FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I need do fast typing clear urjent no chatgpt used i will give 5 upvotes pls full explain with diagram

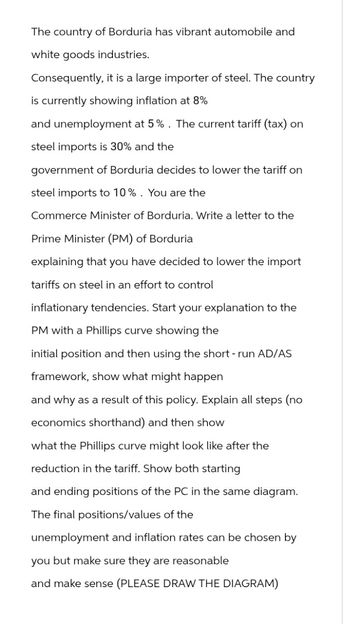

Transcribed Image Text:The country of Borduria has vibrant automobile and

white goods industries.

Consequently, it is a large importer of steel. The country

is currently showing inflation at 8%

and unemployment at 5%. The current tariff (tax) on

steel imports is 30% and the

government of Borduria decides to lower the tariff on

steel imports to 10%. You are the

Commerce Minister of Borduria. Write a letter to the

Prime Minister (PM) of Borduria

explaining that you have decided to lower the import

tariffs on steel in an effort to control

inflationary tendencies. Start your explanation to the

PM with a Phillips curve showing the

initial position and then using the short-run AD/AS

framework, show what might happen

and why as a result of this policy. Explain all steps (no

economics shorthand) and then show

what the Phillips curve might look like after the

reduction in the tariff. Show both starting

and ending positions of the PC in the same diagram.

The final positions/values of the

unemployment and inflation rates can be chosen by

you but make sure they are reasonable

and make sense (PLEASE DRAW THE DIAGRAM)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- posting this questions please solve. Subject = General Accountarrow_forwardSuppose you have been hired by President Emmanuel Macron of France as an economic policy consultant. In order to finance an increase in unemployment benefits, the French government needs to raise €10 billion in additional tax revenue. President Macron is considering two policies to achieve this goal: a new tax on gasoline or a new tax on bequests (money left to your children or other heirs). Which of these two policies would be the most economically efficient? Why? Explain why the policy you recommended in a.) might be politically unpopular. Dismayed by your assessment, President Macron proposes a third alternative: a broad decrease in current taxes. Explain why this could increase tax revenue for the French government, but it is unlikely to work in practice.arrow_forwardSuppose that you are a finance manager at a U.S. based MNC. On January 1st, you anticipate you will need to purchase C170,000.00 (Canadian dollars) worth of supplies from a Canadian supplier in March using Canadian dollars (C$). The current spot rate $105,400.00 an dollar is $0.73. Suppose that on February 10th, you find out your MNC no longer needs the order of Canadian supplies and, th Therefore, you wish to close out your futures position. In order to close out your futures position in Canadian dollars, you would a futures contract specifying of March 10th. If the futures contracts for Canadian dollars are priced at $0.62, then your MNC would receive date from that contract in exchange for C$170,000.00. $147,560.00 $137,020.00 $126,480.00 ed Canadian dollars. with a settlement date on the settlementarrow_forward

- Suppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with an initial investment of S$20,000,000 (Singapore dollars). Kittle Co. managers provide you key information regarding the project. 1. The government in Singapore will tax any remitted earnings at a rate of 10.00%. 2. The subsidiary will remit all of it’s after-tax earnings back to the parent. 3. The forecasted exchange rate of the Singapore dollar over the four-year period is $0.50. 4. The salvage value is S$12,000,000, which will be paid by the Singapore government in exchange for ownership of the subsidiary after four years. 5. The required rate of return is 15.00%. Furthermore, no funds can be remitted from the subsidiary to the parent until the subsidiary is sold for the salvage value at the…arrow_forwardSuppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with an initial investment of S$20,000,000 (Singapore dollars). Kittle Co. managers provide you key information regarding the project. 1. The government in Singapore will tax any remitted earnings at a rate of 10.00%. 2. The subsidiary will remit all of it’s after-tax earnings back to the parent. 3. The forecasted exchange rate of the Singapore dollar over the four-year period is $0.50. 4. The salvage value is S$12,000,000, which will be paid by the Singapore government in exchange for ownership of the subsidiary after four years. 5. The required rate of return is 15.00%. Furthermore, no funds can be remitted from the subsidiary to the parent until the subsidiary is sold for the salvage value at…arrow_forwardGeneral Motors exports cars to Spain but the strong dollar against the euro hurts sales of GM cars in Spain. In the Spanish market, GM faces competition from the Italian and French car makers, such as Fiat and Renault, whose operating currencies are the euro. What kind of measures would you recommend so that GM can maintain its market share in Spain?arrow_forward

