaction.

.....

13

Debit

Credit

View general journal

>

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Prepare the journal entry to record Zende Company's issuance of 65,000 shares of $4 par value common stock assuming the shares sell for: a. $4 cash per share. b. $5 cash per share. View transaction list Journal entry worksheet Record the issuance of 65,000 shares of $4 par value common stock assuming the shares sell for $4 cash per share. 2 Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardCullumber Company had these transactions during the current period. June 12 Issued 80,500 shares of $1 par value common stock for cash of $301,875. July 11 Issued 3,200 shares of $100 par value preferred stock for cash at $106 per share. Nov. 28 Purchased 2,950 shares of treasury stock for $10,000. Prepare the journal entries for the Cullumber Company transactions shown above. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Creditarrow_forwardAt the end of the reporting period, Michael Scott Company reports the following selected accounts and balances: Cash, $50,000 · Accounts Receivable, $42,000 Inventory, $28,000 Allowance for Doubtful Accounts, $12,000 Equipment (net of A/D), $100,000 Accounts Payable, $20,000 • Common Stock, $55,000 Premium on Bonds Payable, $16,000 Using the above information, answer the following questions: A) What is the company's current ratio? (Select] B) What is the company's quick (acid-test) ratio [Select)arrow_forward

- First National Bank buys and sells securities. The company's fiscal year ends on December 31. The following selected transactions relating to First National's trading account occurred during the year. December 20 Purchases 180,000 shares in Classic Computers common stock for $684,000 ($3.80 per share). December 28 Receives cash dividends of $4,800 from the Classic Computers shares. Required: How will each of these transactions affect the financial statements? bok nt Complete this question by entering your answers in the tabs below. December 20 December 28 Purchases 180,000 shares in Classic Computers common stock for $684,000 ($3.80 per share). How will this transaction affect the financial statements? Note: Amounts to be deducted should be indicated by a minus sign. Assets Balance Sheet Liabilities Stockholders' Equity Revenues & Common Stock Retained Earnings >arrow_forwardI need D answerd please.arrow_forwardComplete the necessary journal entry for June 30 by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. View transaction list Journal entry worksheet 1 On December 31 Spearmint, Inc., issued $450,000 of 9 percent, 3-year bonds for cash of $461,795. After recording the related entry, Bonds Payable had a balance of $450,000 and Premium on Bonds Payable had a balance of $11,795. Spearmint uses the straight-line bond amortization method. The first Note: Enter debits before credits. General Journal Debit Credit Date June 30 Clear entry View general journal Record entryarrow_forward

- Entries for selected corporate transactions Instructions Chart of Accounts Journal Instructions Selected transactions completed by ATV Discount Corporation during the current fiscal year are as follows: Jan. 5. Split the common stock 3 for 1 and reduced the par from $75 to $25 per share. After the split, there were 1,275,000 common shares outstanding. Mar. 10. Purchased 41,300 shares of the corporation’s own common stock at $29, recording the stock at cost. Apr. 30. Declared semiannual dividends of $0.75 on 70,400 shares of preferred stock and $0.11 on the common stock to stockholders of record on May 15, payable on June 15. June 15. Paid the cash dividends. Aug. 20. Sold 31,900 shares of treasury stock at $33, receiving cash. Oct. 15 Declared semiannual dividends of $0.75 on the preferred stock and $0.11 on the common stock (before the stock dividend). In addition, a 2% common stock dividend was declared on the common stock…arrow_forwardOn the first day of the fiscal year, a company issues a $950,000, 10%, 5-year bond that pays semiannual interest of $47,500 ($950,000 × 10% × 1/2), receiving cash of $884,174. Required: Journalize the entry to record the issuance of the bonds. Refer to the Chart of Accounts for exact wording of account titles. Chart Of Accounts CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 113 Allowance for Doubtful Accounts 114 Notes Receivable 115 Interest Receivable 121 Merchandise Inventory 122 Supplies 131 Prepaid Insurance 140 Land 151 Building 152 Accumulated Depreciation-Building 153 Equipment 154 Accumulated Depreciation-Equipment LIABILITIES 210 Accounts Payable 221 Salaries Payable 231 Sales Tax Payable 241 Notes Payable 242 Interest Payable 251 Bonds Payable 252 Discount on Bonds Payable 253 Premium on Bonds Payable EQUITY…arrow_forwardRatio of Liabilities to Stockholders' Equity and Times Interest Earned The following data were taken from the financial statements of Hunter Inc. for December 31 of two recent years: CurrentYear PreviousYear Accounts payable $698,000 $212,000 Current maturities of serial bonds payable 460,000 460,000 Serial bonds payable, 10% 1,920,000 2,380,000 Common stock, $1 par value 100,000 130,000 Paid-in capital in excess of par 1,130,000 1,130,000 Retained earnings 3,900,000 3,100,000 The income before income tax expense was $714,000 and $624,800 for the current and previous years, respectively. a. Determine the ratio of liabilities to stockholders' equity at the end of each year. Round to one decimal place. Current year fill in the blank 1 Previous year fill in the blank 2 b. Determine the times interest earned ratio for both years. Round to one decimal place. Current year fill in the blank 3 Previous year fill in the blank 4arrow_forward

- On January 1, 2022, the stockholders' equity section of Bridgeport Corporation shows common stock ($4 par value) $1,200,000; paid- in capital in excess of par $1,000,000; and retained earnings $1,240,000. During the year, the following treasury stock transactions occurred. Mar. 1 Purchased 50,000 shares for cash at $15 per share. July 1 Sold 11,000 treasury shares for cash at $17 per share. Sept. 1 Sold 9,500 treasury shares for cash at $14 per share.arrow_forwardRatio the liabilities to stockholders equity and times interest earned. following data were taken from the financial statement of Hunter Inc.for December 31st of two recent years: Current year accounts payable $434,000. Current maturity. 290,000 Serial bonds payable, 10% 1,190,000 Common stock,$1 par value 70,000 Paid- in capital in excess of par 700,000 Retained earnings 2,420,000 Previous year $127,000 290,000 1,480,000 90,000 700,000 1,920,000 The income before income tax expense was $518,000 and $453,000 for the camera in previous years respectively. A. Determine the ratio of liabilities to stockholders Equity at the end of each year. Round to one decimal place. Current year Previous year B. Determine the times interest earned ratio for both years. Round to one decimal place. Current year Previous year C. The ratio of liabilities to stockholders Equity has _______and the number of times bond interest charges were earned has_______ from…arrow_forwardOn May 10, Pronghorn Corporation issues 2,700 shares of $10 par value common stock for cash at $18 per share. Journalize the issuance of the stock. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation May 10 Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education