FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

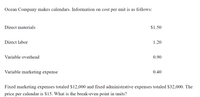

Transcribed Image Text:Ocean Company makes calendars. Information on cost per unit is as follows:

Direct materials

$1.50

Direct labor

1.20

Variable overhead

0.90

Variable marketing expense

0.40

Fixed marketing expenses totaled $12,000 and fixed administrative expenses totaled $32,000. The

price per calendar is $15. What is the break-even point in units?

Expert Solution

arrow_forward

Step 1

Break Even Point refers to the point in which total costs and total revenues are equal. When your company is at break even point which shows, your business does not have profit. But it also does not have a loss.

In simple terms, Break Even Point means No Profit No Loss.

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Variable Costing Norwood Company has the following information for September: Sales $720,000 Variable cost of goods sold 338,400 Fixed manufacturing costs 122,400 Variable selling and administrative expenses 64,800 Fixed selling and administrative expenses 50,400 Determine the following for Norwood Company for the month of September: a. Manufacturing margin $ b. Contribution margin $ c. Operating income $arrow_forwardGiven the following cost and activity observations for Smithson Company’s utilities, use the high-low method to calculate Smithson’s fixed costs per month. Do not round intermediate calculations. Cost Machine Hours January $52,200 20,000 February 75,000 29,000 March 57,000 22,000 April 64,000 24,500 a.$22,800 b.$50,600 c.$2,530 d.$1,533arrow_forwardProvide solution this questionarrow_forward

- Estimated Estimated Variable Cost Fixed Cost (per unit sold) Production costs: Direct materials $50.00 Direct labor 30.00 Factory overhead $350,000 6.00 Selling expenses: Sales salaries and commissions 340,000 4.00 Advertising 116,000 Travel 4,000 Miscellaneous selling expense 2,300 1.00 Administrative expenses: Office and officers' salaries 325,000 Supplies 6,000 4.00 Miscellaneous administrative expense 8,700 1.00 Total $1,152,000 $96.00 It is expected that 12,000 units will be sold at a price of $240 a unit. Maximum sales within the relevant range are 18,000 units. Required: 1. Prepare an estimated income statement for 20Y7. 5:03 99+ 100% 11/29, PrtSc Insert Delete FZ F11 F12 Backspace Num Lock 6. Y Homearrow_forwardSales volume (units) Revenue Variable costs Direct materials Direct labor Contribution margin Fixed costs Profit $30,000 $2.00 $45,000 Use direct labor dollars as the cost driver. Compute allocated fixed costs for Product X: O $20,000 Product X 400 $60,000 $50,000 $25,000 $15,000 $20,000 Product Y 600 $60,000 $15,000 $10,000 $35,000 Total 1,000 $120,000 $40,000 $25,000 $55,000 $50,000 $5,000arrow_forwardSchwiesow Corporation has provided the following information: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Multiple Choice O $14,750 Variable administrative expense Fixed selling and administrative expense If 4,500 units are produced, the total amount of manufacturing overhead cost is closest to:arrow_forward

- For each variable cost per unit listed below, determine the total variable cost when units produced and sold are 25, 50, and 100 units. Direct materials $ 40 Direct labor 80 Variable overhead 9 Sales commission 12arrow_forwardIdentify the semi-variable costs: 10,000 units 18,000 units Materials $15,000 $27,000Labour $13,000 $19,400Rent $11,500 $11,500Selling overheads $30,000 $46,000 Question 2 options: 1) materials and labour 2) labour and rent 3) rent and selling overheads 4) labour and selling overheadsarrow_forwardMenk Corporation has provided the following information: Cost per Unit Cost per Period Direct materials $ 6.80 Direct labor $ 3.80 Variable manufacturing overhead $ 2.00 Fixed manufacturing overhead $ 20,200 Sales commissions $ 0.50 Variable administrative expense $ 0.40 Fixed selling and administrative expense $ 10,100 Required: a. If 5,220 units are sold, what is the variable cost per unit sold? Note: Round "Per unit" answer to 2 decimal places. b. If 5,220 units are sold, what is the total amount of variable costs related to the units sold? c. If 5,220 units are produced, what is the total amount of manufacturing overhead cost incurred? a. Variable cost per unit sold b. Total variable costs c. Total manufacturing overhead costarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education