- Consider the information about the economy of Pakistan. Note that the currency of Pakistan is the rupee. The government purchases: 3.00 trillions of rupees. Individuals consume: 11.30 trillions of rupees. Individuals save: 5.14 trillions of rupees. Businesses invest: 1.30 trillions of rupees. Foreigners spend: 0.69 trillions of rupees to purchase Pakistani firms. Pakistan imports: 1.92 trillions of rupees. Pakistan exports: 1.31 trillions of rupees. Calculate Pakistan's GDP. Assume that the values are all current and no conversions need to be made. Give your answer in terms of trillions of rupees, and round to two decimals.arrow_forwardSuppose that Retrojo Inc. is a U.S. based MNC that will need to purchase F$2.00 million (Fijian dollars, F$) worth of imports from Fiji in 90 days. Currently, the spot rate for the Fijian dollar is $0.80 per F$. Suppose that Retrojo negotiates a forward contract with a bank, which commits it to purchasing Fijian dollars at F $2,000,000.00 at $0.80 per Fijian dollar in 90 days. Thus, Retrojo knows with certainty that it will need F$2,000,000.00×$0.80 per Fijian dollars =$1,600,000.00 for this exchange. Assume the Fijian dollar depreciates over this time period to $0.67 per Fijian dollar. If this were the case the outside of the contract only (U.S. dollars) would be needed to exchange for the required F$2,000,000.00.arrow_forwardSuppose that Retrojo Inc. is a U.S. based MNC that will need to purchase F$1.10 million (Fijian dollars, F$) worth of imports from Fiji in 90 days. Currently, the spot rate for the Fijian dollar is $0.53 per F$. Suppose that Retrojo negotiates a forward contract with a bank, which commits it to purchasing Fijian dollars at F$1,100,000.00 at $0.53 per Fijian dollar in 90 days. Thus, Retrojo knows with certainty that it will need F$1,100,000.00 × $0.53 per Fijian dollars = $583,000.00 for this exchange. Assume the Fijian dollar depreciates over this time period to $0.42 per Fijian dollar. If this were the case the, outside of the contract with the bank, only $ (U.S. dollars) would be needed to exchange for the required F$1,100,000.00.arrow_forward

- LUSAKA (Reuters) - Zambia should keep mineral royalties capped at 7.5% in the 2020 budget to safeguard the health of the mining sector and promote additional investment, the Chamber of Mines said on Tuesday. The mining body said in proposals submitted to the finance ministry that the 2019 mining tax regime had raised the tax burden on mines to unsustainable and uncompetitive levels. Africa's No.2 copper producer increased its sliding scale for royalties of 4 to 6% by 1.5 percentage points and introduced a new 10% tax when the price of copper exceeds $7,500 per tonne. The scale is adjusted so that royalties are paid at higher levels as commodity prices climb and are reduced as prices fall. "If the 1.5% increment on each band of the sliding scale is to be maintained, the maximum rate should be capped at 7.5%, for an LME copper price equalling or exceeding US$7,500/tonne," the Chamber of Mines said. The mineral royalty tax should also be tax-deductible for mining firms as making it…arrow_forwardRogue River Exporters USA has $100,000 of before-tax foreign income. The host country has a corporate income tax rate of 25% and the U.S. has a corporate income tax rate of 35%. If the U.S. has a bilateral trade agreement with the host country that calls for the total tax paid to be equal to the maximum amount that could be paid in the highest taxing country, what is the total amount of income taxes Rogue River Exporters will pay to the host country, and how much will they pay in U.S income taxes on the foreign earned income? A) $25,000; $10,000 B) $25,000; $26,250 C) $35,000; $0 D) None of the abovearrow_forwardHull Importing Company is a U.S.-based firm that imports small gift items and sells them to retail gift shops across the United States. About half of the value of Hull’s purchases comes from the United Kingdom, while the remaining purchases are from Mexico. The imported goods are denominated in the currency of the country where they are produced. Hull normally does not hedge its purchases. In previous years, the Mexican peso and pound fluctuated substantially against the dollar (although not by the same degree). Hull’s expenses are directly tied to these currency values because all of its products are imported. It has been successful because the imported gift items are somewhat unique and are attractive to U.S. consumers. However, Hull has been unable to pass on higher costs (due to a weaker dollar) to its consumers, because consumers would then switch to different gift items sold at other stores.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education