Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

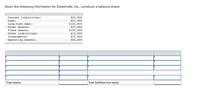

Transcribed Image Text:Given the following information for Smashville, Ic., construct a balance sheet:

$22,000

$21,000

$102,000

$37,000

$120,000

$12,000

$33,000

$64,000

Current liabilities:

Cash:

Long-term debt:

Other assets:

Fixed assets:

Other liabilities:

Investments:

Operating assets:

Total assets

Total liabilities and equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- i need the answer quicklyarrow_forwardPresented below are data taken from the records of Wildhorse Company. December 31,2020 December 31,2019 Cash $15,200 $8,100 Current assets other than cash 84,700 60,600 Long-term investments 10,000 52,900 Plant assets 332,400 215,200 $442,300 $336,800 Accumulated depreciation $20,100 $40,100 Current liabilities 39,600 22,100 Bonds payable 74,800 –0– Common stock 254,500 254,500 Retained earnings 53,300 20,100 $442,300 $336,800 Additional information: 1. Held-to-maturity debt securities carried at a cost of $42,900 on December 31, 2019, were sold in 2020 for $33,600. The loss (not unusual) was incorrectly charged directly to Retained Earnings. 2. Plant assets that cost $50,500 and were 80% depreciated were sold during 2020 for $8,000. The loss was incorrectly charged directly to Retained Earnings. 3. Net income as reported on the…arrow_forwardThe summarized balance sheet of WIPRO Itd forthe year ended 31/03/2020 and 31/03/2021 are given below. Prepare funds flow statement. Liabilities Equity share capital General Reserve Pro fit&loss a/c Sundry Creditor Provision for Tax 2020 5,00,000 2,00,000 40,000 1,58,000 45,000 2021 Assets 2020 2021 Land & Building 6,00,000 2,20,000 1,32,000 1,72,000 30,000 1,80,000 Plant and Machinery 2,10,000 80,000 2,00,000 1,70,000 1,03,000 9,43,000 3,00,000 2,76,000 95,000 1,90,000 1,95,000 98,000 11,54,000 Other fixed Assets Stock Debtors Cash at bank Total 9,43,000 The following adjustment the company faces during the year. 11,54,000 Total Dividend Rs. 30,000 was paid during the year. An old machinery costing 1,20.000 was sold for 1,00,000 and the depreciation Rs 50,000.arrow_forward

- The following are the ending balances of accounts at December 31, 2021, for the Valley Pump Corporation. Credits Account Title Cash Accounts receivable Inventory Interest payable Investment in equity securities Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Copyright (net) Prepaid expenses (next 12 months) Accounts payable Deferred revenue (next 12 months) Notes payable Allowance for uncollectible accounts Common stock Retained earnings Totals $ Debits 44,000 94,000 119,000 82,000 158,000 395,000 113,000 31,000 51,000 $ 29,000 119,000 44,000 84,000 39,000 345,000 6,000 390,000 31,000 $1,087,000 $1,087,000 Additional Information: 1. The $158,000 balance in the land account consists of $119,000 for the cost of land where the plant and office buildings are located. The remaining $39,000 represents the cost of land being held for speculation. 2. The $82,000 balance in the investment in equity securities account represents an investment in the…arrow_forwardRequired: a. What is the ratio of real assets to total assets? (Hint: for this question, only include those listed under "Real assets") b. What is the ratio of real assets to total assets for nonfinancial firms in the following table? Assets Real assets Equipment and intellectual property Real estate Inventories Total real assets Financial assets Deposits and cash Marketable securities Required A $ Billion $ 8,345 14,423 2,724 $ 25,492 Required B $ 2,333 4,059 4,075 14,005 $ 24,472 $ 49,964 % Total 16.7% 28.9 5.5 51.0% 4.7% 8.1 8.2 28.0 49.0% 100.0% Liabilities and Net Worth Liabilities Debt securities Bank loans & mortgages Other loans Trade debt Other Total liabilities Complete this question by entering your answers in the tabs below. Net worth $ Billion Trade and consumer credit Other Total financial assets TOTAL Balance sheet of U.S. nonfinancial corporations Note: Column sums may differ from total because of rounding error. Source: Flow of Funds Accounts of the United States,…arrow_forwardPlease help me fastarrow_forward

- Following this balance sheet of chevron's company, provide me with a horizontal analysis comparative balance sheets.arrow_forwardProfile Co has the following assets and liabilities: Assets: Cash $100 , account receivable,$150 ; Inventory,$240 ,land $200, plant net of accumulated amortization $300 : liabilities short term bank loan, $60 : accounts payable long term loan mortage loan ,$160 ,profolio co long term assets total wasarrow_forwardPrepare the balance sheet and income statement by rearranging the above items. Note: Be sure to list the assets and liabilities in order of their liquidity. Enter all amounts as positive values. Cash Receivables Inventories BALANCE SHEET Assets Liabilities and Shareholders' Equity $ 15 Payables $ 35 35 Debt due for repayment 25 50 Total current assets $ 100 Total current liabilities $ 60 Property, plant, and equipment 520 Long-term debt Total liabilities 350 $ 410 Net fixed assets Total assets $ 520 Shareholders' equity 90 $ 620 Total liabilities and shareholders' equity $ 500arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardBalance Sheet You are evaluating the balance sheet for Campus Corporation. From the balance sheet you find the following balances: Cash and marketable securities = $391,000, Accounts receivable = $191,000, Inventory = $91,000, Accrued wages and taxes = $10,900, Accounts payable = $309,000, and Notes payable = $609,000. What is Campus's net working capital? Multiple Choice $1,601,900 О $673,000 О -$255,900 $928,900arrow_forwardUsing the following Balance Sheet summary information, calculate for the two companies presented:working capitalcurrent ratio Company L and Company M, respectively: Current assets $124,680, $180,550. Current liabilities 63,250, 153,250.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education