FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:3-3, 8-4, 8-6)

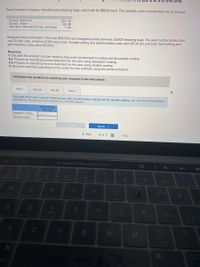

Great Outdoze Company manufactures sleeping bags, which sell for $66.10 each. The variable costs of production are as follows:

Direct material

Direct labor

Variable manufacturing overhead

$19.10

10.30

7.40

Budgeted fixed overhead in 20x1 was $157,500 and budgeted production was 25,000 sleeping bags. The year's actual production

was 25,000 units, of which 21,300 were sold. Variable selling and administrative costs were $1.30 per unit sold; fixed selling and

administrative costs were $22,000.

Required:

1. Calculate the product cost per sleeping bag under (a) absorption costing and (b) variable costing.

2-a. Prepare an operating income statement for the year using absorption costing.

2-b. Prepare an operating income statement for the year using variable costing.

3. Reconcile reported operating income under the two methods using the shortcut method.

Complete this question by entering your answers in the tabs below.

Req 1

Req 2A

Req 2B

Reg 3

Calculate the product cost per sleeping bag under (a) absorption costing and (b) variable costing. (Do not round intermediate

calculations. Round your final answers to 2 decimal places.)

Product Cost

Per Unit

Absorption costing

Variable costing

Reg 1

Req :

>

< Prev

3 of 3

Next>

Q Search or enter website name

2:

4

6.

7

U

OP

D

G

H.

CI

S'

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Godoarrow_forwardFremont Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $40 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of 25% of direct labor cost. The unit costs to produce comparable carrying cases are expected to be as follows:Cost Driver Dollar Amount per UnitDirect materials $15Direct labor 20Factory overhead (25% of direct labor) 5Total cost per unit 40If Fremont Computer Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 5% of the direct labor costs. a. Prepare a differential analysis dated September 30 to determine whether the company should make (Alternative 1) or buy (Alternative 2) the carrying case. b. Based on the data presented, would it be advisable to make the carrying cases or to continue buying them? Explain in your own words.arrow_forwardPreble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 4 pounds at $10.00 per pound Direct labor: 2 hours at $16 per hour Variable overhead: 2 hours at $6 per hour 12.00 Total standard variable cost per unit The company also established the following cost formulas for its selling expenses: Fixed Cost Variable Cost per Month per Unit Sold. Advertising Sales salaries and commissions Shipping expenses $ 19.00 The planning budget for March was based on producing and selling 30,000 units. However, during March the company actually produced and sold 34,500 units and incurred the following costs: a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production. b. Direct-laborers worked 62,000 hours at a rate of $17.00 per hour. c. Total variable manufacturing overhead for the month was $390,600. d.…arrow_forward

- Skolnick Corporation has provided the following information: Cost per Unit Direct materials $ 5.20 Direct labor $ 4.70 Variable manufacturing overhead $ 1.80 Cost per Period Fixed manufacturing overhead $ 126,000 Sales commissions $ 1.40 Variable administrative expense $ 0.60 Cost per Period Fixed selling and administrative expense $39,600 Selling price $20.6 per unit. The value of break-even point sales is:arrow_forwardNorthern Sparks. sells sparkplug for $48 each. The direct materials cost per unit is $15 and the direct labor is 0.50 hours at a rate of $28 per hour. Fixed manufacturing overhead is budgeted at $72,500 per period. Calculate the break even point in units. (Remember: You cannot sell partial units).arrow_forwardMake-or-Buy Decision Companion Technologies Company has been purchasing carrying cases for its portable tablets at a delivered cost of $57 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of 42% of direct labor cost. The fully absorbed unit costs to produce comparable carrying cases are expected to be as follows: Direct materials Direct labor $24.00 21.00 Factory overhead (42% of direct labor). Total cost per unit 8.82 $53.82 < If Companion Technologies Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 12% of the direct labor costs. a. Prepare a differential analysis report for the make-or-buy decision. Enter your final answer as a positive amount if it represents a net cost savings; enter a negative amount if it represents an increase in cost. COMPANION TECHNOLOGIES COMPANY Manufacture Carrying…arrow_forward

- Palladium Inc. produces a variety of household cleaning products. Palladium's controller has developed standard costs for the following four overhead items: Overhead Item Total Fixed Cost Variable Rate per Direct Labor Hour Maintenance Power Indirect labor Rent $86,000 140,000 $0.20 0.45 2.10 35,000 Next year, Palladium expects production to require 88,000 direct labor hours Exercise 9-63 Flexible Budget for Various Levels of Activity Refer to the information for Palladium Inc. above. Required: 1. Prepare an overhead budget for the expected level of direct labor hours for the coming year. 2. Prepare an overhead budget that reflects production that is 15% higher than expected and for production that is 15% lower than expected.arrow_forwardCompanion Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $58 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of 44% of direct labor cost. The total unit costs to produce comparable carrying cases are expected to be as follows: Direct materials $28.00 Direct labor 17.00 Factory overhead (44% of direct labor) 7.48 Total cost per unit $52.48 If Companion Computer Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 15% of the direct labor costs. a. Prepare a differential analysis dated February 24 to determine whether the company should Make Carrying Case (Alternative 1) or Buy Carrying Case (Alternative 2). If required, round your answers to two decimal places. If an amount is zero, enter "0". For those boxes in which you…arrow_forwardKubin Company's relevant range of production is 15,000 to 19,000 units. When it produces and sells 17,000 units, its average costs per unit are as follows: Amount per Unit $ 7.60 $ 4.60 $ 2.10 $ 5.60 $ 4.10 $ 3.10 $ 1.60 $ 1.10 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Required: 1. If 15,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 19,000 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 15,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 4. If 19,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 15,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 19,000 units are produced,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education