CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

fgd

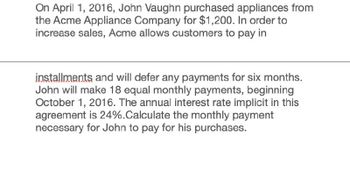

Transcribed Image Text:On April 1, 2016, John Vaughn purchased appliances from

the Acme Appliance Company for $1,200. In order to

increase sales, Acme allows customers to pay in

installments and will defer any payments for six months.

John will make 18 equal monthly payments, beginning

October 1, 2016. The annual interest rate implicit in this

agreement is 24%.Calculate the monthly payment

necessary for John to pay for his purchases.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Gear Up Co. pays 65% of its purchases in the month of purchase, 30% in the month after the purchase, and 5% in the second month following the purchase. What are the cash payments if it made the following purchases in 2018?arrow_forwardChemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms of the note show a maturity date of 36 months, and an annual interest rate of 8%. What is the accumulated interest entry if 9 months have passed since note establishment?arrow_forwardOn January 1, 2018, King Inc. borrowed $150,000 and signed a 5-year, note payable with a 10% interest rate. Each annual payment is in the amount of $39,569 and payment is due each Dec. 31. What is the journal entry on Jan. 1 to record the cash received and on Dec. 31 to record the annual payment? (You will need to prepare the first row in the amortization table to determine the amounts.)arrow_forward

- On April 1, 2024, Antonio purchased appliances from the Acme Appliance Company for $2,100. In order to increase sales, Acme allows customers to pay in installments and will defer any payments for six months. Antonio will make 18 equal monthly payments, beginning October 1, 2024. The annual interest rate implicit in this agreement is 24%. Required: Calculate the monthly payment necessary for Antonio to pay for his purchases. Note: Use tables, Excel, or a financial calculator. Do not round Intermediate calculations. Round your final answers to nearest whole dollar amount. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Monthly paymentarrow_forwardcorrect answer pleasearrow_forwardOn April 19, 2018, Millipede Machinery sold a tractor to Thomas Hartwood, accepting a note promising payment of $120,000 in five years. The applicable effective interest rate is 7%. What amount of sales revenue wouldMillipede recognize on April 19, 2018, for the Hartwood transaction?arrow_forward

- Parker Young recently received his monthly MasterCard bill for the period June 1-30, 2017, and wants to verify the monthly finance charge calculation, which is assessed at a rate of 19% per year and based on ADBs, including new purchases. His outstanding balance, purchases, and payments are as follows: Previous balance: $256 Purchases: Payments: June 4 $117 June 21 $35 June 12 $79 June 20 $92 June 26 $72 What is his ADB for the period? (Use a table like the one in Exhibit 6.8 for your calculations.) Do not round intermediate calculations. Round the answer to 2 decimal places. What is his the finance charge for the period? (Use a table like the one in Exhibit 6.8 for your calculations.) Do not round intermediate calculations. Round the answer to 2 decimal places.arrow_forwardset answerarrow_forwardOn January 1, 2006, Mr. Jones took out a loan amounting to $10,000. He then made annual repayments of $1,000 on the first day of 2007, 2008, and 2009. Additionally, on July 1, 2009, he made an extra payment of $5,000 and ceased any further repayments. Assuming the quarterly discount rate is 8%, calculate the remaining balance of Mr. Jones's loan as of January 1, 2015.arrow_forward

- Haatim opened an RRSP deposit account on December 1, 2008, with a deposit of $2500. He added $2500 on October 1, 2010, and $2500 on February 1, 2012. How much is in his account on January 1, 2016, if the deposit earns 7.8% p.a. compounded monthly?arrow_forwardplease help answerarrow_forwardBlake Miller recently received his monthly MasterCard bill for the period June 1-30, 2021, and wants to verify the monthly finance charge calculation, which is assessed at a rate of 23 percent per year and based on ADBs, including new purchases. His outstanding balance, purchases, and payments are as follows: Previous Balance: $303 Purchases: Payments: June 4 $111 June 21 $35 June 12 $45 June 20 $127 June 26 $43 What are his ADB and finance charges for the period? (Use a table like the one in Exhibit 6.7 for your calculations.) Round the answers to the nearest cent. ADB: $ Finance charges: $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College