Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

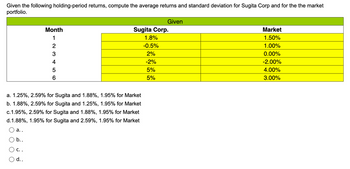

Transcribed Image Text:Given the following holding-period returns, compute the average returns and standard deviation for Sugita Corp and for the the market

portfolio.

a..

b..

C..

Month

a. 1.25%, 2.59% for Sugita and 1.88%, 1.95% for Market

b. 1.88%, 2.59% for Sugita and 1.25%, 1.95% for Market

c.1.95%, 2.59% for Sugita and 1.88%, 1.95% for Market

d. 1.88%, 1.95% for Sugita and 2.59%, 1.95% for Market

d..

123 45

6

Given

Sugita Corp.

1.8%

-0.5%

2%

-2%

5%

5%

Market

1.50%

1.00%

0.00%

-2.00%

4.00%

3.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following table for different assets for 1926 through 2020. Standard Deviation 19.7% Series Large-company stocks Small-company stocks Long-term corporate bonds Long-term government bonds Intermediate-term government bonds U.S. Treasury bills Inflation Average return 12.2% 16.2 6.5 6.1 5.3 3.3 2.9 Expected range of returns Expected range of returns a. What range of returns would you expect to see 68 percent of the time for large-company stocks? Note: A negative answer should be indicated by a minus sign. Enter your answers from lowest to highest. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. b. What about 95 percent of the time? 31.3 8.5 9.8 Note: A negative answer should be indicated by a minus sign. Enter your answers from lowest to highest. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. % to % to 5.6 3.1 4.0 % %arrow_forwardCalculate the correlation coefficient (PAB) for the following situation: (Round intermediate calculations and the final answer to 4 decimal place, e.g. 0.2921.) State of the Probability of Expected return on Expected return on economy occurrence stock A in this state stock B in this state High growth 30% 39.5% 56.5% Moderate 25% 18.5% 26.5% Recession 45% -6.5% -16.5% Correlation coefficientarrow_forwardReview the following market information: Current Stock Market Return 11.25% Current T-Bill Price $979.43 Historic T-Bill Average Return 2.80% Historic Stock Market Average Return 8.10% Stock Beta 1.23 What is the required return (rounded to two places)?arrow_forward

- The historical returns data for the past three years for Company A's stock is -6.0%, 15%, 15% and that of the market portfolio is 10%, 10% and 16%. According to the security market line (SML), the Stock A is:A. Over priced B. Under priced C. Correctly pricedD. Need more informationarrow_forwardThe following information relates to the possible returns of ABC limited share depending on the performance of the economy: State of the economy Probability of the returns Return Boom 0.4 20% Normal 0.4 15% Recession 0.2 9% Required: i. Compute the expected return of the share ii. Compute the standard deviation and coefficient of variation of the share.arrow_forwardO Considering the following information regarding the performance of a portfolio manager in a recent quarter, (i) identify the Alpha of the manager's portfolio compared to benchmark (ii) identify the contributions of asset allocation and security selection to relative performance. Stocks Bonds Treasury bills Manager's Manager's Benchmark Benchmark Return Weight Relarn 1% 2% 2% 1.5% 0.75% 0.5% 0.50 0.30 0.20 weight 0.30 0.30 0.40arrow_forward

- Colonel Motors (C) Separated Edison (S) Expected Return 10% 8% Standard Deviation 6% 3% Please represent graphically all potential combinations of stocks C and S, if the correlation coefficient between the returns of stocks C and S is: A) 1 B) 0 C) -1 Please report these investment opportunity sets in the corresponding Excel sheets.arrow_forwardHow is this set-up to solve? Ford Stock I) & II) were in previous question GM stock produced the following monthly returns (January - May): 5%, 8%, -2%, 12%, and 15%. Ford stock produced the following monthly returns (January - May): 1%, 10%, 6%, 3%, and 2%. I) Calculate the average return for each stock. II) Calculate the standard deviation of monthly return for each stock. III) Calculate the correlation coefficient between GM and Ford stocks.arrow_forwardUse the following information to calculate the expected return and standard deviation of a portfolio that is 60 percent invested in 3 Doors, Incorporated, and 40 percent invested in Down Company: Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Expected return, E(R) Standard deviation, o Correlation Expected return Standard deviation 3 Doors, Incorporated 16% 46 0.31 2.00% 2.00% Down Company 24% 48arrow_forward

- Ef 579.arrow_forwardThe expected return and standard deviation of a portfolio that is 60 percent invested in 3 Doors, Incorporated, and 40 percent invested in Down Company are the following: Expected return, E(R) Standard deviation, o 3 Doors, Down Incorporated Company 10% 33 Correlation +1 Correlation 0 Correlation-1 What is the standard deviation if the correlation is +1? 0? -1? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. 11% 44 Standard Deviation % % %arrow_forwardCompute the annual tracking error from the following information: Quarter Portfolio B's 1 2 3 4 O 1.06% O 2.12% O 3.67% O 4.25% O None Portfolio A's Return (%) 1.15 1.89 1.15 -0.47 Return (%) 1.65 -0.10 0.52 -0.60arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education