Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Accounting question

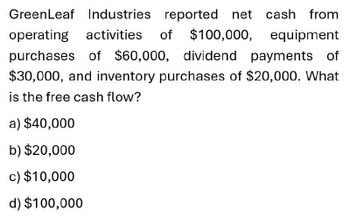

Transcribed Image Text:GreenLeaf Industries reported net cash from

operating activities of $100,000, equipment

purchases of $60,000, dividend payments of

$30,000, and inventory purchases of $20,000. What

is the free cash flow?

a) $40,000

b) $20,000

c) $10,000

d) $100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kela Corporation reports net income of $510,000 that includes depreciation expense of $85,000. Also, cash of $46,000 was borrowed on a 3-year note payable. Based on this data, total cash inflows from operating activities are: Multiple Choice O $641,000. $595,000. O $556,000 $425,000arrow_forwardCalculate the Free Cash Flow for Polaris. Item EBITDA Depreciation Tax Rate, T Current Assets Current Liabilities CAPEX Polaris Inc. Selected Financial Information ($000's) Year 0 19,324 17,147 Year 1 10,000 1,188 31% 15,520 15,823 2,078arrow_forwardKela Corporation reports net income of $570,000 that includes depreciation expense of $78,000. Also, cash of $59,000 was borrowed on a 4-year note payable. Based on this data, total cash inflows from operating activities are: Multiple Choice $629,000. $648,000. $492,000. $707,000.arrow_forward

- The balance sheet of Computer World reports total assets of $350,000 and $450,000 at the beginning and end of the year, respectively. Sales revenues are $800,000, net income is $100,000, and net cash flows from operating activities are $150,000. What is Computer World's cash return on assets? Multiple Choice 37.5% 25.0% 33.3% 42.9%arrow_forwardcalculate cash flow from assets if given year 1: sales=9402, depreciation=1350, costs of good sold=3235, administrative expenses=767, interest expenses=630, cash=4931, accounts receivable=6527, short term notes payable=953, long term debt=16152, net fixed assets=41346, accounts payable=5179, inventory=11604, and dividends=1147 and given year 2: sales=10091, depreciation=1351, costs of good sold=3672, administrative expenses=641, interest expenses=724, cash=6244, accounts receivable=7352, short term notes payable=895, long term debt=19260, net fixed assets=42332, accounts payable=5022, inventory=11926, and dividends=1261 and tax rate is 34%arrow_forwarddo not copy from bartleby The net income for the year for Genesis, Inc. is $750,000,but the statement of cash flows reports that the net cashprovided by operating activities is $640,000. What mightaccount for the difference?arrow_forward

- > ABC Inc. is preparing its cash flow statement under the direct method and has provided this information: Net credit sales $5,000,000 Accounts receivable, end of the year 1,500,000 Accounts receivable, beginning of the year 2,500,000 Purchases (on account) 4,000,000 Trade payable, end of the year 1,900,000 Trade payable, beginning of the year 2,000,000 Operating expenses 3,000,000 Accrued expenses, beginning of the year 500,000 Accrued expenses, end of the year 400,000 Depreciation on property, plant, and equipment 600,000 > Required: Prepare the operating activities section of cash flow statement under the direct method.arrow_forwardKela Corporation reports net income of $530,000 that includes depreciation expense of $74,000. Also, cash of $55,000 was borrowed on a 4-year note payable. Based on this data, total cash inflows from operating activities are Mutiple Choice S604.000 O $585,000 O $669.000. $456,000. Ps >>> Type here to search Ps 39% A d) O 99+ ブォ PISO F10 F1 F12 Insert CE T D G H. K アV MI Alt Ctriarrow_forwardLee Company has provided the following information: • Cash flow from operating activities, $258,000 .Net Income, $186.000 • Interest expense, $38,000 Interest cash payments, $28,000 • Income tax payments, $158,000 Income tax expense, $154.000 Using the modified method discussed in the text, what was Lee's cash coverage ratio? . Multiple Choice O O 15.86 16.07 8.04 6.50arrow_forward

- 8. State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows:12. Sweeter Enterprises Inc. has cash flows from operating activities of $300,000. Cash flows used for investments in property, plant, and equipment totaled $63,000, of which 60% of this investment was used to replace existing capacity.arrow_forwardZoogle has the following selected data ($ in millions):Net sales $24,651Net income 6,620Operating cash flows 9,326Total assets, beginning 41,768Total assets, ending 50,497Required:1. Calculate the return on assets.2. Calculate the cash return on assets.3. Calculate the cash flow to sales ratio and the asset turnover ratio.arrow_forwardMazaya Company has the following information available: Net Income R.O. 55,000; Cash Provided by Operations R.O. 68,200; Cash Sales R.O. 143,000; Capital Expenditures R.O.24,200; Dividends Paid R.O. 6,600. What is Mazaya's free cash flow? Select one: a. R.O.61,600 b. R.O.37,400 c R.O.44,000 d. R.O.24,200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning