FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Explain

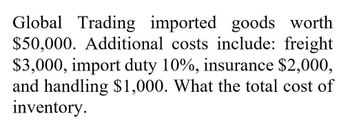

Transcribed Image Text:Global Trading imported goods worth

$50,000. Additional costs include: freight

$3,000, import duty 10%, insurance $2,000,

and handling $1,000. What the total cost of

inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- This year, Lambert Company will ship 1,500,000 pounds of goods to customers at a cost of $1,200,000. If a customer orders 10,000 pounds and produces $200,000 of revenue( total revenue is $20million), The amount of shipping cost assigned to the customer by using ABC would be a. Unable to be determined. b.$8,000($0.80per pound shipped) c.$24, 000(2% of the shipping cost) d. $12,000(1% of the shipping cost) e. None of thesearrow_forwardProvide Answer about this Question with Correct optionarrow_forwardNeed answer of this Question with explanationarrow_forward

- This year, Lambert Company will ship 1,500,000 pounds of goods to customers ata cost of $1,200,000. If a customer orders 10,000 pounds and produces $200,000 ofrevenue (total revenue is $20 million), the amount of shipping cost assigned to thecustomer by using ABC would bea. unable to be determined.b. $8,000 ($0.80 per pound shipped).c. $24,000 (2% of the shipping cost).d. $12,000 (1% of the shipping cost).e. None of these.arrow_forwardIf average revenue per unit is expected to be $25 and cost of goods sold are expected to be $17 per unit, how many units must be sold to breakeven on investment if the investment cost is $240,000? O 40,000 O 14,117 O 9,600 O 65,118arrow_forwardProvide answer of this Questionarrow_forward

- Shipping expense is $9,000 for 8,000 kilograms shipped and $11,250 for 11,000 kilograms shipped. Assuming that this activity is within the relevant range, if the company ships 9,500 kilograms, what is the expected shipping expense? Use the high-low method. Show your calculations. Without plagiarismarrow_forward1. Subject : - Financearrow_forwardIf the selling price per unit is $50, the variable expense per unit is $20, and total fixed expenses are $260,000, what are the breakeven sales in dollars? A. $433,333 B. $650,000 OC. $185,714 ⒸD. $156,000arrow_forward

- Lattimer Company had the following results of operations for the past year: Contribution margin (15,60 0 units ) income statement Per Unit Annual Total Sales $ 12.00 $ 187,200 Variable costs Direct materials 1.50 23,400 62,400 15,600 Direct labor 4.00 Overhead 1.00 Contribution margin Fixed costs 5.50 85,800 Fixed overhead 1.00 15,600 Fixed selling and administrative expenses 1.40 21,840 $ 3.10 $ 48,360 Income foreign company offers to buy 5,200 units at $7.50 per unit. In addition to variable costs, selling these units WNOU roduction capacity is 25,600 units. If Lattimer accepts this additional business, the special order will yield a: Multiple Choice $3,900 profit. $2,100 loss.arrow_forwardnkt.3 A company sells Yoohoo for $6 a can with unit sales of 10,000. If cost of goods is $40,000, what is total sales?arrow_forwardThe selling price of a product is $75.00 per unit, the variable expense is $55.00 per unit, and the breakeven sales in dollars is $300,000, what are total fixed expenses? $80,000 $4,000 $300,000 $20arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education