Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

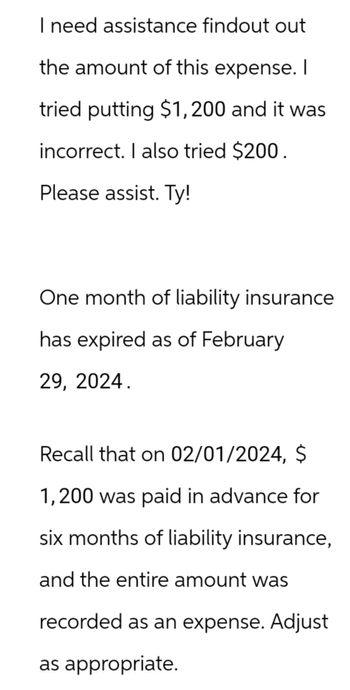

Transcribed Image Text:I need assistance findout out

the amount of this expense. I

tried putting $1,200 and it was

incorrect. I also tried $200.

Please assist. Ty!

One month of liability insurance

has expired as of February

29, 2024.

Recall that on 02/01/2024, $

1,200 was paid in advance for

six months of liability insurance,

and the entire amount was

recorded as an expense. Adjust

as appropriate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hawkies Inc. has an October 31 fiscal year. On August 1, 2020 Hawkies Inc. paid $ 72000 for insurance coverage from August 1, 2020 to July 31, 2021. Calculate prepaid insurance as at October 31, 2020. Round your answer to the nearest dollar. Your Answer:arrow_forwardUnder M. Sabio Company’s accounting system, all insurance premiums paid are debited to prepaid insurance. For interim financial reports, M Sabio makes monthly estimated charges to insurance expenses with credits to prepaid insurance. Additional information for the year ended December 31, 2019 are as follows: Prepaid Insurance at December 31, 2018 P120,500 Charges to insurance expense during 2019( including a year- End adjustment of P10,500) 437,500 Prepaid Insurance at December 31, 2019 110,000 What was the total amount of insurance premiums paid by M. Sabio during 2019? P448,000 P427,000 P327,500 P437,500arrow_forwardOn June 7,2019, Dilby Mechanical Corp completed $50,00 of servicing work for a client and billed them for that amount plus a GST of $2,500 and PST of $3,50; terms are N20. Required: a. Prepare the journal entry as it would appear in Dilby's accounting records. b. Assume the receivable established on June 7 was collected on June 27. Record the entry.arrow_forward

- Maple Tree Inc. purchased a 12-month insurance policy on March 1, 2019 for $900. At December 31, 2019, the adjusting journal entry to record expiration of this asset will include a: o Debit to Insurance Expense and a credit to Prepaid Insurance for $900 o Debit to Prepaid Insurance and a credit to Insurance Expense for $100 o Debit to Insurance Expense and a credit to Prepaid Insurance for $75 o None of the abovearrow_forwardOn July 1, 2022, Damlen Jurado Company pays $12.000 to its insurance company for a 2-year insurance pollicy. Prepare the necessary journal entries for Damlen Jurado on July 1 and December 31. (Credit account titles are automatically Indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles ond enter O for the amounts. Record Journal entriles in the order presented in the problem)arrow_forwardA company makes the payment of a one-year insurance premium of $4,584 on March 1, 2019. c. Calculate the amount of prepaid insurance that should be reported on the December 31, 2019, balance sheet with respect to this policy.arrow_forward

- Do a journal entry to account for insurance expense incurred in the month of December. Date the journal entry for December 31, 2019. If the insurance was paid on december 10 in the amount of $636 and runs through May 31st. How do I record this in Journal entry?arrow_forwardRequlred Information [The following information applies to the questions displayed below.] A company makes the payment of a one-year Insurance premlum of $4,248 on March 1, 2019. c. Calculate the amount of prepald Insurance that should be reported on the December 31, 2019, balance sheet with respect to this policy. Prepaid insurancearrow_forwardFollowing are transactions of Danica Company 13 Accepted a $9,500, 45-day, 81 note in granting Miranda Lee a extension on her past-due account receivable. Prepared an adjusting entry to record accrued interest the Lee note. Complete the table to calculate the Interest amounts at Dexember 31^ \st and use the calculated value to prepare your journal entries. (Do not round your intermediate calculations. Use 360 days a year.)arrow_forward

- F.22.arrow_forwardOn March 1, 2020, Jimenez purchased a one-year insurance policy for $2,400. On that date, Jimenez debited Prepaid Insurance for $2,400. If Jimenez prepares financial statements at the end of March, the adjusting journal entry would include a: credit to Insurance Expense for $2,200. credit to Prepaid Insurance for $200. None of these. debit to Insurance Expense for $2,400. debit to Insurance Expense for $2,200.arrow_forwardWhat if the invoice date is 12/27, but the invoice is about next year's sevices, should we record the acount payable at 12/31 for this invoice?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT