Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

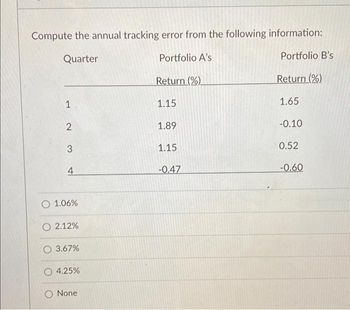

Transcribed Image Text:Compute the annual tracking error from the following information:

Quarter

Portfolio B's

1

2

3

4

O 1.06%

O 2.12%

O 3.67%

O 4.25%

O None

Portfolio A's

Return (%)

1.15

1.89

1.15

-0.47

Return (%)

1.65

-0.10

0.52

-0.60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Investment Standard Assets Expected return Correlation Beta weight Deviation Asset A 15.00% 30.00% 45.00% Corr A.B = 0.60 1.21 Asset B 45.00% 24.00% 20.00% Corr A.C = -0.45 1.17 Asset C 40.00% 16.00% 15.00% Corr B.C = 0.24 0.65 Questions 1. Calculate expected return of portfolio with all 3 risky assets 2. Calculate Standard deviation of portfolio with all 3 risky assets 3. Assume you sell out Asset A, and replace it with T-Bill, using the same investment weight. Calculate expected return of portfolio of T-Bill and 2 risky assets (Asset B, and C) Answers % % % 4. Assume you sell out Asset A, and replace it with T-Bill, using the same investment weight. Calculate standard deviation of portfolio of T-Bill and 2 risky assets (Asset B, and C) % 5. Calculate beta of portfolio with all 3 risky assets (round to 2 digits after decimal). 6. Use CAPM, calculate required rate of return of all 3 risky assets. 7. Use CAPM, assume you add a new asset, Asset D, into portfolio. You adjust your…arrow_forwardonsider the historical return data of ABC portfolio as below. 1990 4% 1991 10% 1992 2% 1993 1% 1994 5% 1995 -1% 1996 7% 1997 -3% 1998 0% 1999 3% What is the sample (empirical) probability that return is greater than or equal to 4%? Why?arrow_forwardCalculate the standard deviation for the following returns: Year 2017 2018 2019 2020 Return 12.03% -8.24% 1.34% 4.55% Group of answer choices 8.4% 8.1% 7.6% 7.3%arrow_forward

- QUESTION 12 Use the table below to answer questions 12 through 15. What is the portfolio tracking error? O A. 81.35 basis points OB. 86.35 basis points O C. 83.35 basis points D. 80.35 basis points Month January February March April May June July August September October November December Portfolio A's Return (%) 2.15 0.89 1.15 -0.47 1.71 0.10 1.04 2.70 0.66 2.15 -1.38 -0.59 Benchmark Index Return (%) 1.65 -0.10 0.52 -0.60 0.65 0.33 2.31 1.10 1.23 2.02 -0.61 -1.20arrow_forwardWhat is the standard deviation of the portfolio that invests equally in all three assets M, N, and O?arrow_forwardFind out the 1- standard deviation 2- variance weight Investment*expected return stock weight Investment Investment Amount expected return stock stocks 0.261 1.45 75000 0.18 Alba Co. 0.0504 0.56 75000 0.09 Batelco Co. 0.0371 0.1 75000 0.371 Delmon poultry. 0.3485 225000 Totalarrow_forward

- Considering the attached set of securities and portfolio returns: Assume that you initially invested $1,000,000 in the portfolio and that the distribution of the annual rate of return of the portfolio is normal. What is the distribution of the return of the portfolio 20 years after its formation? Provide the graph of the distribution of the return of the portfolio.arrow_forwardConsider the following portfolio of assets: Loan Weight 1 0.30 2 0.70 Expected returni ம σ2 13% 11% 9.06% 82.0% P12=-0.87 8.72% 76.0% 012-75.0% What is the variance of the portfolio (round to two decimals)? Note: a^2 denotes the square of a. For example, 2^2 = 4, 3^2=9 (0.3)^2*(82.0%) + (0.7)^2*(76.0%) + (0.3) (0.7)(-0.87) (9.06%) (8.72%) = 30.19 (0.3)^2 (82.0%) + (0.7)^2*(76.0%) + 2(0.3) (0.7)(-0.87) (9.06 %) (8.72%) = 15.75 (0.3)^2*(82.0%) + (0.7)^2*(76.0%) + [(0.3) (0.7)]^2 (-0.87) (9.06%) (8.72%) = 41.59 (0.3) (82.0%) + (0.7) (76.0%) + 2(0.3) (0.7)(-0.87) (9.06 %) (8.72%) = 48.93arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education