SWFT Corp Partner Estates Trusts

42nd Edition

ISBN: 9780357161548

Author: Raabe

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Please provide this question solution general accounting

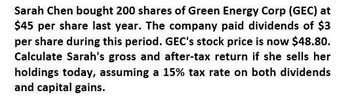

Transcribed Image Text:Sarah Chen bought 200 shares of Green Energy Corp (GEC) at

$45 per share last year. The company paid dividends of $3

per share during this period. GEC's stock price is now $48.80.

Calculate Sarah's gross and after-tax return if she sells her

holdings today, assuming a 15% tax rate on both dividends

and capital gains.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hayley recently invested $31,000 in a public utility stock paying a 6 percent annual dividend. (Hayley’s marginal income tax rate is 32 percent.) Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Required: If Hayley reinvests the annual dividend she receives net of any taxes owed on the dividend, how much will her investment be worth in five years if the dividends paid are qualified dividends? What will her investment be worth in five years if the dividends are nonqualified?arrow_forwardPlease provide correct answer with correct calculation of this accounting questionarrow_forwardThis morning Sophia sold 500 shares of Multiface Consulting for $75.60 per share. She purchased the stock for $70 one year ago. During the time she held the stock, Sophia received two dividend payments; one dividend payment was $1.00 per share and the other dividend payment was $1.10 per share. What yield (rate of return) did Sophia earn on her investment for the year she held the Multiface stock?arrow_forward

- One year ago, Regina purchased $1,050 worth of Elite Electrician’s common stock for $42 per share. During the year, Regina received two dividend payments, each equal to $0.05 per share. The current market value of the stock is $44 per share. What yield did Regina earn on her investment during the year?arrow_forwardGopher Corporation began the year with a large amount of accumulated earnings and profits and ended the year reporting taxable income of $100,000. Gopher wants to distribute its after-tax earnings to its sole shareholder, Sven Anderson. The dividend would meet the requirements to be a qualified dividend, and Sven is subject to a tax rate of 15 percent on dividend income. What is the amount of the dividend distribution and how much income does Sven realize after taxes? Answer is not complete. Corporate income Corporate tax Dividend distribution to Seven Shareholder tax Total after tax income $100,000 $105,000 x $ 15,000arrow_forwardNeed helparrow_forward

- Ahmad Bought A Share Ten Months Ago For $25 A Share, Got A $3.5 Dividend Per Share Last Month, And Sold The Stock Today For $21.5 Per Share. Ahmad Falls In A Marginal Tax Bracket Of 30%. The Tax Rate On Both Capital Gains For Shares Held More Than One Year And Dividend Income Is 15%. What Is Ahmad's After-Tax HPR? 13.2% 11.0% 0.00% 16.7%arrow_forwardBeth bought stock in Apple for $800. While she owned it, she received 20% of the purchase price in dividends. When she sold the stock, at the end of the year, she made a profit of $160. What percent of the cost was the total profit? Use % sign in your answer.arrow_forwardHelen holds 1,000 shares of Fizbo Incorporated stock that she purchased 11 months ago. The stock has done very well and has appreciated $20/share since Helen bought the stock. When sold, the stock will be taxed at capital gains rates (the long-term rate is 15 percent and the short-term rate is the taxpayer's marginal tax rate). Ignore the time value of money. a. If Helen's marginal tax rate is 35 percent, how much would she save by holding the stock an additional month before selling? Tax savings b. What might prevent Helen from waiting to sell? Helen bears if she holds the stock for an additional month. The stock price could substantially if there is market volatility or if the company encounters financial difficulties. In addition, Helen may be selling the stock for which she may be unwilling to wait.arrow_forward

- Roxi owns 500 shares of common stock in the Big Wheeler Corporation. She is pleased to learn that the company earned a very nice profit over the most recent operating period. The company has announced that it will pay each shareholder a dividend of $1 per share out of its after-tax profits. Because Big Wheeler has already paid corporate taxes on this profit, this dividend payout will represent tax-free income for Roxi and this is also called what O Yes taxes have already been paid and its called single payout O No, she still owes taxes and it's called double taxation O No, she still owes taxes and it's called Capital gains tax O Yes, it's tax free and called double exemptionarrow_forwardDev recently sold Protus Corp for $45 after holding back the stock for a year. He received dividends payments totally $1.20 over that year and earned 9.5%. How much did Dev pay for Protus?arrow_forwardJohn Dufresne purchased 100 shares of Louisiana Power and Light on January 3, 2004 at a total cost of $1,983. On December 29, 2005, he sold these shares and netted $2,689, after commissions. Mr. Dufresne has a marginal tax rate of 25% and an average tax rate of 17%. To the nearest dollar, what is the effect on Marty's tax bill from the sale of these shares? A. $0.00 OB. $177 OC. $106 D. $120arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you